Bakkt SPAC Presentation Deck

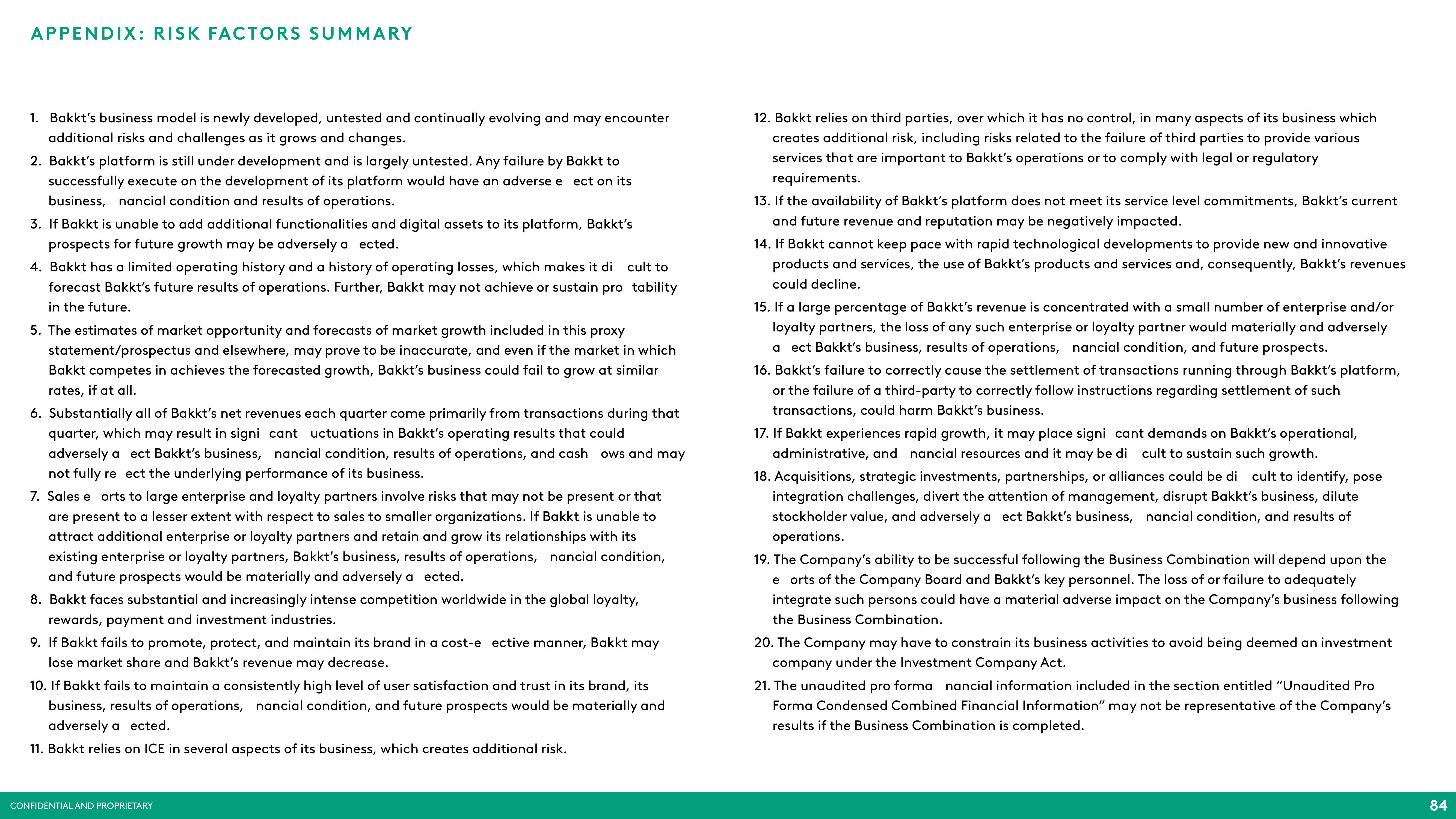

APPENDIX: RISK FACTORS SUMMARY

1. Bakkt's business model is newly developed, untested and continually evolving and may encounter

additional risks and challenges as it grows and changes.

