Citi Investment Banking Pitch Book

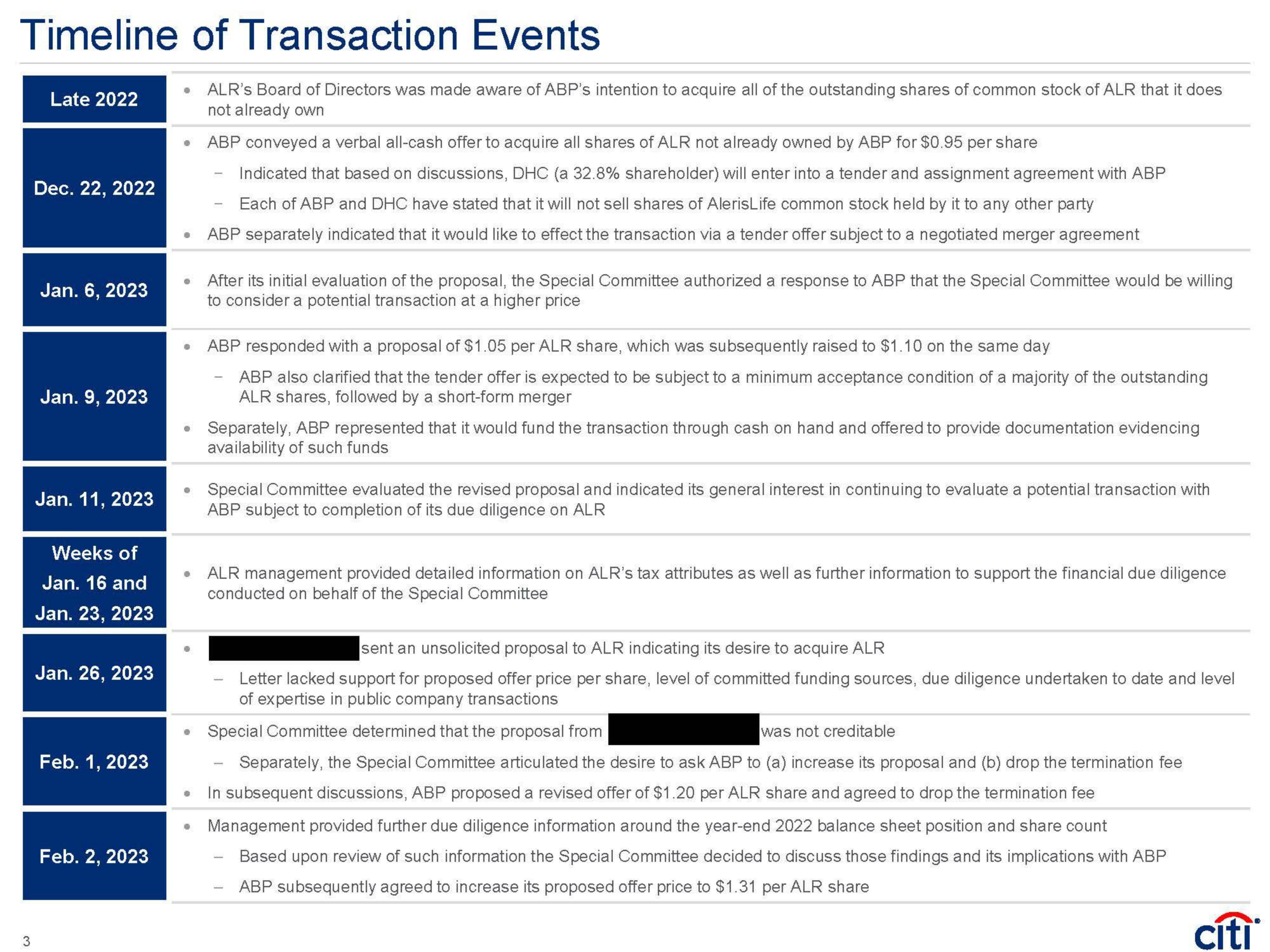

Timeline of Transaction Events

3

Late 2022

Dec. 22, 2022

Jan. 6, 2023

Jan. 9, 2023

Jan. 11, 2023

Weeks of

Jan. 16 and

Jan. 23, 2023

Jan. 26, 2023

Feb. 1, 2023

Feb. 2, 2023

●

●

●

ALR's Board of Directors was made aware of ABP's intention to acquire all of the outstanding shares of common stock of ALR that it does

not already own

ABP conveyed a verbal all-cash offer to acquire all shares of ALR not already owned by ABP for $0.95 per share

Indicated that based on discussions, DHC (a 32.8% shareholder) will enter into a tender and assignment agreement with ABP

Each of ABP and DHC have stated that it will not sell shares of AlerisLife common stock held by it to any other party

ABP separately indicated that it would like to effect the transaction via a tender offer subject to a negotiated merger agreement

After its initial evaluation of the proposal, the Special Committee authorized a response to ABP that the Special Committee would be willing

to consider a potential transaction at a higher price

ABP responded with a proposal of $1.05 per ALR share, which was subsequently raised to $1.10 on the same day

ABP also clarified that the tender offer is expected to be subject to a minimum acceptance condition of a majority of the outstanding

ALR shares, followed by a short-form merger

Separately, ABP represented that it would fund the transaction through cash on hand and offered to provide documentation evidencing

availability of such funds

Special Committee evaluated the revised proposal and indicated its general interest in continuing to evaluate a potential transaction with

ABP subject to completion of its due diligence on ALR

ALR management provided detailed information on ALR's tax attributes as well as further information to support the financial due diligence

conducted on behalf of the Special Committee

sent an unsolicited proposal to ALR indicating its desire to acquire ALR

Letter lacked support for proposed offer price per share, level of committed funding sources, due diligence undertaken to date and level

of expertise in public company transactions

Special Committee determined that the proposal from

was not creditable

Separately, the Special Committee articulated the desire to ask ABP to (a) increase its proposal and (b) drop the termination fee

In subsequent discussions, ABP proposed a revised offer of $1.20 per ALR share and agreed to drop the termination fee

Management provided further due diligence information around the year-end 2022 balance sheet position and share count

Based upon review of such information the Special Committee decided to discuss those findings and its implications with ABP

ABP subsequently agreed to increase its proposed offer price to $1.31 per ALR share

citiView entire presentation