AngloAmerican Results Presentation Deck

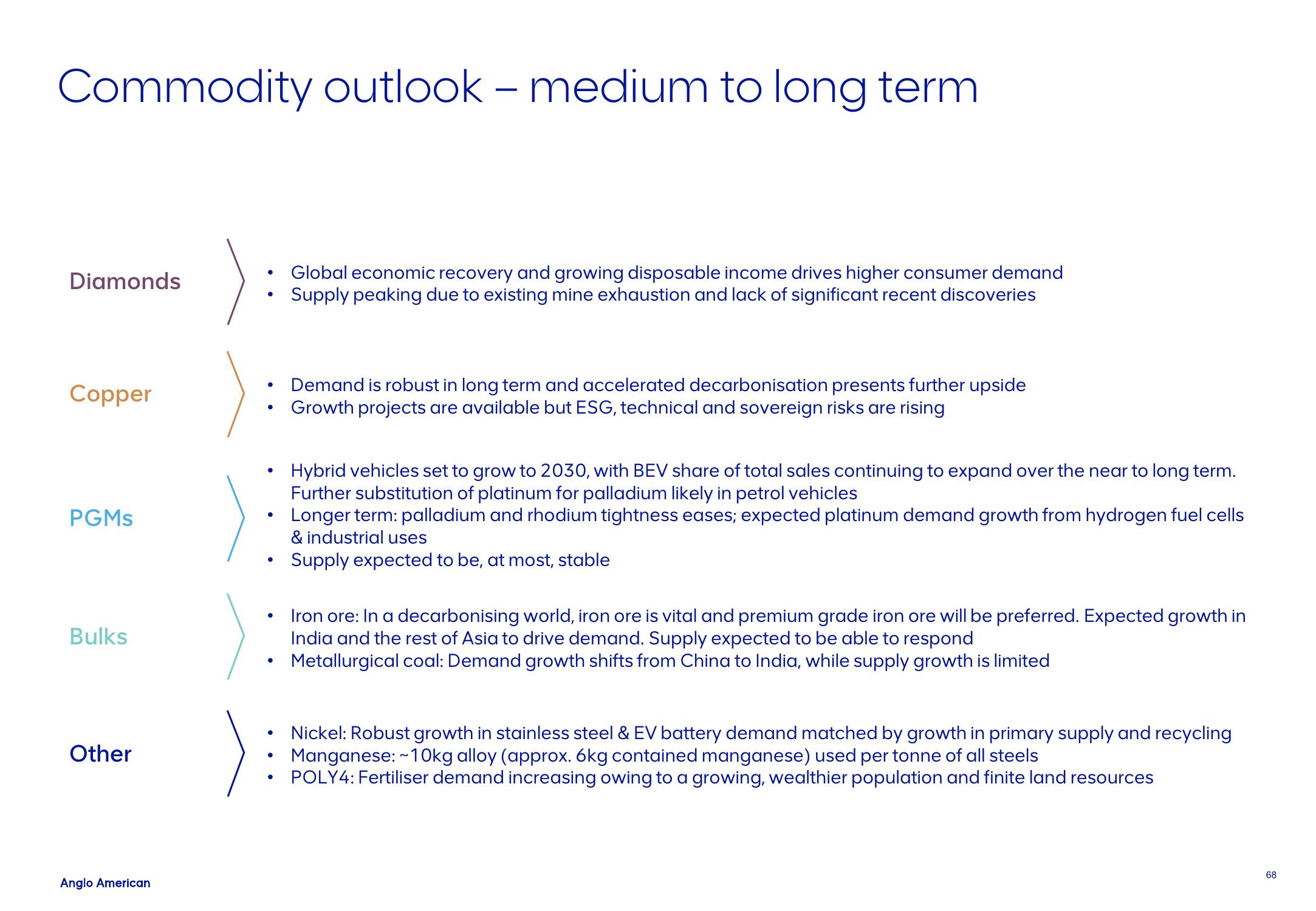

Commodity outlook - medium to long term

Diamonds

Copper

PGMs

Bulks

Other

Anglo American

●

●

●

●

●

●

Global economic recovery and growing disposable income drives higher consumer demand

Supply peaking due to existing mine exhaustion and lack of significant recent discoveries

Demand is robust in long term and accelerated decarbonisation presents further upside

Growth projects are available but ESG, technical and sovereign risks are rising

Hybrid vehicles set to grow to 2030, with BEV share of total sales continuing to expand over the near to long term.

Further substitution of platinum for palladium likely in petrol vehicles

Longer term: palladium and rhodium tightness eases; expected platinum demand growth from hydrogen fuel cells

& industrial uses

Supply expected to be, at most, stable

Iron ore: In a decarbonising world, iron ore is vital and premium grade iron ore will be preferred. Expected growth in

India and the rest of Asia to drive demand. Supply expected to be able to respond

Metallurgical coal: Demand growth shifts from China to India, while supply growth is limited

Nickel: Robust growth in stainless steel & EV battery demand matched by growth in primary supply and recycling

Manganese: ~10kg alloy (approx. 6kg contained manganese) used per tonne of all steels

POLY4: Fertiliser demand increasing owing to a growing, wealthier population and finite land resources

68View entire presentation