2. Bakkt's platform is still under development and is largely untested. Any failure by Bakkt to

successfully execute on the development of its platform would have an adverse e ect on its

business, nancial condition and results of operations.

3. If Bakkt is unable to add additional functionalities and digital assets to its platform, Bakkt's

prospects for future growth may be adversely a ected.

4. Bakkt has a limited operating history and a history of operating losses, which makes it di cult to

forecast Bakkt's future results of operations. Further, Bakkt may not achieve or sustain pro tability

in the future.

5. The estimates of market opportunity and forecasts of market growth included in this proxy

statement/prospectus and elsewhere, may prove to be inaccurate, and even if the market in which

Bakkt competes in achieves the forecasted growth, Bakkt's business could fail to grow at similar

rates, if at all.

6. Substantially all of Bakkt's net revenues each quarter come primarily from transactions during that

quarter, which may result in signi cant uctuations in Bakkt's operating results that could

adversely a ect Bakkt's business, nancial condition, results of operations, and cash ows and may

not fully re ect the underlying performance of its business.

7. Sales e orts to large enterprise and loyalty partners involve risks that may not be present or that

are present to a lesser extent with respect to sales to smaller organizations. If Bakkt is unable to

attract additional enterprise or loyalty partners and retain and grow its relationships with its

existing enterprise or loyalty partners, Bakkt's business, results of operations, nancial condition,

and future prospects would be materially and adversely a ected.

8. Bakkt faces substantial and increasingly intense competition worldwide in the global loyalty,

rewards, payment and investment industries.

9. If Bakkt fails to promote, protect, and maintain its brand in a cost-e ective manner, Bakkt may

lose market share and Bakkt's revenue may decrease.

10. If Bakkt fails to maintain a consistently high level of user satisfaction and trust in its brand, its

business, results of operations, nancial condition, and future prospects would be materially and

adversely a ected.

11. Bakkt relies on ICE in several aspects of its business, which creates additional risk.

CONFIDENTIAL AND PROPRIETARY

12. Bakkt relies on third parties, over which it has no control, in many aspects of its business which

creates additional risk, including risks related to the failure of third parties to provide various

services that are important to Bakkt's operations or to comply with legal or regulatory

requirements.

13. If the availability of Bakkt's platform does not meet its service level commitments, Bakkt's current

and future revenue and reputation may be negatively impacted.

14. If Bakkt cannot keep pace with rapid technological developments to provide new and innovative

products and services, the use of Bakkt's products and services and, consequently, Bakkt's revenues

could decline.

15. If a large percentage of Bakkt's revenue is concentrated with a small number of enterprise and/or

loyalty partners, the loss of any such enterprise or loyalty partner would materially and adversely

a ect Bakkt's business, results of operations, nancial condition, and future prospects.

16. Bakkt's failure to correctly cause the settlement of transactions running through Bakkt's platform,

or the failure of a third-party to correctly follow instructions regarding settlement of such

transactions, could harm Bakkt's business.

17. If Bakkt experiences rapid growth, it may place signi cant demands on Bakkt's operational,

administrative, and nancial resources and it may be di cult to sustain such growth.

18. Acquisitions, strategic investments, partnerships, or alliances could be di cult to identify, pose

integration challenges, divert the attention of management, disrupt Bakkt's business, dilute

stockholder value, and adversely a ect Bakkt's business, nancial condition, and results of

operations.

19. The Company's ability to be successful following the Business Combination will depend upon the

e orts of the Company Board and Bakkt's key personnel. The loss of or failure to adequately

integrate such persons could have a material adverse impact on the Company's business following

the Business Combination.

20. The Company may have to constrain its business activities to avoid being deemed an investment

company under the Investment Company Act.

21. The unaudited pro forma nancial information included in the section entitled "Unaudited Pro

Forma Condensed Combined Financial Information" may not be representative of the Company's

results if the Business Combination is completed.

84View entire presentation