SoftBank Results Presentation Deck

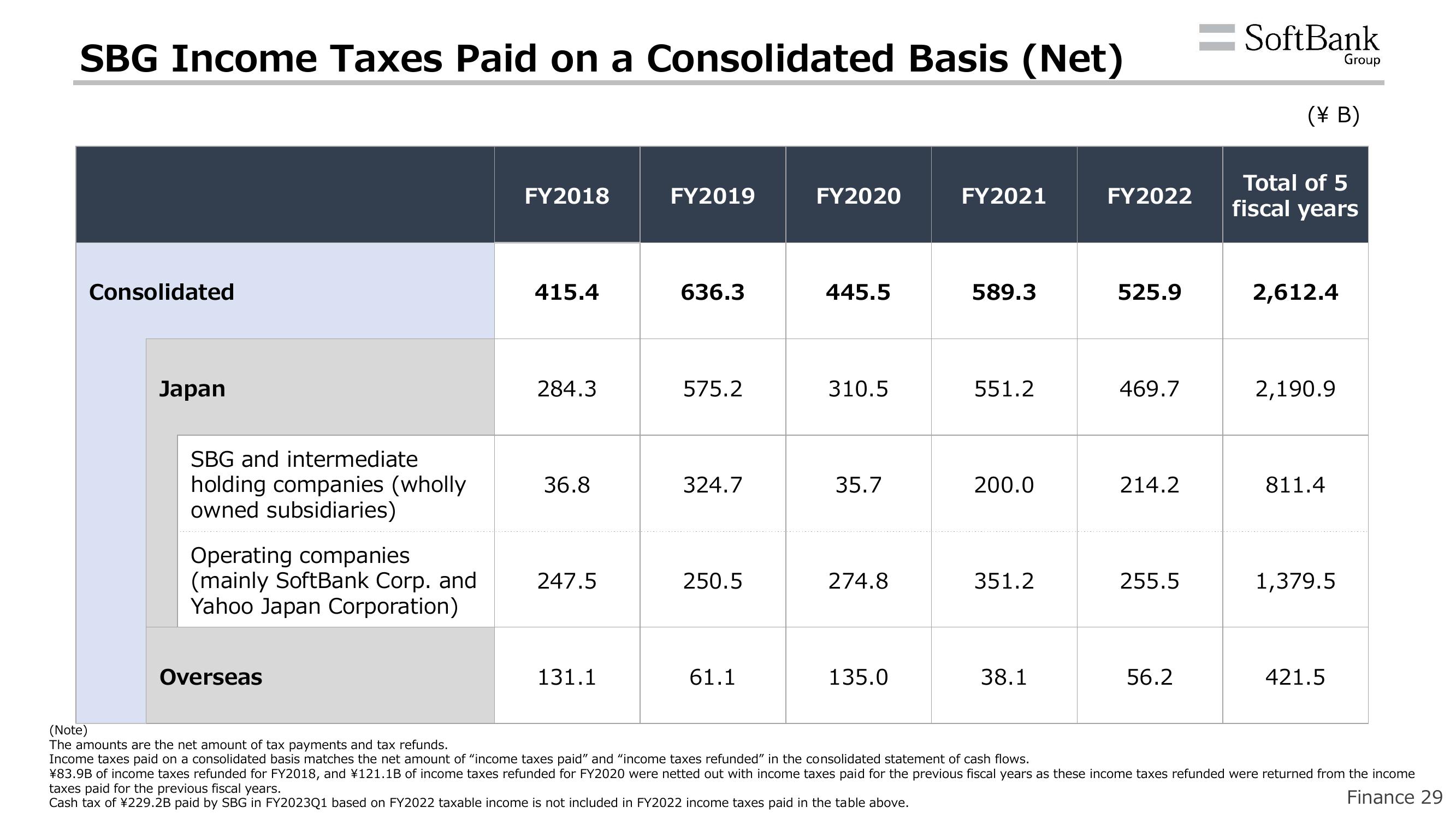

SBG Income Taxes Paid on a Consolidated Basis (Net)

Consolidated

Japan

SBG and intermediate

holding companies (wholly

owned subsidiaries)

Operating companies

(mainly SoftBank Corp. and

Yahoo Japan Corporation)

Overseas

FY2018

415.4

284.3

36.8

247.5

131.1

FY2019

636.3

575.2

324.7

250.5

61.1

FY2020

445.5

310.5

35.7

274.8

135.0

FY2021

589.3

551.2

200.0

351.2

38.1

FY2022

525.9

469.7

214.2

255.5

56.2

= SoftBank

(\ B)

Total of 5

fiscal years

2,612.4

2,190.9

811.4

Group

1,379.5

421.5

(Note)

The amounts are the net amount of tax payments and tax refunds.

Income taxes paid on a consolidated basis matches the net amount of "income taxes paid" and "income taxes refunded" in the consolidated statement of cash flows.

¥83.9B of income taxes refunded for FY2018, and ¥121.1B of income taxes refunded for FY2020 were netted out with income taxes paid for the previous fiscal years as these income taxes refunded were returned from the income

taxes paid for the previous fiscal years.

Cash tax of ¥229.2B paid by SBG in FY2023Q1 based on FY2022 taxable income is not included in FY2022 income taxes paid in the table above.

Finance 29View entire presentation