Tronox Investor Presentation

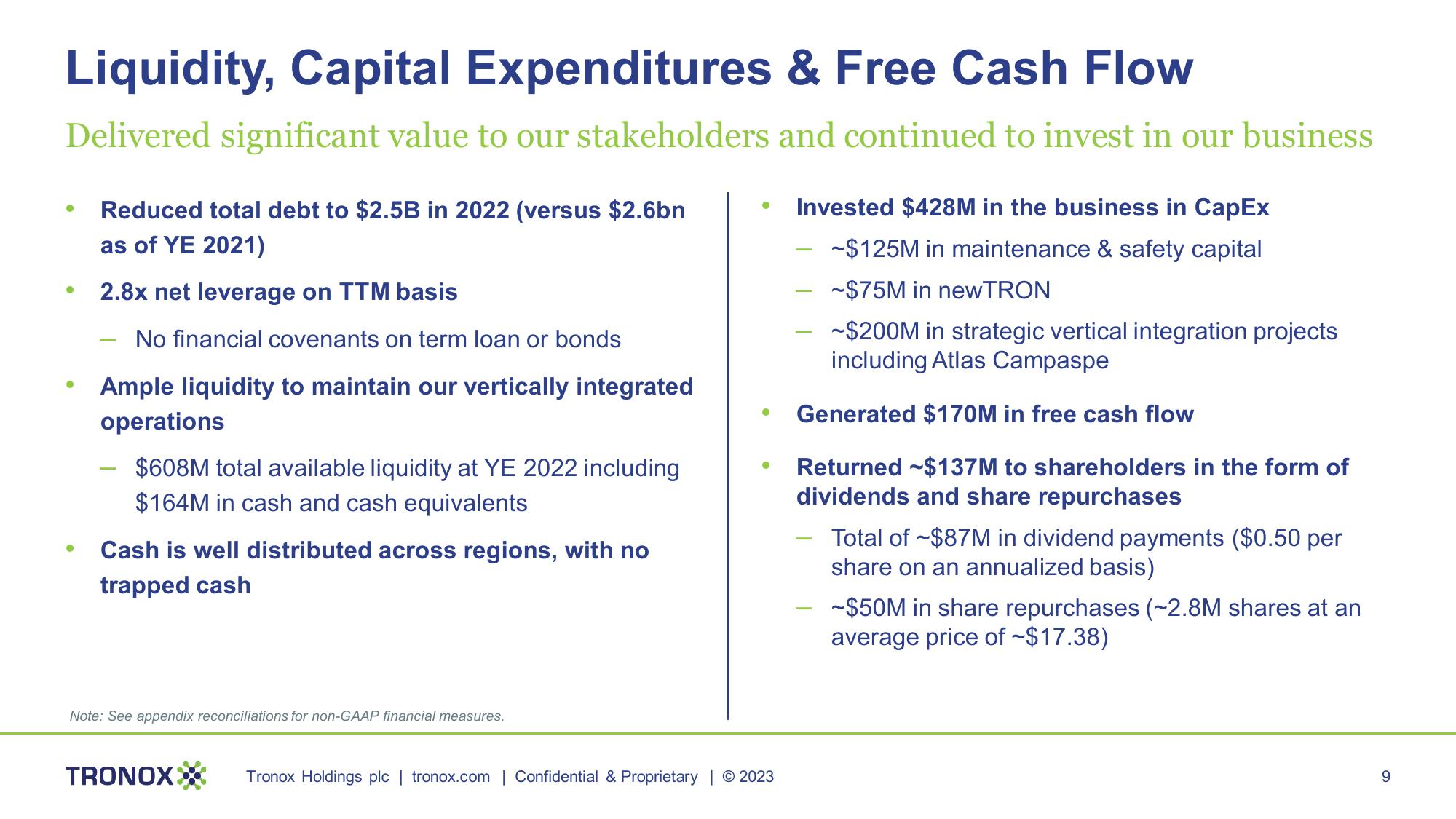

Liquidity, Capital Expenditures & Free Cash Flow

Delivered significant value to our stakeholders and continued to invest in our business

Reduced total debt to $2.5B in 2022 (versus $2.6bn

as of YE 2021)

2.8x net leverage on TTM basis

No financial covenants on term loan or bonds

Ample liquidity to maintain our vertically integrated

operations

$608M total available liquidity at YE 2022 including

$164M in cash and cash equivalents

Cash is well distributed across regions, with no

trapped cash

Note: See appendix reconciliations for non-GAAP financial measures.

●

TRONOXX Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2023

Invested $428M in the business in CapEx

-$125M in maintenance & safety capital

-$75M in new TRON

-$200M in strategic vertical integration projects

including Atlas Campaspe

Generated $170M in free cash flow

Returned $137M to shareholders in the form of

dividends and share repurchases

Total of $87M in dividend payments ($0.50 per

share on an annualized basis)

~$50M in share repurchases (~2.8M shares at an

average price of ~$17.38)

9View entire presentation