2Q YTD Cash Flow Summary

☆

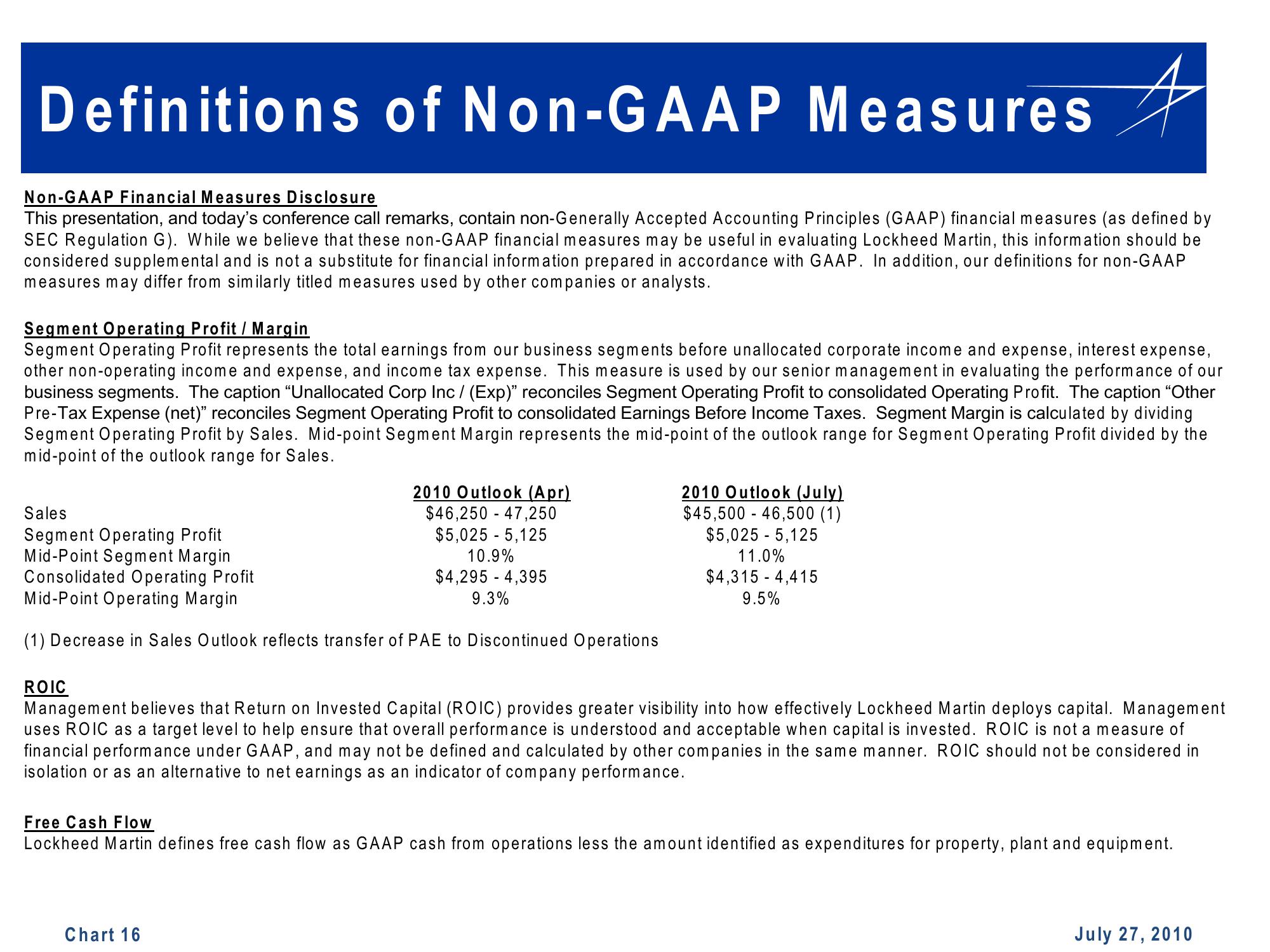

Non-GAAP Financial Measures Disclosure

This presentation, and today's conference call remarks, contain non-Generally Accepted Accounting Principles (GAAP) financial measures (as defined by

SEC Regulation G). While we believe that these non-GAAP financial measures may be useful in evaluating Lockheed Martin, this information should be

considered supplemental and is not a substitute for financial information prepared in accordance with GAAP. In addition, our definitions for non-GAAP

measures may differ from similarly titled measures used by other companies or analysts.

Definitions of Non-GAAP Measures

Segment Operating Profit / Margin

Segment Operating Profit represents the total earnings from our business segments before unallocated corporate income and expense, interest expense,

other non-operating income and expense, and income tax expense. This measure is used by our senior management in evaluating the performance of our

business segments. The caption "Unallocated Corp Inc / (Exp)" reconciles Segment Operating Profit to consolidated Operating Profit. The caption "Other

Pre-Tax Expense (net)" reconciles Segment Operating Profit to consolidated Earnings Before Income Taxes. Segment Margin is calculated by dividing

Segment Operating Profit by Sales. Mid-point Segment Margin represents the mid-point of the outlook range for Segment Operating Profit divided by the

mid-point of the outlook range for Sales.

2010 Outlook (Apr)

$46,250 47,250

$5,025 - 5,125

10.9%

$4,295 -4,395

9.3%

Sales

Segment Operating Profit

Mid-Point Segment Margin

Consolidated Operating Profit

Mid-Point Operating Margin

(1) Decrease in Sales Outlook reflects transfer of PAE to Discontinued Operations

2010 Outlook (July)

$45,500 46,500 (1)

$5,025 - 5,125

11.0%

$4,315-4,415

9.5%

ROIC

Management believes that Return on Invested Capital (ROIC) provides greater visibility into how effectively Lockheed Martin deploys capital. Management

uses ROIC as a target level to help ensure that overall performance is understood and acceptable when capital is invested. ROIC is not a measure of

financial performance under GAAP, and may not be defined and calculated by other companies in the same manner. ROIC should not be considered in

isolation or as an alternative to net earnings as an indicator of company performance.

Chart 16

Free Cash Flow

Lockheed Martin defines free cash flow as GAAP cash from operations less the amount identified as expenditures for property, plant and equipment.

July 27, 2010View entire presentation