Better Results Presentation Deck

Q4 2023 Outlook

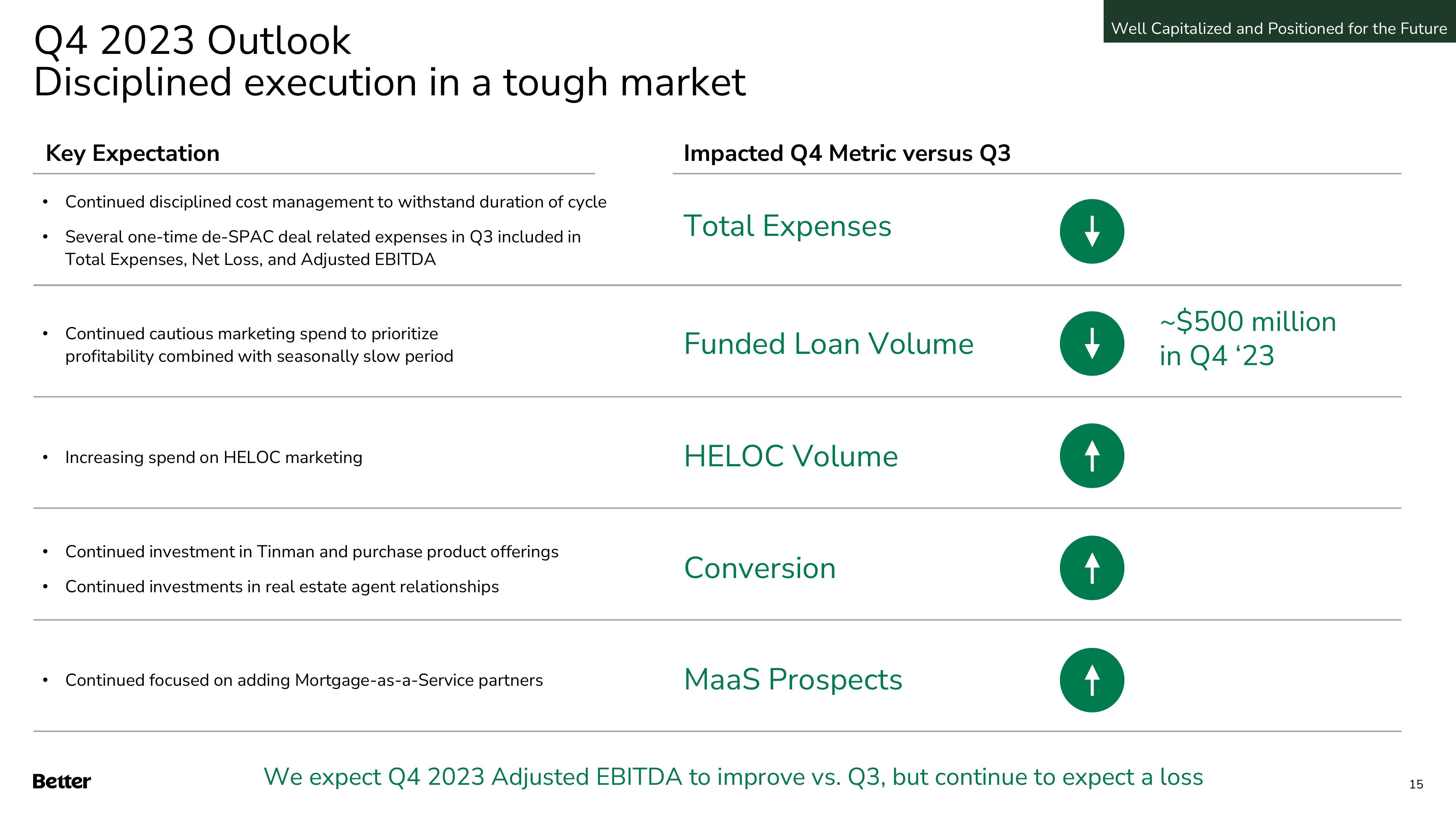

Disciplined execution in a tough market

Key Expectation

●

Continued disciplined cost management to withstand duration of cycle

Several one-time de-SPAC deal related expenses in Q3 included in

Total Expenses, Net Loss, and Adjusted EBITDA

Continued cautious marketing spend to prioritize

profitability combined with seasonally slow period

Increasing spend on HELOC marketing

Continued investment in Tinman and purchase product offerings

Continued investments in real estate agent relationships

Continued focused on adding Mortgage-as-a-Service partners

Better

Impacted Q4 Metric versus Q3

Total Expenses

Funded Loan Volume

HELOC Volume

Conversion

MaaS Prospects

↓

↑

Well Capitalized and Positioned for the Future

~$500 million

in Q4 '23

We expect Q4 2023 Adjusted EBITDA to improve vs. Q3, but continue to expect a loss

15View entire presentation