Deutsche Bank Results Presentation Deck

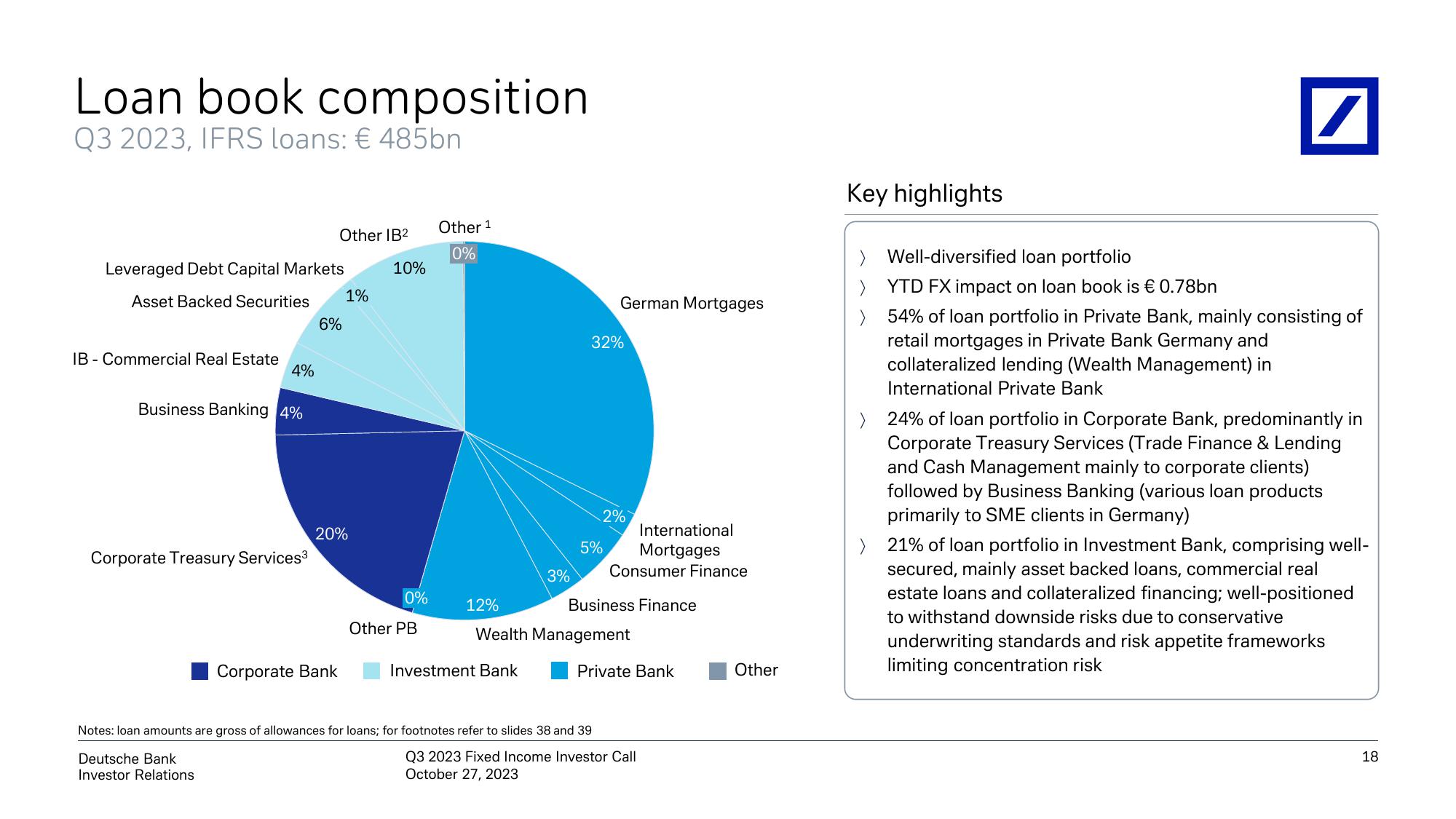

Loan book composition

Q3 2023, IFRS loans: € 485bn

Leveraged Debt Capital Markets

Asset Backed Securities

IB - Commercial Real Estate

4%

Business Banking 4%

Corporate Treasury Services³

Deutsche Bank

Investor Relations

Other IB²

6%

Corporate Bank

1%

20%

10%

0%

Other PB

Other ¹

0%

3%

Investment Bank

German Mortgages

32%

2%

International

5% Mortgages

Consumer Finance

12%

Business Finance

Wealth Management

Private Bank

Notes: loan amounts are gross of allowances for loans; for footnotes refer to slides 38 and 39

Q3 2023 Fixed Income Investor Call

October 27, 2023

Other

Key highlights

>

>

/

Well-diversified loan portfolio

YTD FX impact on loan book is € 0.78bn

54% of loan portfolio in Private Bank, mainly consisting of

retail mortgages in Private Bank Germany and

collateralized lending (Wealth Management) in

International Private Bank

> 24% of loan portfolio in Corporate Bank, predominantly in

Corporate Treasury Services (Trade Finance & Lending

and Cash Management mainly to corporate clients)

followed by Business Banking (various loan products

primarily to SME clients in Germany)

> 21% of loan portfolio in Investment Bank, comprising well-

secured, mainly asset backed loans, commercial real

estate loans and collateralized financing; well-positioned

to withstand downside risks due to conservative

underwriting standards and risk appetite frameworks

limiting concentration risk

18View entire presentation