Rover Investor Update

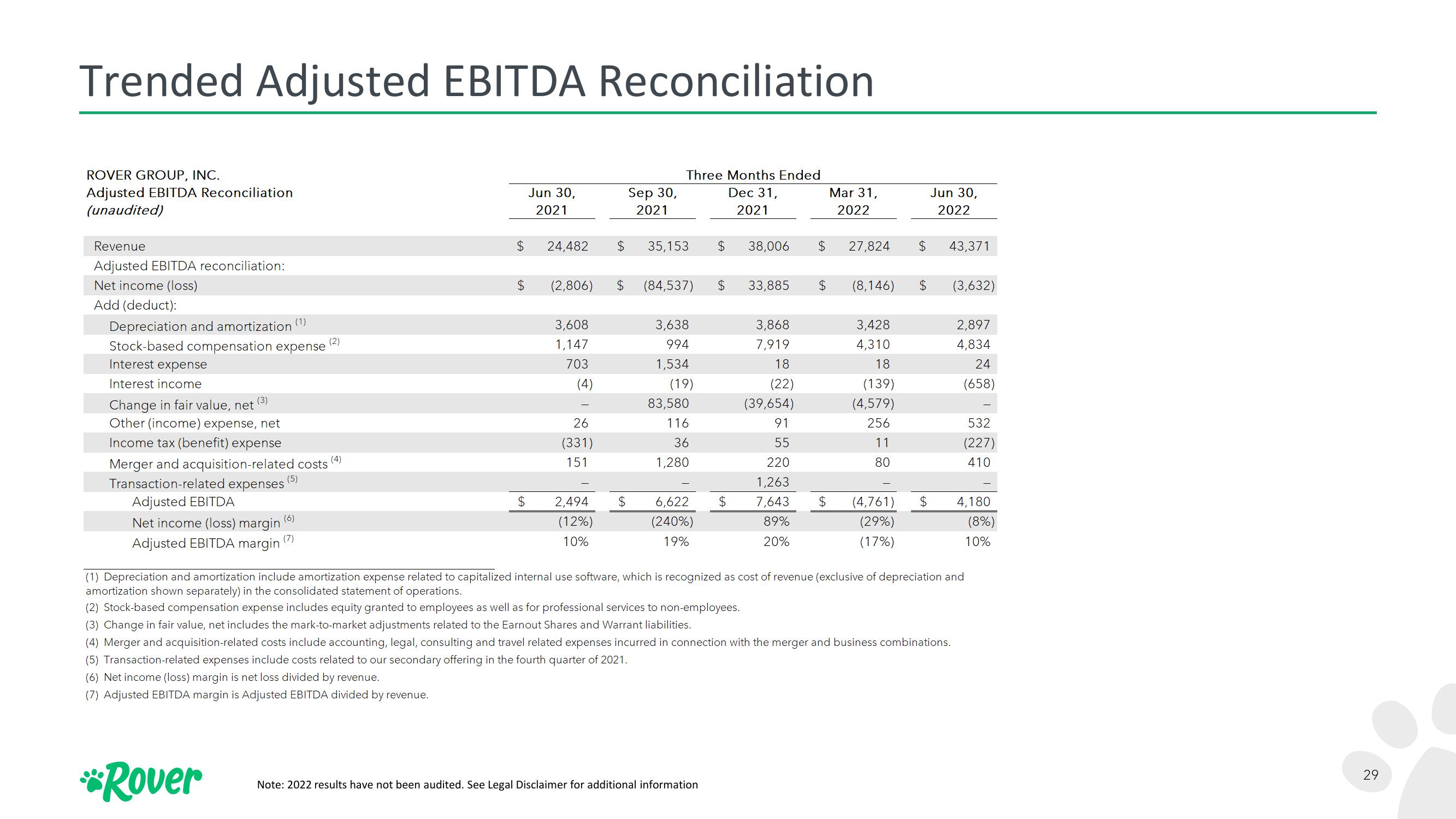

Trended Adjusted EBITDA Reconciliation

Three Months Ended

Dec 31,

2021

ROVER GROUP, INC.

Adjusted EBITDA Reconciliation

(unaudited)

Revenue

Adjusted EBITDA reconciliation:

Net income (loss)

Add (deduct):

Depreciation and amortization

Stock-based compensation expense

Interest expense

Interest income

(3)

Change in fair value, net

Other (income) expense, net

Income tax (benefit) expense

(1)

(4)

Merger and acquisition-related costs

Transaction-related expenses (5)

Adjusted EBITDA

Net income (loss) margin (6)

Adjusted EBITDA margin

(7)

(2)

*Rover

$

$

Jun 30,

2021

24,482

(2,806)

3,608

1,147

703

(4)

26

(331)

151

2,494

(12%)

10%

$

$

$

Sep 30,

2021

35,153 $

(84,537) $

3,638

994

1,534

(19)

83,580

116

36

1,280

6,622

(240%)

19%

$

Note: 2022 results have not been audited. See Legal Disclaimer for additional information

38,006

33,885

3,868

7,919

18

(22)

$

$

(39,654)

91

55

220

1,263

7,643 $

89%

20%

Mar 31,

2022

27,824

(8,146)

3,428

4,310

18

(139)

(4,579)

256

11

80

(4,761)

(29%)

(17%)

$

$

$

Jun 30,

2022

43,371

(3,632)

2,897

4,834

24

(658)

532

(227)

410

(1) Depreciation and amortization include amortization expense related to capitalized internal use software, which is recognized as cost of revenue (exclusive of depreciation and

amortization shown separately) in the consolidated statement of operations.

(2) Stock-based compensation expense includes equity granted to employees as well as for professional services to non-employees.

(3) Change in fair value, net includes the mark-to-market adjustments related to the Earnout Shares and Warrant liabilities.

(4) Merger and acquisition-related costs include accounting, legal, consulting and travel related expenses incurred in connection with the merger and business combinations.

(5) Transaction-related expenses include costs related to our secondary offering in the fourth quarter of 2021.

(6) Net income (loss) margin is net loss divided by revenue.

(7) Adjusted EBITDA margin is Adjusted EBITDA divided by revenue.

4,180

(8%)

10%

29View entire presentation