Trian Partners Activist Presentation Deck

■

■

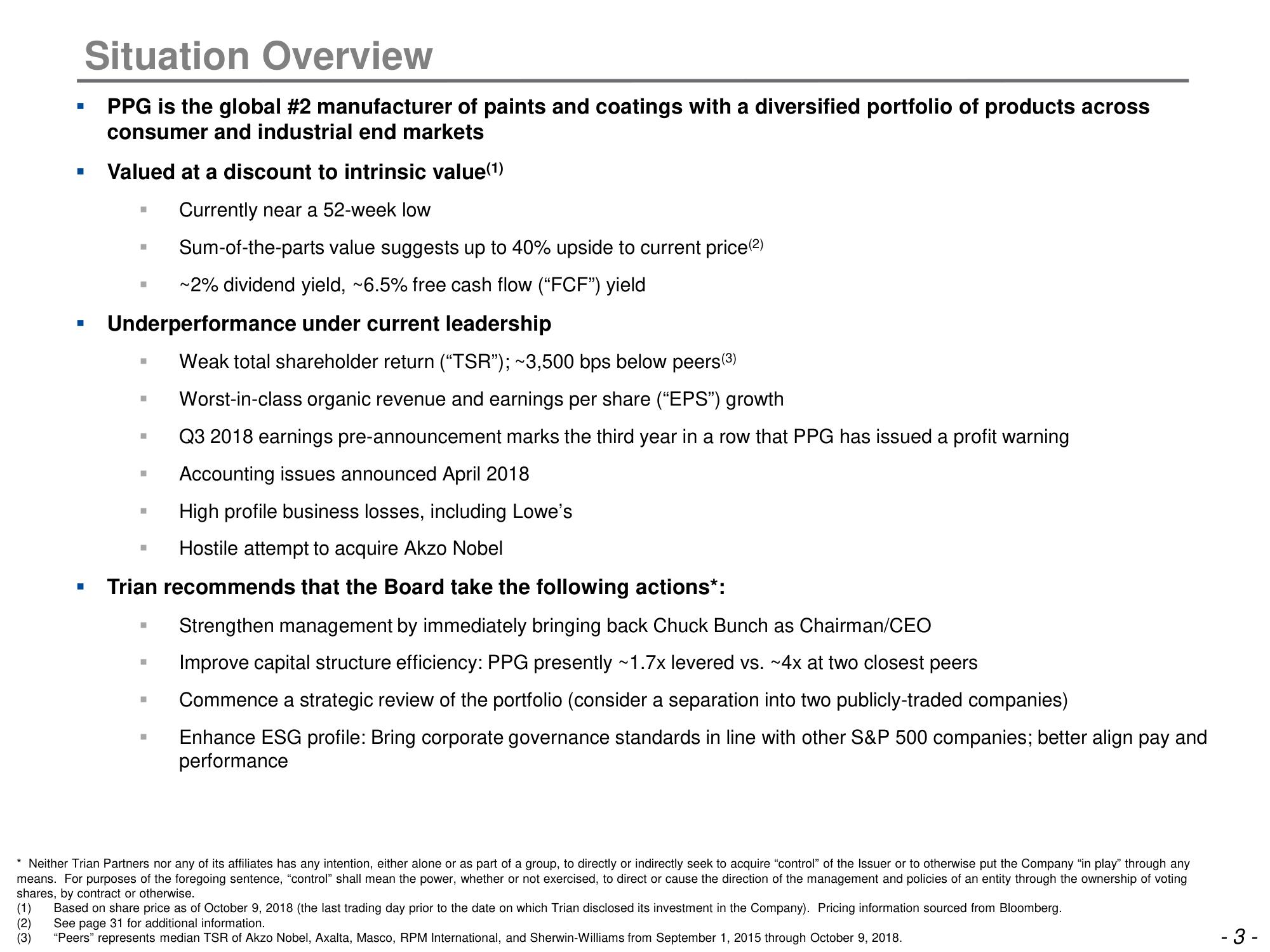

Situation Overview

PPG is the global #2 manufacturer of paints and coatings with a diversified portfolio of products across

consumer and industrial end markets

Valued at a discount to intrinsic value(¹)

Currently near a 52-week low

Sum-of-the-parts value suggests up to 40% upside to current price (2)

~2% dividend yield, ~6.5% free cash flow ("FCF") yield

■

■

H

Underperformance under current leadership

■

■

■

■

Weak total shareholder return ("TSR"); ~3,500 bps below peers(3)

■

Worst-in-class organic revenue and earnings per share ("EPS") growth

Q3 2018 earnings pre-announcement marks the third year in a row that PPG has issued a profit warning

Accounting issues announced April 2018

High profile business losses, including Lowe's

Hostile attempt to acquire Akzo Nobel

Trian recommends that the Board take the following actions*:

Strengthen management by immediately bringing back Chuck Bunch as Chairman/CEO

Improve capital structure efficiency: PPG presently ~1.7x levered vs. ~4x at two closest peers

Commence a strategic review of the portfolio (consider a separation into two publicly-traded companies)

Enhance ESG profile: Bring corporate governance standards in line with other S&P 500 companies; better align pay and

performance

* Neither Trian Partners nor any of its affiliates has any intention, either alone or as part of a group, to directly or indirectly seek to acquire "control" of the Issuer or to otherwise put the Company "in play" through any

means. For purposes of the foregoing sentence, "control" shall mean the power, whether or not exercised, to direct or cause the direction of the management and policies of an entity through the ownership of voting

shares, by contract or otherwise.

(1) Based on share price as of October 9, 2018 (the last trading day prior to the date on which Trian disclosed its investment in the Company). Pricing information sourced from Bloomberg.

(2) See page 31 for additional information.

(3)

"Peers" represents median TSR of Akzo Nobel, Axalta, Masco, RPM International, and Sherwin-Williams from September 1, 2015 through October 9, 2018.

- 3-View entire presentation