Azerion SPAC Presentation Deck

The financial result

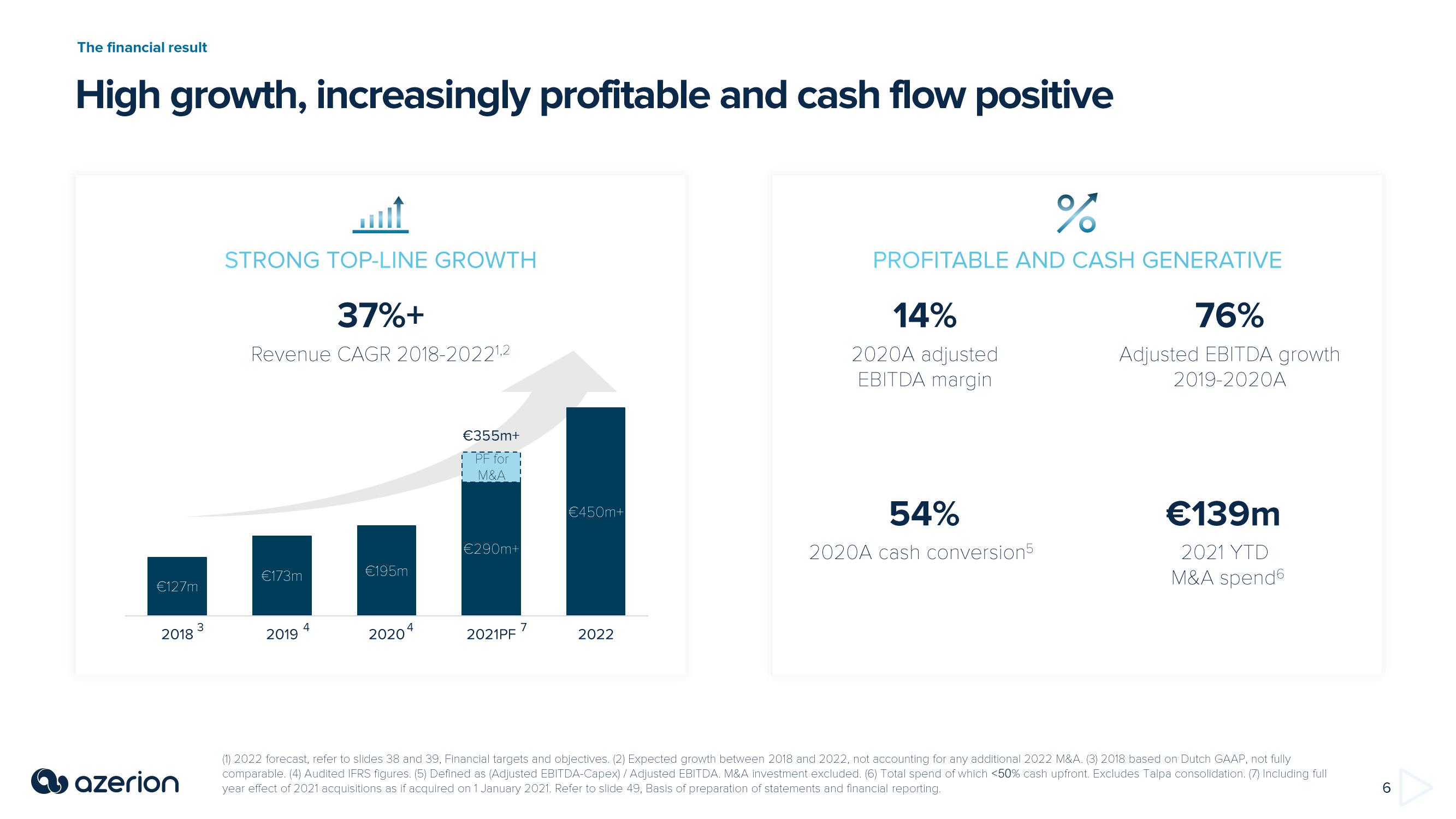

High growth, increasingly profitable and cash flow positive

€127m

2018

azerion

3

STRONG TOP-LINE GROWTH

37%+

Revenue CAGR 2018-20221,2

€173m

2019

4

€195m

20204

€355m+

PF for

M&A

€290m+

2021PF

7

€450m+

2022

%

PROFITABLE AND CASH GENERATIVE

14%

2020A adjusted

EBITDA margin

54%

2020A cash conversion5

76%

Adjusted EBITDA growth

2019-2020A

€139m

2021 YTD

M&A spend

(1) 2022 forecast, refer to slides 38 and 39, Financial targets and objectives. (2) Expected growth between 2018 and 2022, not accounting for any additional 2022 M&A. (3) 2018 based on Dutch GAAP, not fully

comparable. (4) Audited IFRS figures. (5) Defined as (Adjusted EBITDA-Capex) / Adjusted EBITDA. M&A investment excluded. (6) Total spend of which <50% cash upfront. Excludes Talpa consolidation. (7) Including full

year effect of 2021 acquisitions as if acquired on 1 January 2021. Refer to slide 49, Basis of preparation of statements and financial reporting.

6View entire presentation