MoneyLion SPAC Presentation Deck

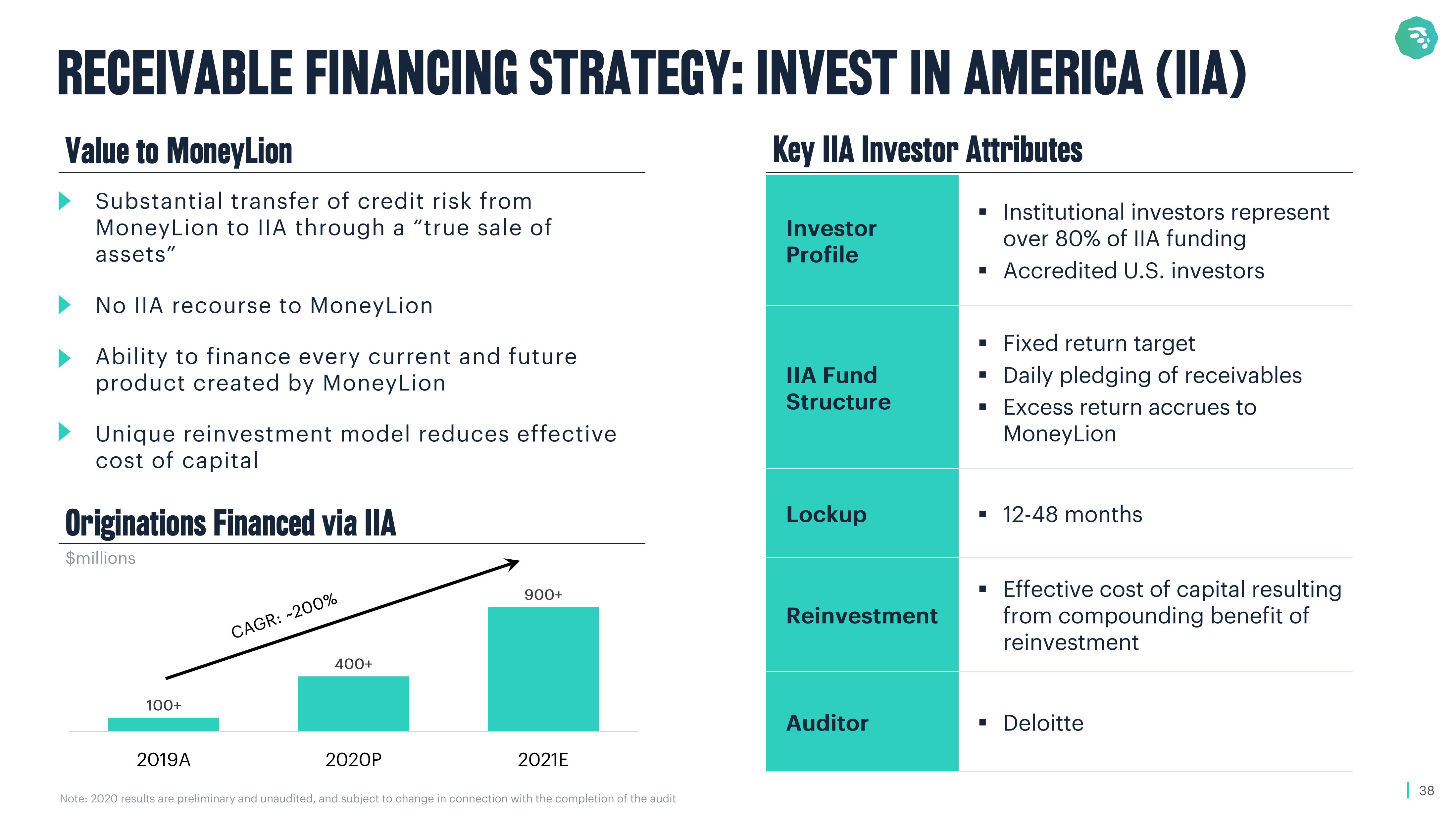

RECEIVABLE FINANCING STRATEGY: INVEST IN AMERICA (IIA)

Key IIA Investor Attributes

Value to MoneyLion

Substantial transfer of credit risk from

MoneyLion to IIA through a "true sale of

assets"

No IIA recourse to MoneyLion

Ability to finance every current and future

product created by MoneyLion

Unique reinvestment model reduces effective

cost of capital

Originations Financed via IIA

$millions

100+

2019A

CAGR: -200%

400+

2020P

900+

2021E

Note: 2020 results are preliminary and unaudited, and subject to change in connection with the completion of the audit

Investor

Profile

IIA Fund

Structure

Lockup

Reinvestment

Auditor

▪ Institutional investors represent

over 80% of IIA funding

▪ Accredited U.S. investors

. Fixed return target

Daily pledging of receivables

■ Excess return accrues to

MoneyLion

▪ 12-48 months

▪ Effective cost of capital resulting

from compounding benefit of

reinvestment

▪ Deloitte

| 38View entire presentation