Pershing Square Activist Presentation Deck

B. PF McDonald's Financial Analysis

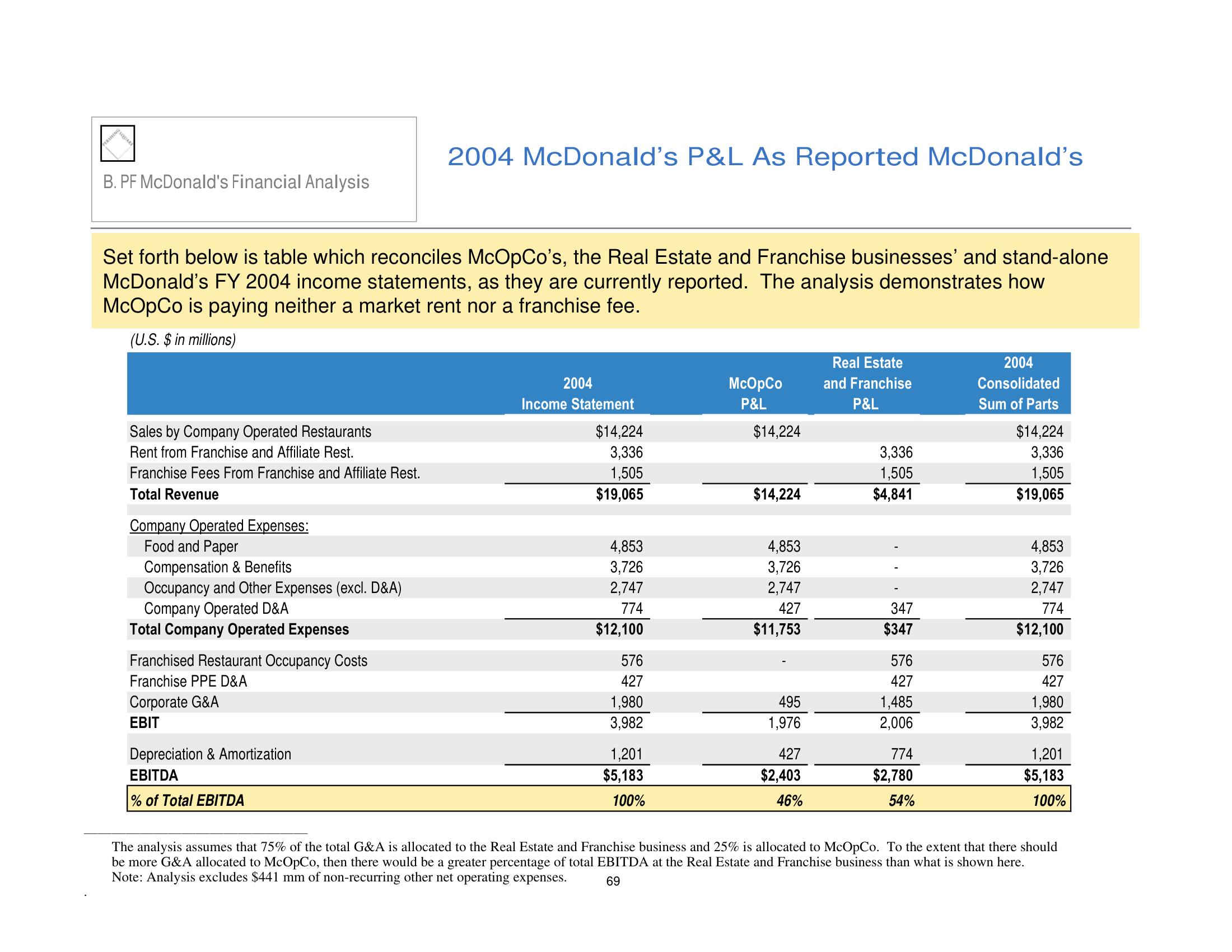

Set forth below is table which reconciles McOpCo's, the Real Estate and Franchise businesses' and stand-alone

McDonald's FY 2004 income statements, as they are currently reported. The analysis demonstrates how

McOpCo is paying neither a market rent nor a franchise fee.

(U.S. $ in millions)

Sales by Company Operated Restaurants

Rent from Franchise and Affiliate Rest.

Franchise Fees From Franchise and Affiliate Rest.

Total Revenue

Company Operated Expenses:

Food and Paper

Compensation & Benefits

Occupancy and Other Expenses (excl. D&A)

Company Operated D&A

Total Company Operated Expenses

Franchised Restaurant Occupancy Costs

Franchise PPE D&A

Corporate G&A

EBIT

2004 McDonald's P&L As Reported McDonald's

Depreciation & Amortization

EBITDA

% of Total EBITDA

2004

Income Statement

$14,224

3,336

1,505

$19,065

4,853

3,726

2,747

774

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

McOpCo

P&L

$14,224

$14,224

4,853

3,726

2,747

427

$11,753

495

1,976

427

$2,403

46%

Real Estate

and Franchise

P&L

3,336

1,505

$4,841

347

$347

576

427

1,485

2,006

774

$2,780

54%

2004

Consolidated

Sum of Parts

$14,224

3,336

1,505

$19,065

4,853

3,726

2,747

774

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. To the extent that there should

be more G&A allocated to McOpCo, then there would be a greater percentage of total EBITDA at the Real Estate and Franchise business than what is shown here.

Note: Analysis excludes $441 mm of non-recurring other net operating expenses. 69View entire presentation