LVMH Results Presentation Deck

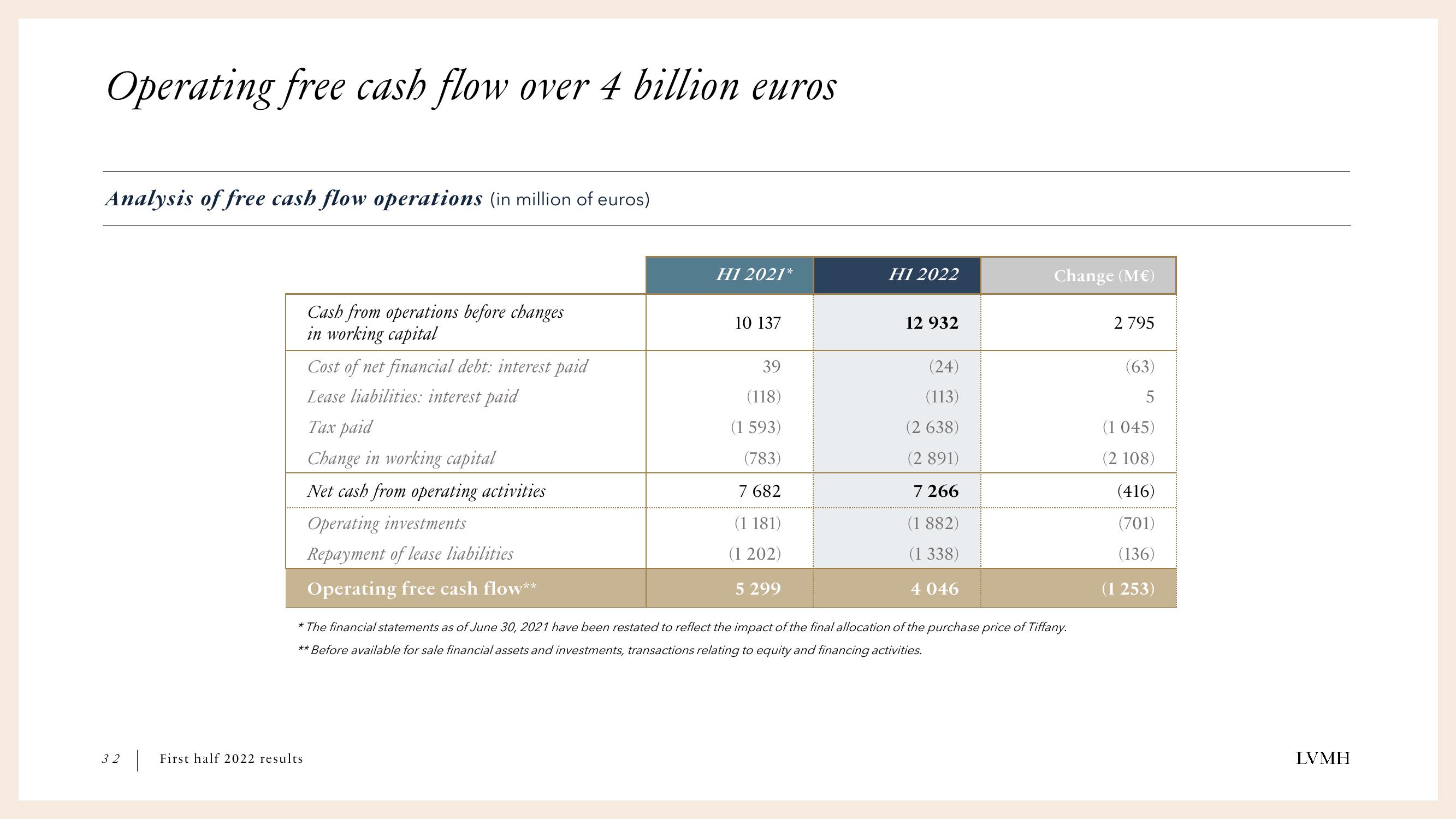

Operating free cash flow over 4 billion euros

Analysis of free cash flow operations (in million of euros)

Cash from operations before changes

in working capital

32 First half 2022 results

Cost of net financial debt: interest paid

Lease liabilities: interest paid

Tax paid

Change in working capital

Net cash from operating activities

Operating investments

Repayment of lease liabilities

Operating free cash flow**

H1 2021*

10 137

39

(118)

(1 593)

(783)

7 682

(1 181)

(1 202)

5 299

H1 2022

12 932

(24)

(113)

(2 638)

(2 891)

7 266

(1 882)

(1 338)

4 046

Change (M€)

* The financial statements as of June 30, 2021 have been restated to reflect the impact of the final allocation of the purchase price of Tiffany.

** Before available for sale financial assets and investments, transactions relating to equity and financing activities.

2 795

(63)

5

(1 045)

(2 108)

(416)

(701)

(136)

(1 253)

LVMHView entire presentation