KKR Real Estate Finance Trust Results Presentation Deck

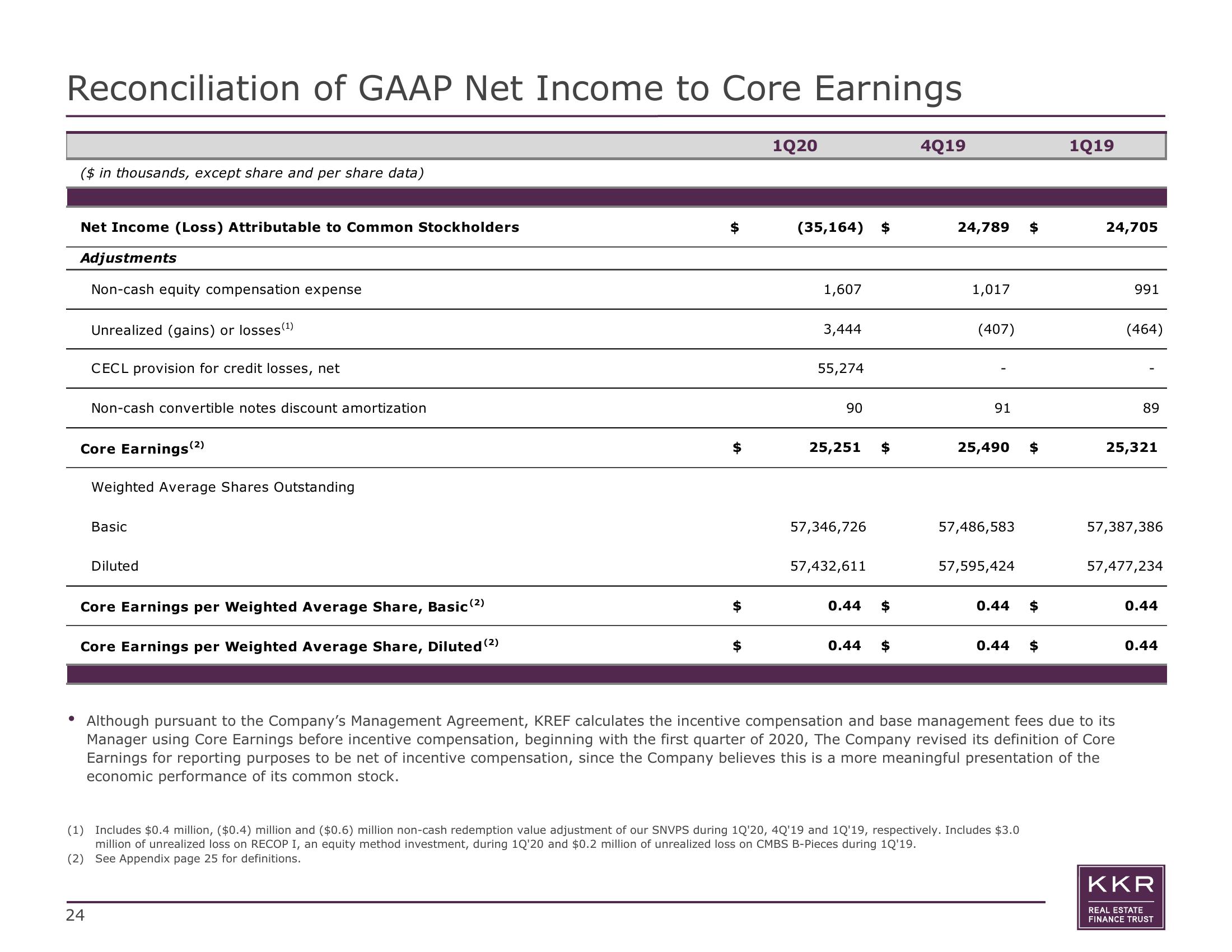

Reconciliation of GAAP Net Income to Core Earnings

($ in thousands, except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses (¹)

CECL provision for credit losses, net

Non-cash convertible notes discount amortization

Core Earnings (2)

Weighted Average Shares Outstanding

24

Basic

Diluted

Core Earnings per Weighted Average Share, Basic (²)

Core Earnings per Weighted Average Share, Diluted (²)

1Q20

(35,164)

1,607

3,444

55,274

90

25,251

57,346,726

57,432,611

0.44

0.44

4Q19

24,789

1,017

(407)

91

25,490

57,486,583

57,595,424

0.44

0.44

(1) Includes $0.4 million, ($0.4) million and ($0.6) million non-cash redemption value adjustment of our SNVPS during 1Q'20, 4Q'19 and 10'19, respectively. Includes $3.0

million of unrealized loss on RECOP I, an equity method investment, during 1Q'20 and $0.2 million of unrealized loss on CMBS B-Pieces during 1Q'19.

(2) See Appendix page 25 for definitions.

1Q19

24,705

991

• Although pursuant to the Company's Management Agreement, KREF calculates the inc entive compensation and base management fees due to its

Manager using Core Earnings before incentive compensation, beginning with the first quarter of 2020, The Company revised its definition of Core

Earnings for reporting purposes to be net of incentive compensation, since the Company believes this is a more meaningful presentation of the

economic performance of its common stock.

(464)

89

25,321

57,387,386

57,477,234

0.44

0.44

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation