Bunzl Investor Day Presentation Deck

A STRONG PROCESS SUPPORTS OUR SUCCESS

Organisation and valuation discipline key to performance

Organisation and process

• Local origination; relationships built locally

●

●

Central corporate development team responsible for execution, in addition

to seeking new opportunities

Current central corporate development team has completed c.120

acquisitions

Strong history of new businesses joining Bunzl without impacting

commercial operations

-

Business areas responsible for onboarding and integration

Early focus on synergy delivery, cash management, financial reporting

and health & safety with minimal impact to commercial operations

Year 2 and beyond the focus turns to leveraging Bunzl's scale through

opportunities such as sourcing, own brand introduction, digital

investments and efficiency projects

CAPITAL MARKETS DAY 2021

●

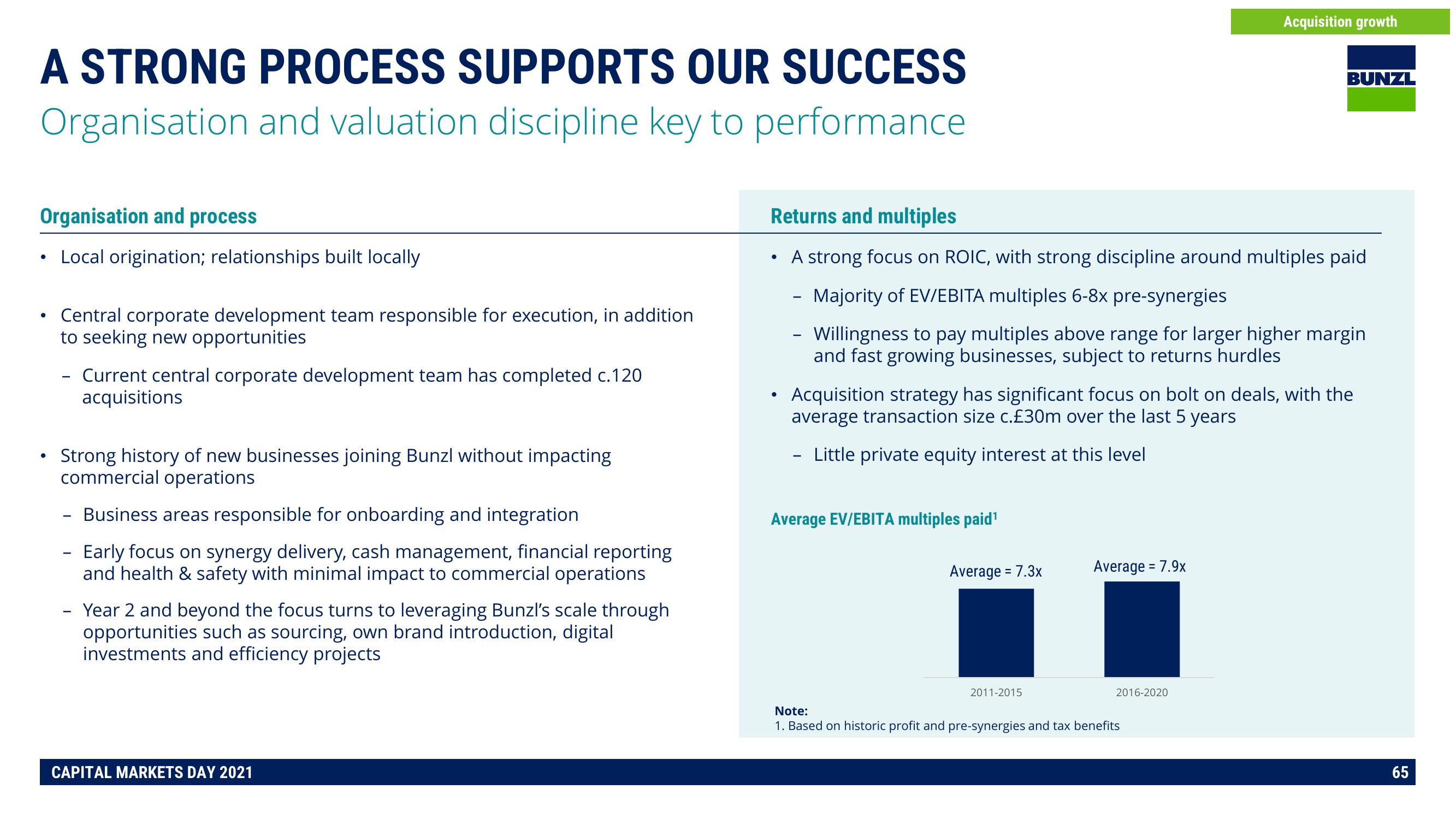

Returns and multiples

A strong focus on ROIC, with strong discipline around multiples paid

●

- Majority of EV/EBITA multiples 6-8x pre-synergies

Willingness to pay multiples above range for larger higher margin

and fast growing businesses, subject to returns hurdles

Average EV/EBITA multiples paid¹

Acquisition strategy has significant focus on bolt on deals, with the

average transaction size c.£30m over the last 5 years

Little private equity interest at this level

Average = 7.3x

2011-2015

Acquisition growth

Average = 7.9x

BUNZL

2016-2020

Note:

1. Based on historic profit and pre-synergies and tax benefits

65View entire presentation