Bed Bath & Beyond Results Presentation Deck

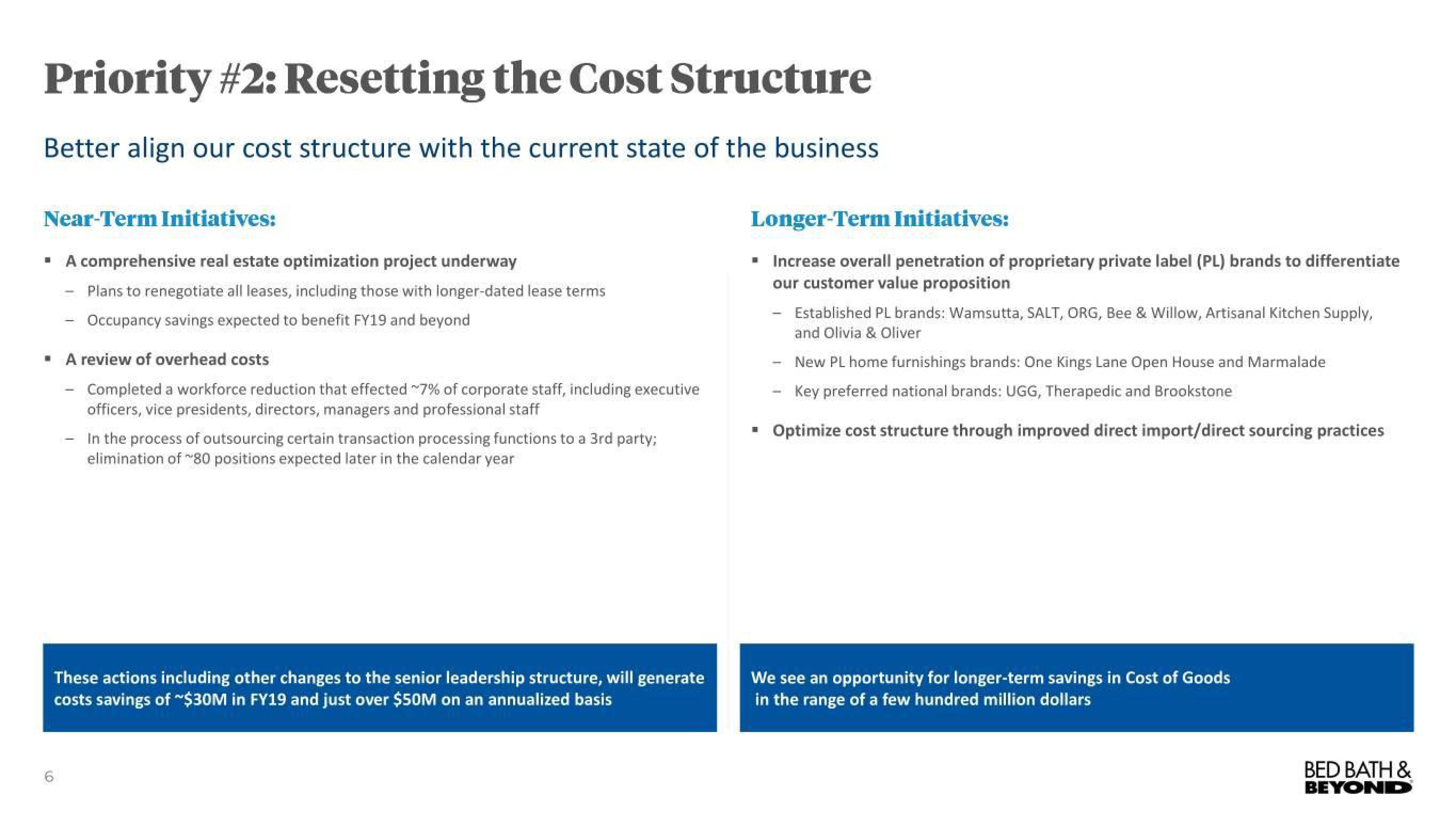

Priority #2: Resetting the Cost Structure

Better align our cost structure with the current state of the business

Near-Term Initiatives:

▪ A comprehensive real estate optimization project underway

Plans to renegotiate all leases, including those with longer-dated lease terms

Occupancy savings expected to benefit FY19 and beyond

▪ A review of overhead costs

Completed a workforce reduction that effected ~7% of corporate staff, including executive

officers, vice presidents, directors, managers and professional staff

LO

In the process of outsourcing certain transaction processing functions to a 3rd party;

elimination of 80 positions expected later in the calendar year

These actions including other changes to the senior leadership structure, will generate

costs savings of ~$30M in FY19 and just over $50M on an annualized basis

6

Longer-Term Initiatives:

▪ Increase overall penetration of proprietary private label (PL) brands to differentiate

our customer value proposition

Established PL brands: Wamsutta, SALT, ORG, Bee & Willow, Artisanal Kitchen Supply,

and Olivia & Oliver

New PL home furnishings brands: One Kings Lane Open House and Marmalade

Key preferred national brands: UGG, Therapedic and Brookstone

Optimize cost structure through improved direct import/direct sourcing practices

We see an opportunity for longer-term savings in Cost of Goods

in the range of a few hundred million dollars

BED BATH &

BEYONDView entire presentation