ironSource SPAC Presentation Deck

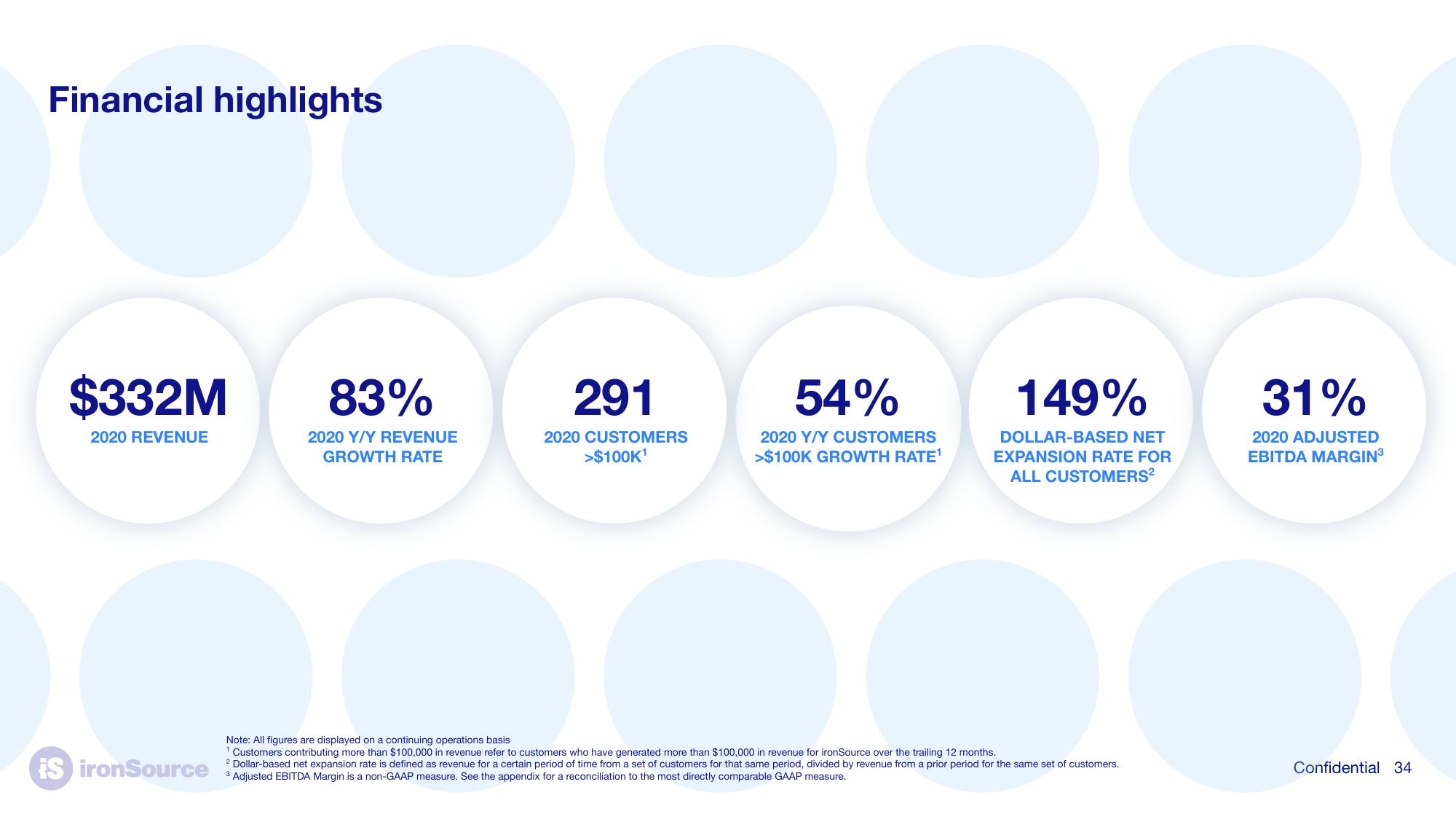

Financial highlights

$332M

2020 REVENUE

iS ironSource

83%

2020 Y/Y REVENUE

GROWTH RATE

291

2020 CUSTOMERS

>$100K¹

54%

2020 Y/Y CUSTOMERS

>$100K GROWTH RATE¹

149%

DOLLAR-BASED NET

EXPANSION RATE FOR

ALL CUSTOMERS²

Note: All figures are displayed on a continuing operations basis

¹ Customers contributing more than $100,000 in revenue refer to customers who have generated more than $100,000 in revenue for ironSource over the trailing 12 months.

2 Dollar-based net expansion rate is defined as revenue for a certain period of time from a set of customers for that same period, divided by revenue from a prior period for the same set of customers.

3 Adjusted EBITDA Margin is a non-GAAP measure. See the appendix for a reconciliation to the most directly comparable GAAP measure.

31%

2020 ADJUSTED

EBITDA MARGIN³

Confidential 34View entire presentation