LanzaTech SPAC Presentation Deck

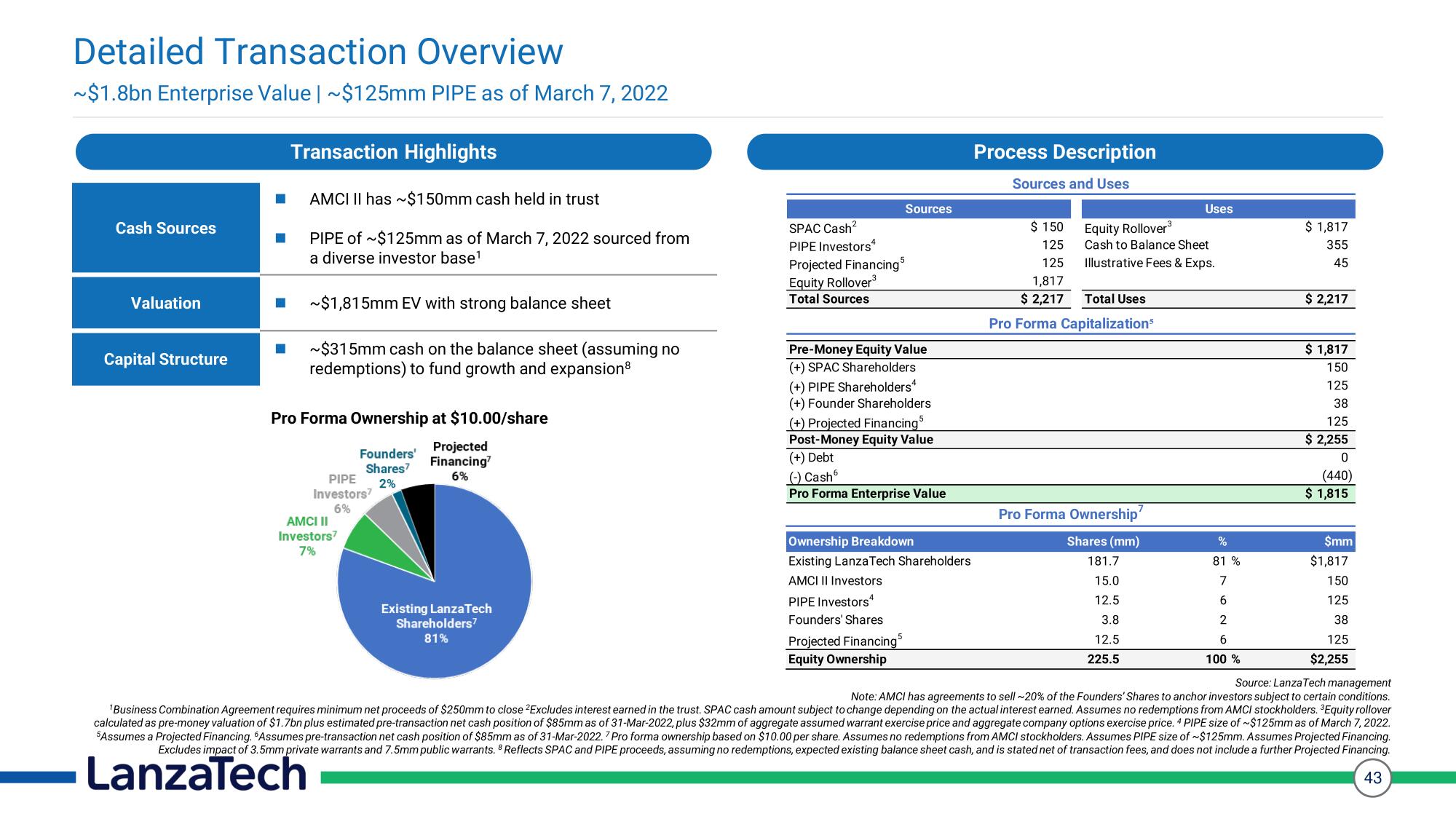

Detailed Transaction Overview

~$1.8bn Enterprise Value | ~$125mm PIPE as of March 7, 2022

Cash Sources

Valuation

Capital Structure

Transaction Highlights

AMCI II has ~$150mm cash held in trust

PIPE of ~$125mm as of March 7, 2022 sourced from

a diverse investor base¹

~$1,815mm EV with strong balance sheet

~$315mm cash on the balance sheet (assuming no

redemptions) to fund growth and expansion8

Pro Forma Ownership at $10.00/share

Founders'

Shares7

2%

Projected

Financing'

6%

PIPE

Investors

6%

AMCI II

Investors7

7%

Existing LanzaTech

Shareholders7

81%

Sources

SPAC Cash²

PIPE Investors4

Projected Financing³

Equity Rollover³

Total Sources

Pre-Money Equity Value

(+) SPAC Shareholders

(+) PIPE Shareholders4

(+) Founder Shareholders

(+) Projected Financing5

Post-Money Equity Value

(+) Debt

(-) Cash6

Pro Forma Enterprise Value

Ownership Breakdown

Existing Lanza Tech Shareholders

AMCI II Investors

PIPE Investors

Founders' Shares

Projected Financing

Equity Ownership

Process Description

Sources and Uses

$ 150

125

125

1,817

$ 2,217

Total Uses

Pro Forma Capitalization³

Uses

Equity Rollover³

Cash to Balance Sheet

Illustrative Fees & Exps.

Pro Forma Ownership'

Shares (mm)

181.7

15.0

12.5

3.8

12.5

225.5

%

81%

7

6

2

6

100 %

$ 1,817

355

45

$ 2,217

$ 1,817

150

125

38

125

$ 2,255

0

(440)

$ 1,815

$mm

$1,817

150

125

38

125

$2,255

Source: LanzaTech management

Note: AMCI has agreements to sell ~20% of the Founders' Shares to anchor investors subject to certain conditions.

'Business Combination Agreement requires minimum net proceeds of $250mm to close ²Excludes interest earned in the trust. SPAC cash amount subject to change depending on the actual interest earned. Assumes no redemptions from AMCI stockholders. ³Equity rollover

calculated as pre-money valuation of $1.7bn plus estimated pre-transaction net cash position of $85mm as of 31-Mar-2022, plus $32mm of aggregate assumed warrant exercise price and aggregate company options exercise price. 4 PIPE size of ~$125mm as of March 7, 2022.

5Assumes a Projected Financing. Assumes pre-transaction net cash position of $85mm as of 31-Mar-2022. 7 Pro forma ownership based on $10.00 per share. Assumes no redemptions from AMCI stockholders. Assumes PIPE size of ~$125mm. Assumes Projected Financing.

Excludes impact of 3.5mm private warrants and 7.5mm public warrants. 8 Reflects SPAC and PIPE proceeds, assuming no redemptions, expected existing balance sheet cash, and is stated net of transaction fees, and does not include a further Projected Financing.

43

LanzaTechView entire presentation