LandSea Homes Investor Presentation

34

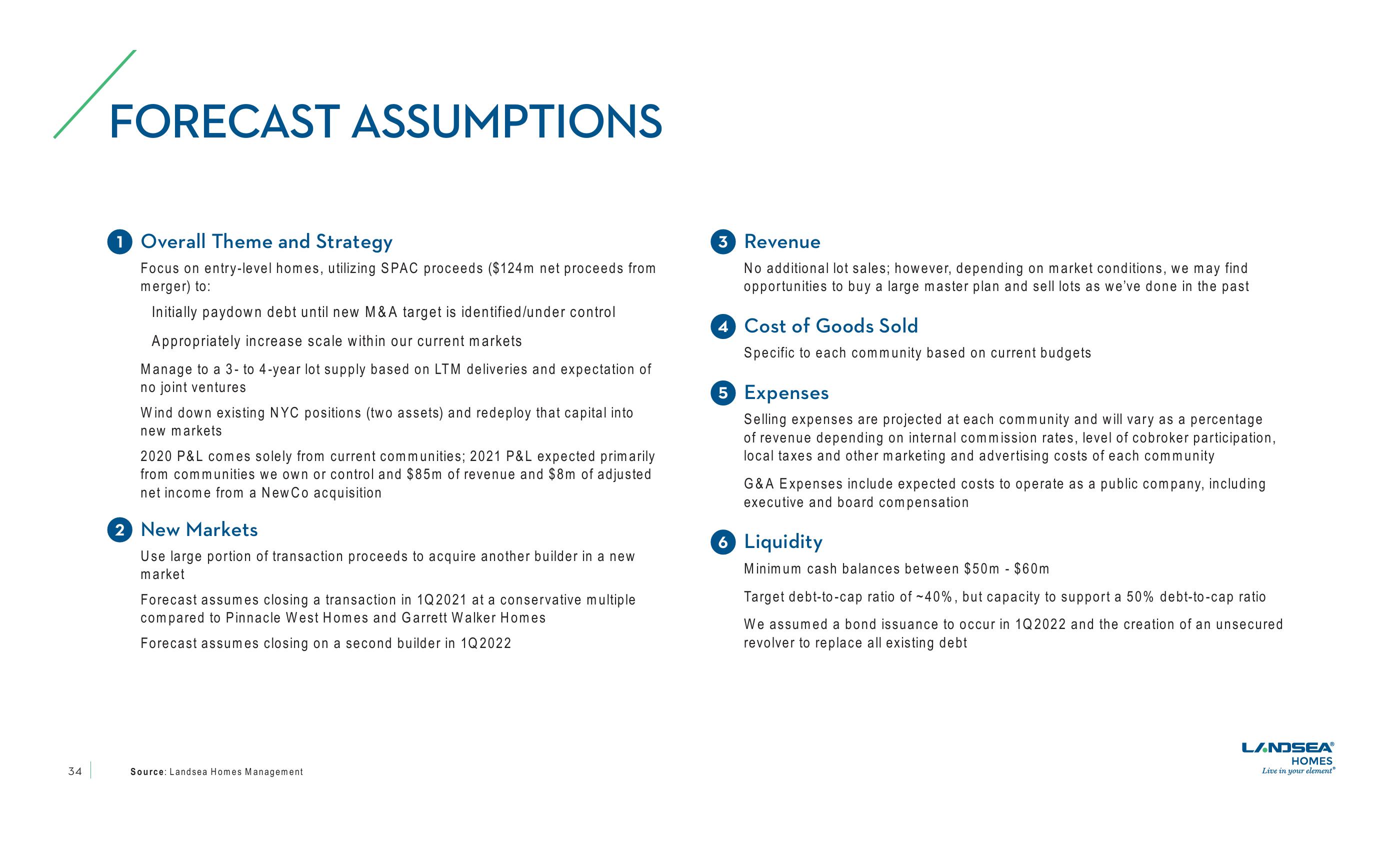

FORECAST ASSUMPTIONS

1 Overall Theme and Strategy

Focus on entry-level homes, utilizing SPAC proceeds ($124m net proceeds from

merger) to:

Initially paydown debt until new M&A target is identified/under control

Appropriately increase scale within our current markets

Manage to a 3- to 4-year lot supply based on LTM deliveries and expectation of

no joint ventures

Wind down existing NYC positions (two assets) and redeploy that capital into

new markets

2020 P&L comes solely from current communities; 2021 P&L expected primarily

from communities we own or control and $85m of revenue and $8m of adjusted

net income from a New Co acquisition

2 New Markets

Use large portion of transaction proceeds to acquire another builder in a new

market

Forecast assumes closing a transaction in 1Q2021 at a conservative multiple

compared to Pinnacle West Homes and Garrett Walker Homes

Forecast assumes closing on a second builder in 1Q2022

Source: Landsea Homes Management

3 Revenue

No additional lot sales; however, depending on market conditions, we may find

opportunities to buy a large master plan and sell lots as we've done in the past

4 Cost of Goods Sold

Specific to each community based on current budgets

5 Expenses

Selling expenses are projected at each community and will vary as a percentage

revenue depending on internal commission rates, level of cobroker participation,

local taxes and other marketing and advertising costs of each community

G&A Expenses include expected costs to operate as a public company, including

executive and board compensation

6 Liquidity

Minimum cash balances between $50m - $60m

Target debt-to-cap ratio of ~40%, but capacity to support a 50% debt-to-cap ratio

We assumed a bond issuance to occur in 1Q2022 and the creation of an unsecured

revolver to replace all existing debt

LANDSEAⓇ®

HOMES

Live in your element®View entire presentation