J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

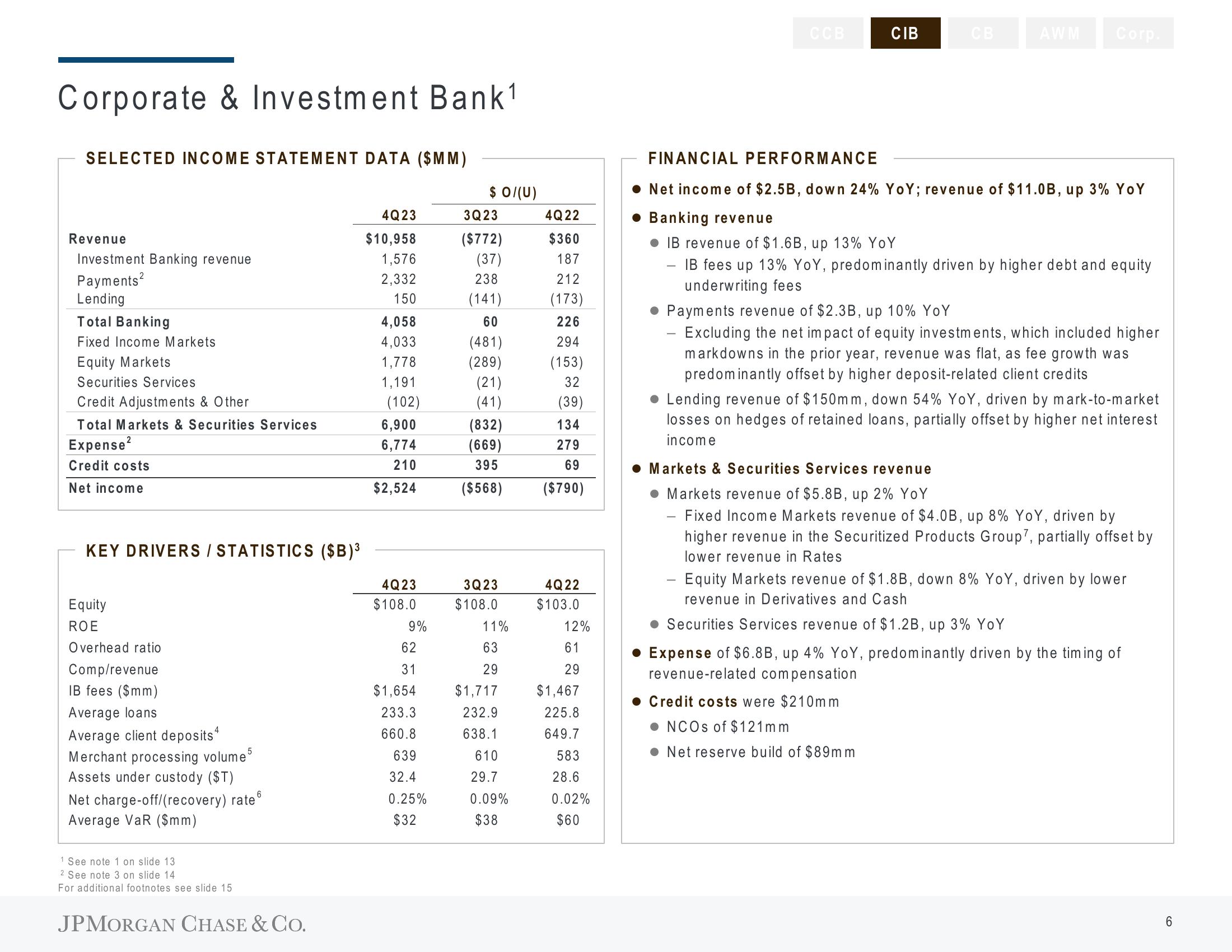

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Investment Banking revenue

Payments²

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services.

Credit Adjustments & Other

Total Markets & Securities Services

Expense²

Credit costs

Net income

KEY DRIVERS / STATISTICS ($B)³

Equity

ROE

Overhead ratio

Comp/revenue

IB fees ($mm)

Average loans

4

Average client deposits

Merchant processing volume

Assets under custody ($T)

6

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 13

2 See note 3 on slide 14

For additional footnotes see slide 15

JPMORGAN CHASE & CO.

4Q23

$10,958

1,576

2,332

150

4,058

4,033

1,778

1,191

(102)

6,900

6,774

210

$2,524

4Q23

$108.0

9%

62

31

$1,654

233.3

660.8

639

32.4

0.25%

$32

$ 0/(U)

3Q23

($772)

(37)

238

(141)

60

(481)

(289)

(21)

(41)

212

(173)

226

294

(153)

32

(39)

(832)

134

(669)

279

395

69

($568) ($790)

3Q23

$108.0

11%

63

29

4Q22

$360

$1,717

232.9

638.1

610

29.7

0.09%

$38

4Q22

$103.0

12%

61

29

$1,467

225.8

649.7

583

28.6

0.02%

$60

CCB

CIB

CB

AWM Corp.

FINANCIAL PERFORMANCE

Net income of $2.5B, down 24% YoY; revenue of $11.0B, up 3% YoY

Banking revenue

IB revenue of $1.6B, up 13% YoY

IB fees up 13% YoY, predominantly driven by higher debt and equity

underwriting fees

Payments revenue of $2.3B, up 10% YoY

Excluding the net impact of equity investments, which included higher

markdowns in the prior year, revenue was flat, as fee growth was

predominantly offset by higher deposit-related client credits

Lending revenue of $150mm, down 54% YoY, driven by mark-to-market

losses on hedges of retained loans, partially offset by higher net interest

income

Markets & Securities Services revenue

Markets revenue of $5.8B, up 2% YoY

Fixed Income Markets revenue of $4.0B, up 8% YOY, driven by

higher revenue in the Securitized Products Group7, partially offset by

lower revenue in Rates

- Equity Markets revenue of $1.8B, down 8% YoY, driven by lower

revenue in Derivatives and Cash

Securities Services revenue of $1.2B, up 3% YoY

Expense of $6.8B, up 4% YoY, predominantly driven by the timing of

revenue-related compensation

Credit costs were $210mm

NCOs of $121mm

Net reserve build of $89mm

6View entire presentation