Lordstown Motors Investor Presentation Deck

Pro Forma Equity Ownership

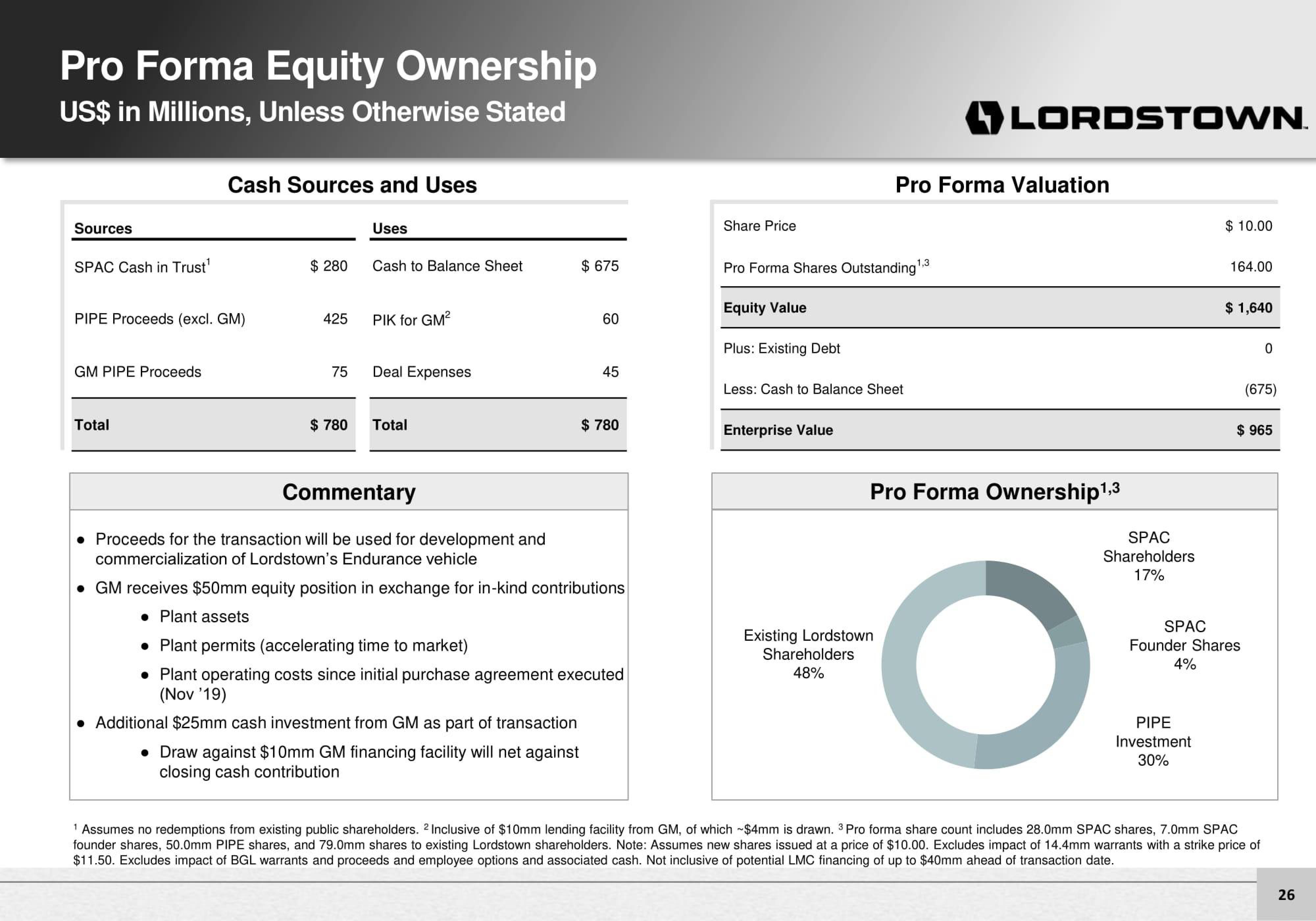

US$ in Millions, Unless Otherwise Stated

Sources

SPAC Cash in Trust¹

PIPE Proceeds (excl. GM)

GM PIPE Proceeds

Cash Sources and Uses

Total

$280

425

75

$780

Uses

Cash to Balance Sheet

PIK for GM²

Deal Expenses

Total

Commentary

• Proceeds for the transaction will be used for development and

commercialization of Lordstown's Endurance vehicle

$ 675

60

Additional $25mm cash investment from GM as part of transaction

• Draw against $10mm GM financing facility will net against

closing cash contribution

45

$ 780

• GM receives $50mm equity position in exchange for in-kind contributions

Plant assets

• Plant permits (accelerating time to market)

• Plant operating costs since initial purchase agreement executed

(Nov '19)

Share Price

Pro Forma Shares Outstanding"

Equity Value

Plus: Existing Debt

Less: Cash to Balance Sheet

Enterprise Value

Pro Forma Valuation

Existing Lordstown

Shareholders

48%

LORDSTOWN.

1.3

Pro Forma Ownership¹,³

O

SPAC

Shareholders

17%

$ 10.00

PIPE

Investment

30%

164.00

$ 1,640

SPAC

Founder Shares

4%

0

(675)

$ 965

¹ Assumes no redemptions from existing public shareholders. 2 Inclusive of $10mm lending facility from GM, of which ~$4mm is drawn. 3 Pro forma share count includes 28.0mm SPAC shares, 7.0mm SPAC

founder shares, 50.0mm PIPE shares, and 79.0mm shares to existing Lordstown shareholders. Note: Assumes new shares issued at a price of $10.00. Excludes impact of 14.4mm warrants with a strike price of

$11.50. Excludes impact of BGL warrants and proceeds and employee options and associated cash. Not inclusive of potential LMC financing of up to $40mm ahead of transaction date.

26View entire presentation