Barclays Global Financial Services Conference

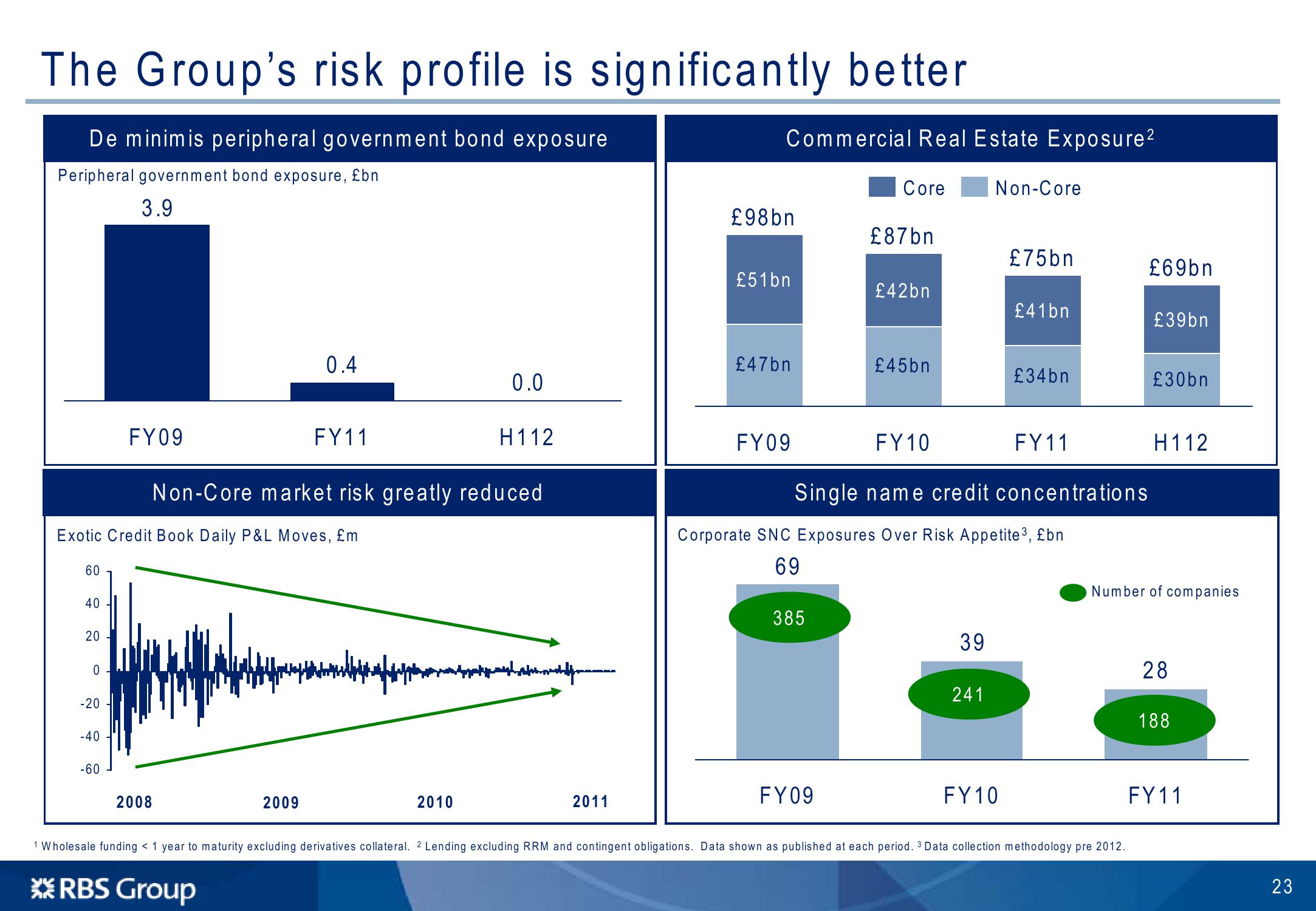

The Group's risk profile is significantly better

De minimis peripheral government bond exposure

Peripheral government bond exposure, £bn

3.9

Commercial Real Estate Exposure²

Non-Core

Core

£98bn

£87bn

£75bn

£69bn

£51bn

£42bn

£41bn

£39bn

0.4

£47bn

£45bn

£34bn

0.0

£30bn

FY09

FY11

H112

FY09

FY10

FY11

H112

Non-Core market risk greatly reduced

Single name credit concentrations

Corporate SNC Exposures Over Risk Appetite ³, £bn

Exotic Credit Book Daily P&L Moves, £m

60

40

20

20

0

-20

-40

-60

2008

2009

2010

2011

69

Number of companies

385

39

28

241

188

FY09

FY10

1 Wholesale funding < 1 year to maturity excluding derivatives collateral. 2 Lending excluding RRM and contingent obligations. Data shown as published at each period. 3 Data collection methodology pre 2012.

*RBS Group

FY11

23

23View entire presentation