Hydrafacial SPAC Presentation Deck

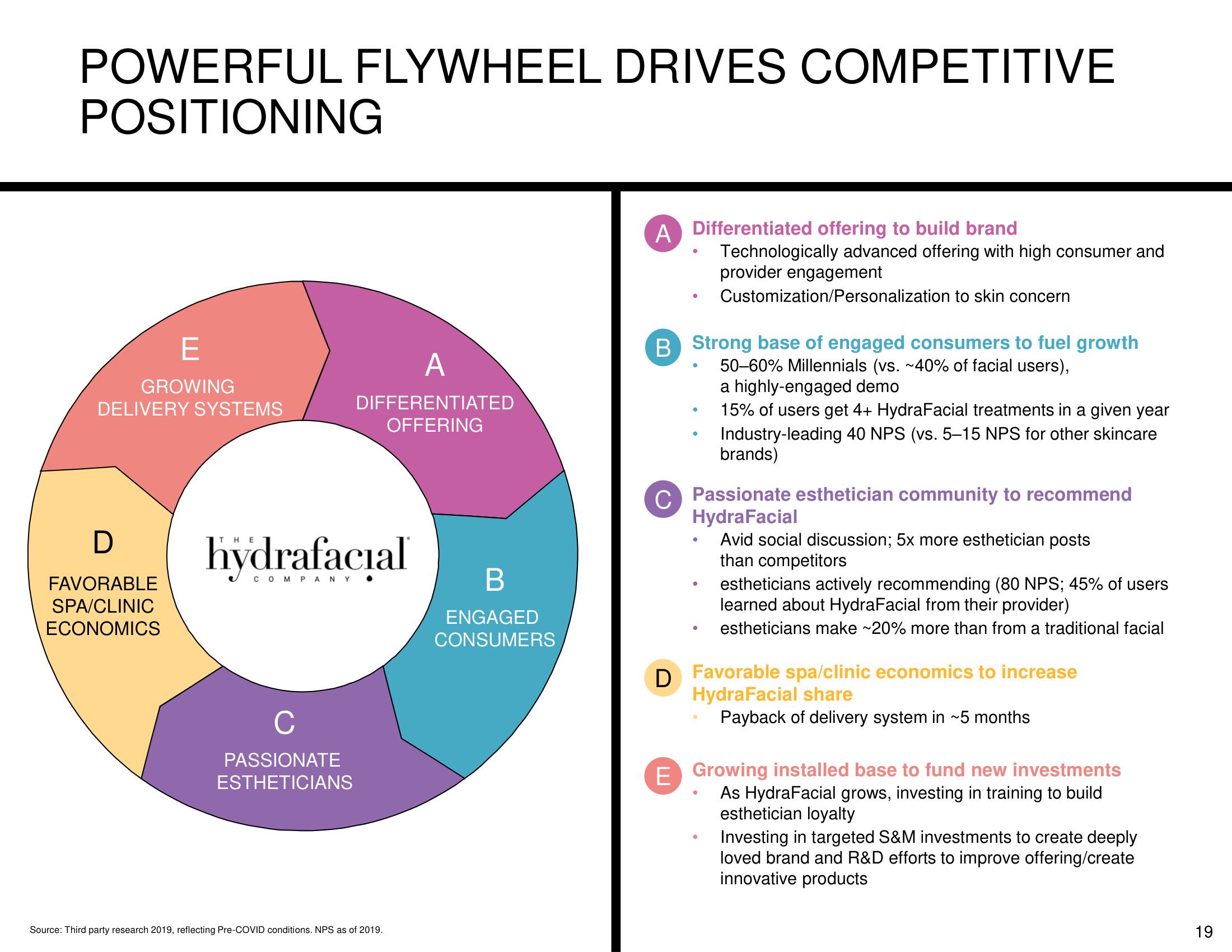

POWERFUL FLYWHEEL DRIVES COMPETITIVE

POSITIONING

E

GROWING

DELIVERY SYSTEMS

D

FAVORABLE

SPA/CLINIC

ECONOMICS

A

DIFFERENTIATED

OFFERING

hydrafacial

COMPANY.

C

PASSIONATE

ESTHETICIANS

Source: Third party research 2019, reflecting Pre-COVID conditions. NPS as of 2019.

B

ENGAGED

CONSUMERS

A Differentiated offering to build brand

B Strong base of engaged consumers to fuel growth

50-60% Millennials (vs. ~40% of facial users),

a highly-engaged demo

15% of users get 4+ HydraFacial treatments in a given year

Industry-leading 40 NPS (vs. 5-15 NPS for other skincare

brands)

Technologically advanced offering with high consumer and

provider engagement

Customization/Personalization to skin concern

C Passionate esthetician community to recommend

HydraFacial

D

E

Avid social discussion; 5x more esthetician posts

than competitors

estheticians actively recommending (80 NPS; 45% of users

learned about HydraFacial from their provider)

estheticians make ~20% more than from a traditional facial

Favorable spa/clinic economics to increase

HydraFacial share

Payback of delivery system in ~5 months

Growing installed base to fund new investments

As HydraFacial grows, investing in training to build

esthetician loyalty

Investing in targeted S&M investments to create deeply

loved brand and R&D efforts to improve offering/create

innovative products

19View entire presentation