The Urgent Need for Change and The Superior Path Forward

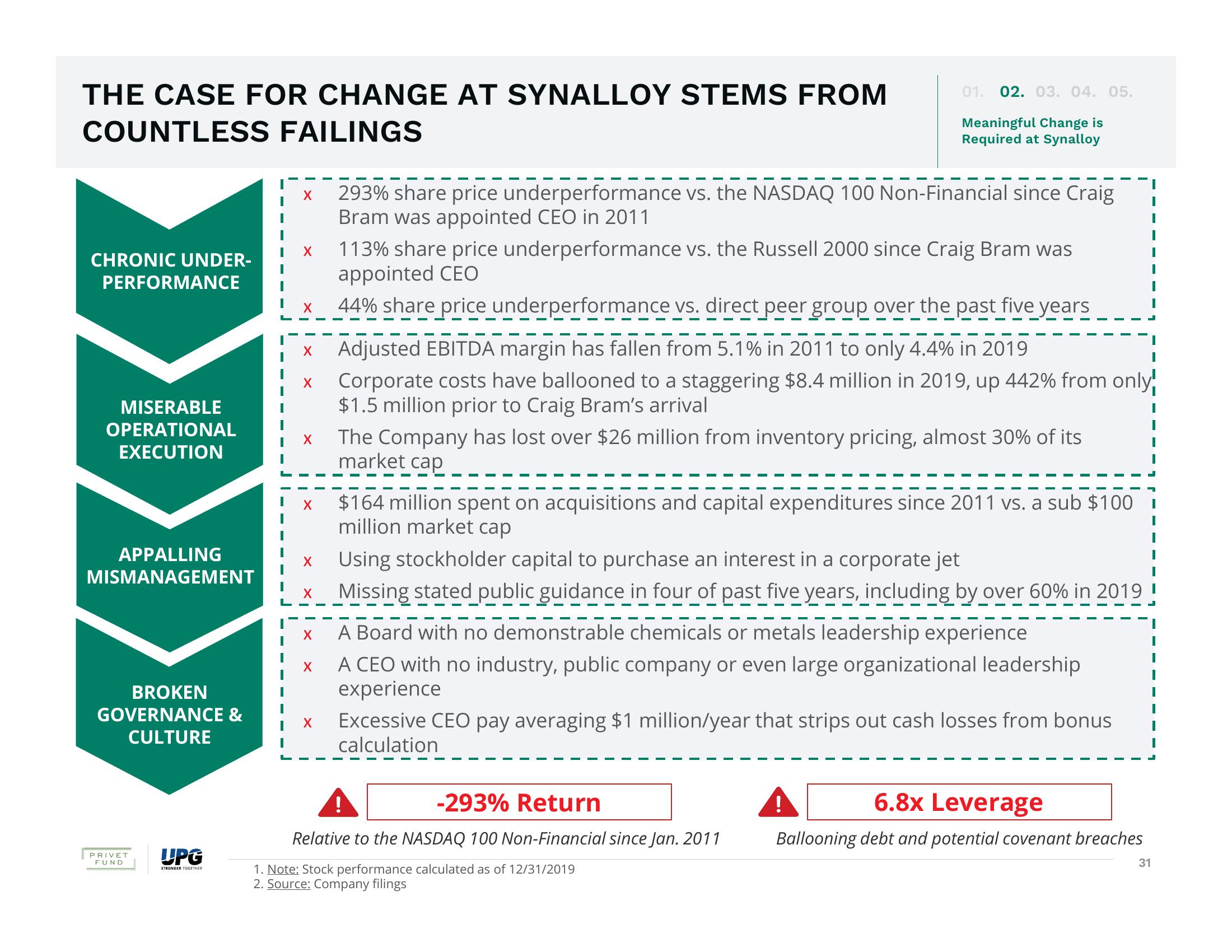

THE CASE FOR CHANGE AT SYNALLOY STEMS FROM

COUNTLESS FAILINGS

CHRONIC UNDER-

PERFORMANCE

MISERABLE

OPERATIONAL

EXECUTION

APPALLING

MISMANAGEMENT

BROKEN

GOVERNANCE &

CULTURE

PRIVET

FUND

UPG

STRONGER TOGETHER

X

X

X

01. 02. 03. 04. 05.

X Adjusted EBITDA margin has fallen from 5.1% in 2011 to only 4.4% in 2019

X Corporate costs have ballooned to a staggering $8.4 million in 2019, up 442% from only

$1.5 million prior to Craig Bram's arrival

X

Meaningful Change is

Required at Synalloy

293% share price underperformance vs. the NASDAQ 100 Non-Financial since Craig

Bram was appointed CEO in 2011

X The Company has lost over $26 million from inventory pricing, almost 30% of its

market cap

X

113% share price underperformance vs. the Russell 2000 since Craig Bram was

appointed CEO

44% share price underperformance vs. direct peer group over the past five years

X $164 million spent on acquisitions and capital expenditures since 2011 vs. a sub $100

million market cap

X Using stockholder capital to purchase an interest in a corporate jet

X Missing stated public guidance in four of past five years, including by over 60% in 2019

A Board with no demonstrable chemicals or metals leadership experience

A CEO with no industry, public company or even large organizational leadership

experience

-293% Return

Relative to the NASDAQ 100 Non-Financial since Jan. 2011

1. Note: Stock performance calculated as of 12/31/2019

2. Source: Company filings

Excessive CEO pay averaging $1 million/year that strips out cash losses from bonus

calculation

6.8x Leverage

Ballooning debt and potential covenant breaches

I

I

31View entire presentation