Oatly Results Presentation Deck

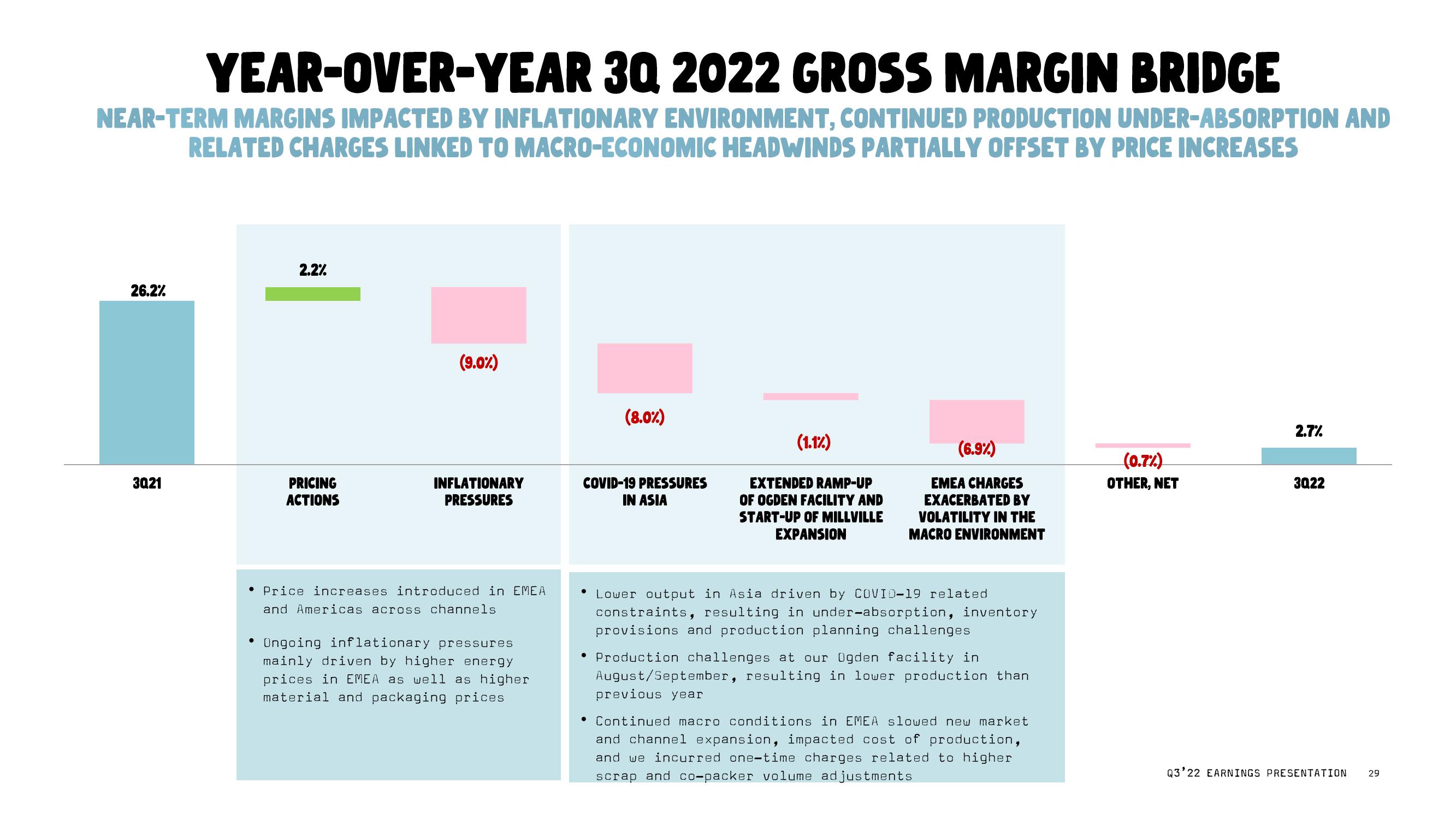

YEAR-OVER-YEAR 3Q 2022 GROSS MARGIN BRIDGE

NEAR-TERM MARGINS IMPACTED BY INFLATIONARY ENVIRONMENT, CONTINUED PRODUCTION UNDER-ABSORPTION AND

RELATED CHARGES LINKED TO MACRO-ECONOMIC HEADWINDS PARTIALLY OFFSET BY PRICE INCREASES

26.2%

3021

2.2%

●

PRICING

ACTIONS

(9.0%)

INFLATIONARY

PRESSURES

• Price increases introduced in EMEA

and Americas across channels

Ongoing inflationary pressures

mainly driven by higher energy

prices in EMEA as well as higher

material and packaging prices

(8.0%)

COVID-19 PRESSURES

IN ASIA

(1.1%)

EXTENDED RAMP-UP

OF OGDEN FACILITY AND

START-UP OF MILLVILLE

EXPANSION

(6.9%)

EMEA CHARGES

EXACERBATED BY

VOLATILITY IN THE

MACRO ENVIRONMENT

• Lower output in Asia driven by COVID-19 related

constraints, resulting in under-absorption, inventory

provisions and production planning challenges

• Production challenges at our Ogden facility in

August/September, resulting in lower production than

previous year

Continued macro conditions in EMEA slowed new market

and channel expansion, impacted cost of production,

and we incurred one-time charges related to higher

scrap and co-packer volume adjustments

(0.7%)

OTHER, NET

2.7%

3022

Q3'22 EARNINGS PRESENTATION

29View entire presentation