Melrose Mergers and Acquisitions Presentation Deck

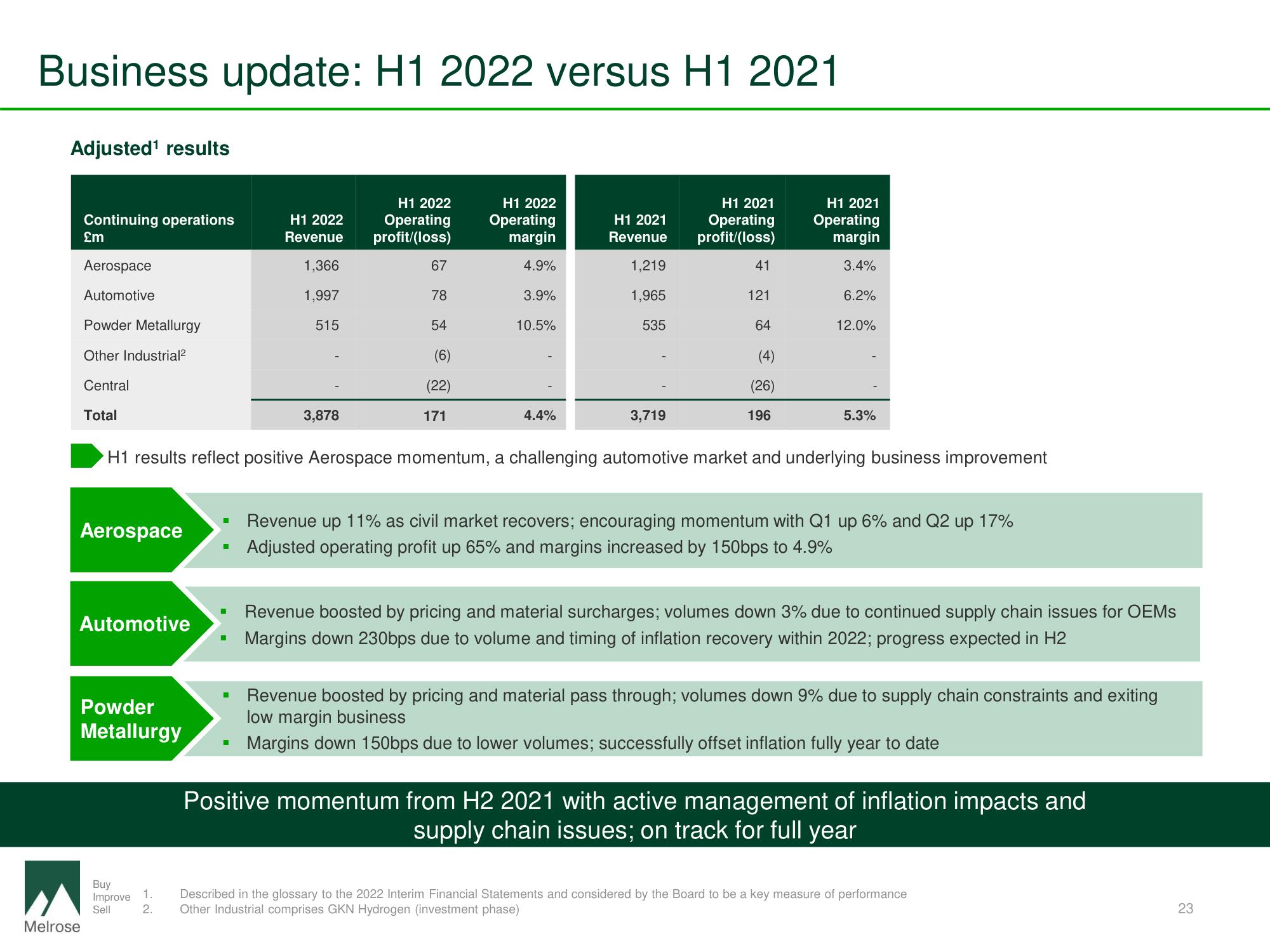

Business update: H1 2022 versus H1 2021

Adjusted¹ results

Continuing operations

£m

Melrose

Aerospace

Automotive

Powder Metallurgy

Other Industrial²

Central

Total

Aerospace

Automotive

Powder

Metallurgy

H1 2022

Revenue

1,366

1,997

515

Buy

Improve 1.

Sell

2.

3,878

H1 2022

Operating

profit/(loss)

67

78

54

(6)

(22)

171

H1 2022

Operating

margin

4.9%

3.9%

10.5%

4.4%

H1 2021

Revenue

1,219

1,965

535

3,719

H1 2021

Operating

profit/(loss)

41

121

64

(4)

(26)

H1 results reflect positive Aerospace momentum, a challenging automotive market and underlying business improvement

196

H1 2021

Operating

margin

3.4%

6.2%

12.0%

5.3%

Revenue up 11% as civil market recovers; encouraging momentum with Q1 up 6% and Q2 up 17%

Adjusted operating profit up 65% and margins increased by 150bps to 4.9%

Revenue boosted by pricing and material surcharges; volumes down 3% due to continued supply chain issues for OEMs

Margins down 230bps due to volume and timing of inflation recovery within 2022; progress expected in H2

Revenue boosted by pricing and material pass through; volumes down 9% due to supply chain constraints and exiting

low margin business

Margins down 150bps due to lower volumes; successfully offset inflation fully year to date

Positive momentum from H2 2021 with active management of inflation impacts and

supply chain issues; on track for full year

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

Other Industrial comprises GKN Hydrogen (investment phase)

23View entire presentation