Vale Results Presentation Deck

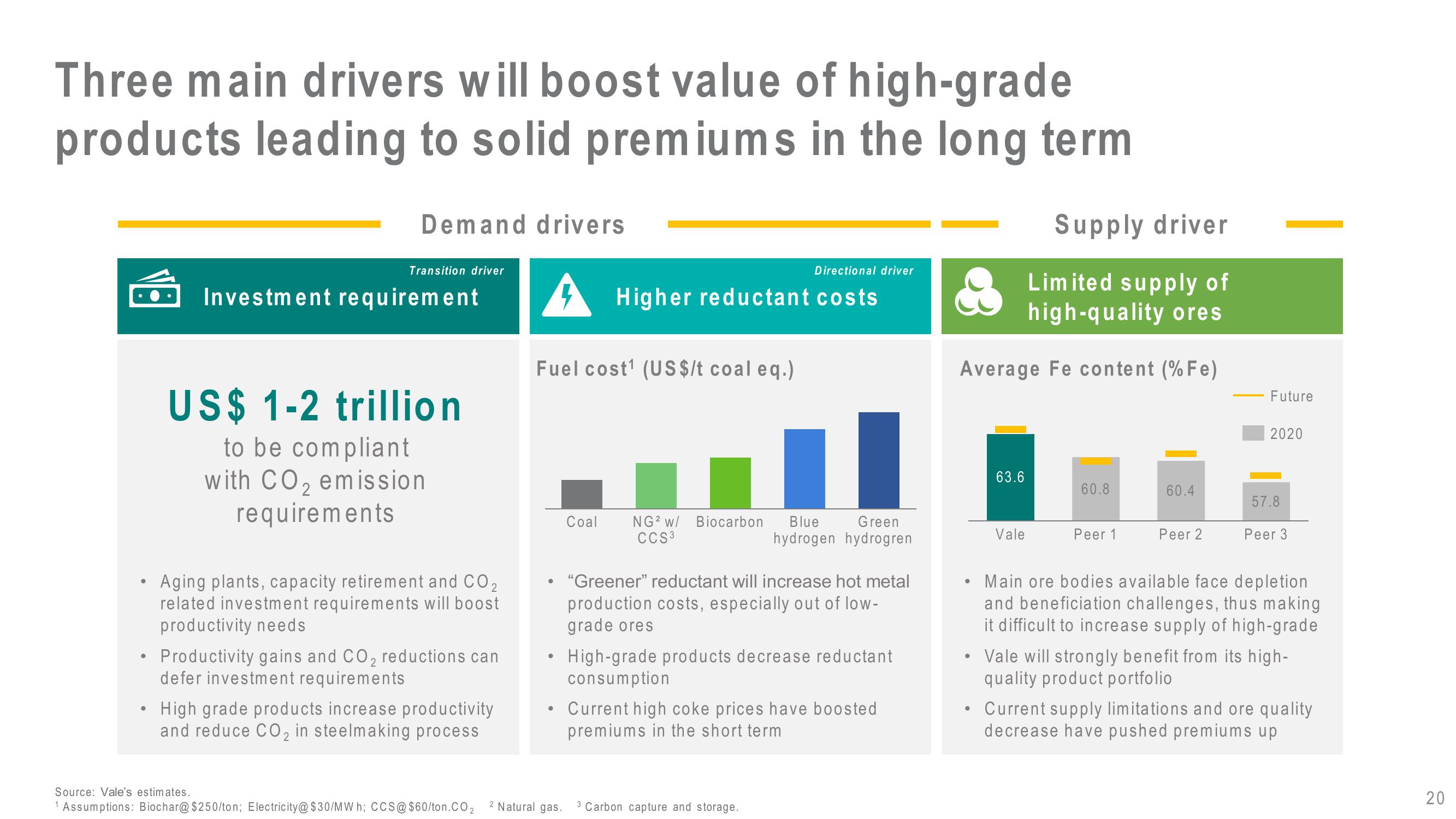

Three main drivers will boost value of high-grade

products leading to solid premiums in the long term

●

Demand drivers

●

Transition driver

Investment requirement

US$ 1-2 trillion

to be compliant

with CO₂ emission

requirements

Aging plants, capacity retirement and CO₂

related investment requirements will boost

productivity needs

●

• Productivity gains and CO₂ reductions can

defer investment requirements

High grade products increase productivity

and reduce CO₂ in steelmaking process

Source: Vale's estimates.

¹ Assumptions: Biochar@$250/ton; Electricity@$30/MWh; CCS@$60/ton.CO2

Fuel cost¹ (US$/t coal eq.)

●

Higher reductant costs

2 Natural gas.

Coal NG2 w/ Biocarbon

CCS3

Directional driver

• High-grade products decrease reductant

consumption

Blue Green

hydrogen hydrogren

"Greener" reductant will increase hot metal

production costs, especially out of low-

grade ores

3 Carbon capture and storage.

Current high coke prices have boosted

premiums in the short term

Supply driver

Limited supply of

high-quality ores

Average Fe content (% Fe)

●

63.6

Vale

60.8

Peer 1

60.4

Peer 2

Future

2020

57.8

Peer 3

Main ore bodies available face depletion

and beneficiation challenges, thus making

it difficult to increase supply of high-grade

Vale will strongly benefit from its high-

quality product portfolio

Current supply limitations and ore quality

decrease have pushed premiums up

20View entire presentation