Oatly Results Presentation Deck

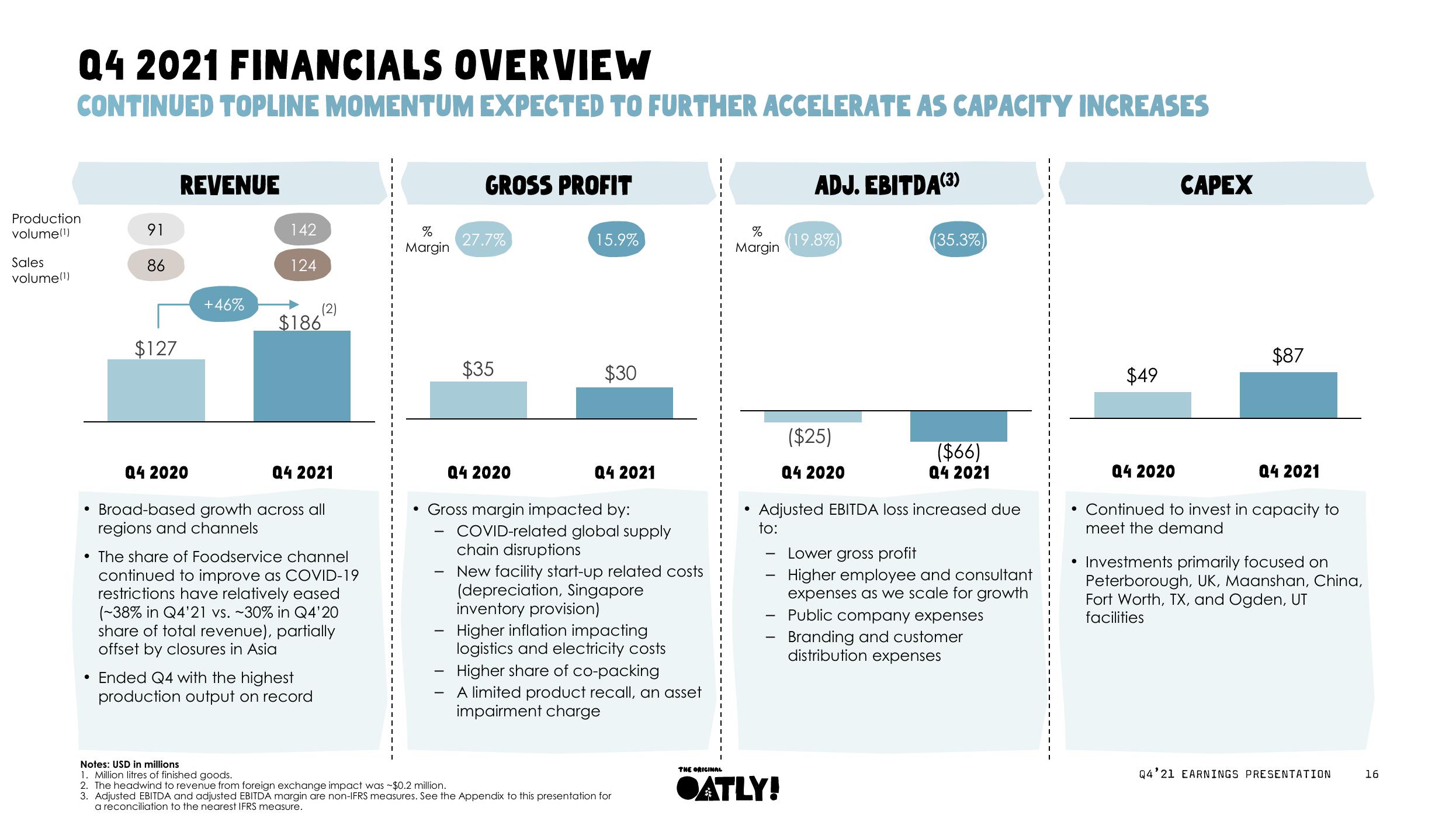

Q4 2021 FINANCIALS OVERVIEW

CONTINUED TOPLINE MOMENTUM EXPECTED TO FURTHER ACCELERATE AS CAPACITY INCREASES

Production

volume(¹)

Sales

volume(1)

●

91

86

$127

REVENUE

+46%

Q4 2020

142

124

$186

Q4 2021

Broad-based growth across all

regions and channels

• The share of Foodservice channel

continued to improve as COVID-19

restrictions have relatively eased

(-38% in Q4'21 vs. -30% in Q4'20

share of total revenue), partially

offset by closures in Asia

• Ended Q4 with the highest

production output on record

%

Margin

●

-

-

GROSS PROFIT

-

27.7%

$35

Q4 2020

15.9%

Gross margin impacted by:

$30

Q4 2021

COVID-related global supply

chain disruptions

New facility start-up related costs

(depreciation, Singapore

inventory provision)

Higher inflation impacting

logistics and electricity costs

Higher share of co-packing

A limited product recall, an asset

impairment charge

Notes: USD in millions

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was $0.2 million.

3. Adjusted EBITDA and adjusted EBITDA margin are non-IFRS measures. See the Appendix to this presentation for

a reconciliation to the nearest IFRS measure.

THE ORIGINAL

%

Margin

●

-

-

ADJ. EBITDA(3)

●ATLY!

(19.8%)

($25)

Q4 2020

Adjusted EBITDA loss increased due

to:

(35.3%)

($66)

Q4 2021

Lower gross profit

Higher employee and consultant

expenses as we scale for growth

Public company expenses

Branding and customer

distribution expenses

$49

Q4 2020

CAPEX

$87

Q4 2021

• Continued to invest in capacity to

meet the demand

• Investments primarily focused on

Peterborough, UK, Maanshan, China,

Fort Worth, TX, and Ogden, UT

facilities

Q4'21 EARNINGS PRESENTATION

16View entire presentation