Embracer Group Results Presentation Deck

EARNOUT PER YEAR-END

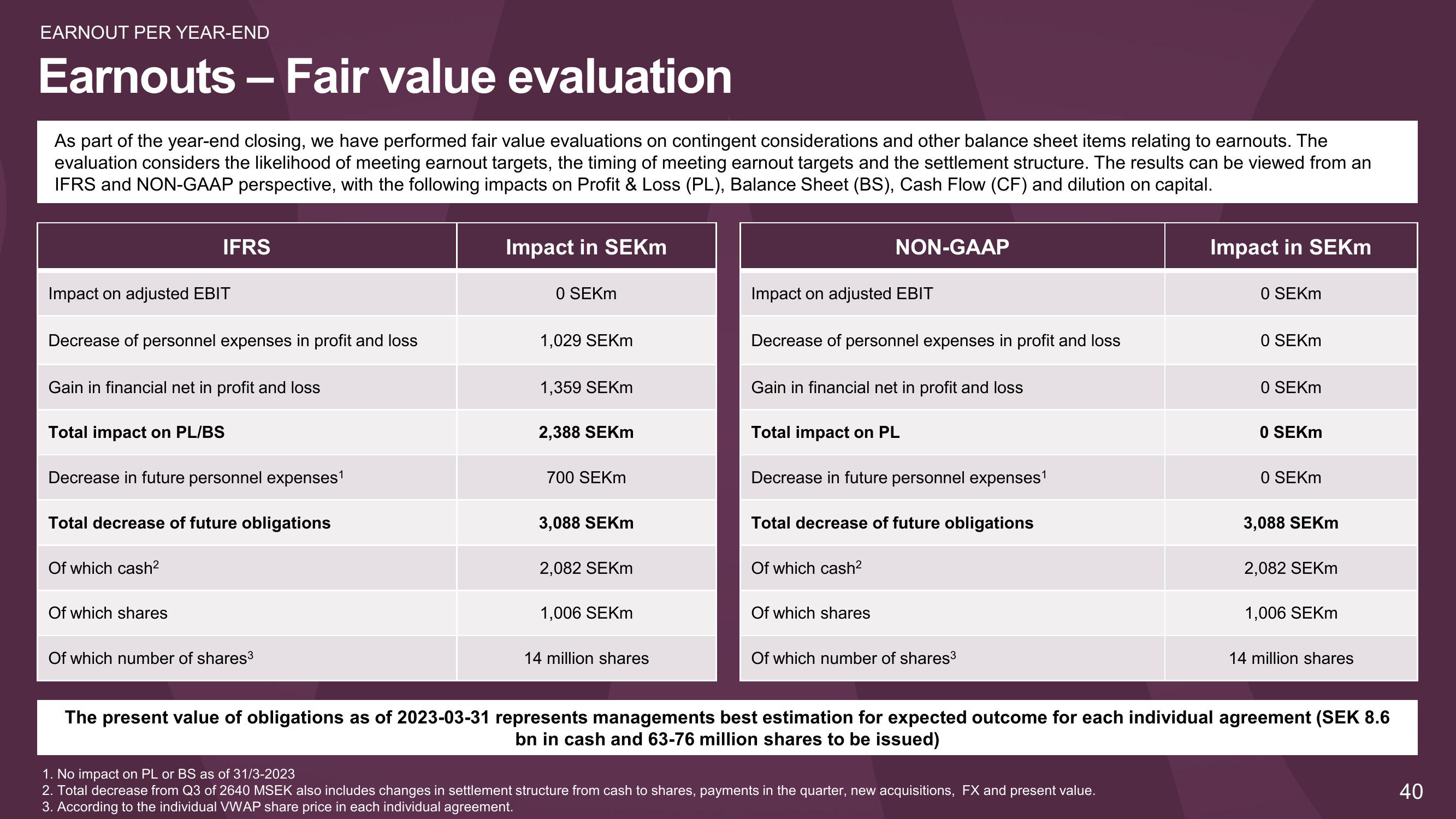

Earnouts - Fair value evaluation

As part of the year-end closing, we have performed fair value evaluations on contingent considerations and other balance sheet items relating to earnouts. The

evaluation considers the likelihood of meeting earnout targets, the timing of meeting earnout targets and the settlement structure. The results can be viewed from an

IFRS and NON-GAAP perspective, with the following impacts on Profit & Loss (PL), Balance Sheet (BS), Cash Flow (CF) and dilution on capital.

Impact on adjusted EBIT

Decrease of personnel expenses in profit and loss

IFRS

Gain in financial net in profit and loss

Total impact on PL/BS

Decrease in future personnel expenses¹

Total decrease of future obligations

Of which cash²

Of which shares

Of which number of shares³

Impact in SEKm

0 SEKM

1,029 SEKM

1,359 SEKM

2,388 SEKM

700 SEKM

3,088 SEKM

2,082 SEKM

1,006 SEKM

14 million shares

Impact on adjusted EBIT

NON-GAAP

Decrease of personnel expenses in profit and loss

Gain in financial net in profit and loss

Total impact on PL

Decrease in future personnel expenses¹

Total decrease of future obligations

Of which cash²

Of which shares

Of which number of shares³

Impact in SEKm

1. No impact on PL or BS as of 31/3-2023

2. Total decrease from Q3 of 2640 MSEK also includes changes in settlement structure from cash to shares, payments in the quarter, new acquisitions, FX and present value.

3. According to the individual VWAP share price in each individual agreement.

0 SEKM

0 SEKM

0 SEKM

0 SEKM

0 SEKM

3,088 SEKM

2,082 SEKM

1,006 SEKM

14 million shares

The present value of obligations as of 2023-03-31 represents managements best estimation for expected outcome for each individual agreement (SEK 8.6

bn in cash and 63-76 million shares to be issued)

40View entire presentation