2nd Quarter 2021 Investor Presentation

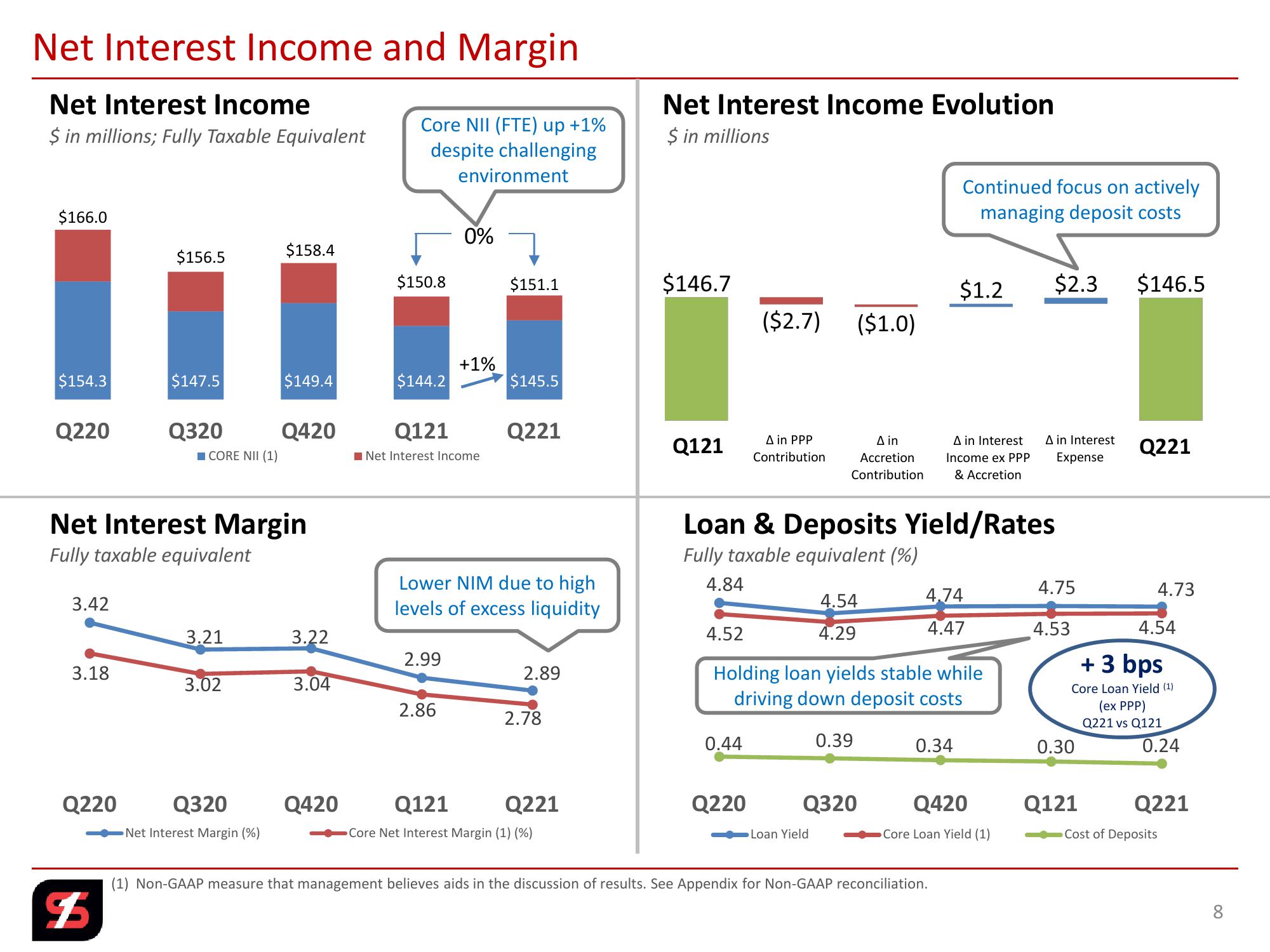

Net Interest Income and Margin

Net Interest Income

$ in millions; Fully Taxable Equivalent

Core NII (FTE) up +1%

despite challenging

environment

Net Interest Income Evolution

$ in millions

$166.0

$156.5

$158.4

$150.8

0%

Continued focus on actively

managing deposit costs

$151.1

$146.7

$1.2

$2.3

$146.5

($2.7) ($1.0)

+1%

$154.3

$147.5

$149.4

$144.2

$145.5

Q220

Q320

Q420

Q121

Q221

■CORE NII (1)

Q121

Net Interest Income

A in PPP

Contribution

A in

Accretion

Contribution

A in Interest

Income ex PPP

& Accretion

A in Interest

Expense

Q221

Net Interest Margin

Fully taxable equivalent

Lower NIM due to high

levels of excess liquidity

3.42

3.21

3.22

2.99

3.18

2.89

3.02

3.04

2.86

2.78

Loan & Deposits Yield/Rates

Fully taxable equivalent (%)

4.84

4.52

4.75

4.73

4.54

4.29

4.74

4.47

4.53

4.54

+ 3 bps

Holding loan yields stable while

driving down deposit costs

0.44

0.39

0.34

0.30

Core Loan Yield (1)

(ex PPP)

Q221 vs Q121

0.24

Q220

Q320

Net Interest Margin (%)

Q420

$

Q121

Q221

Core Net Interest Margin (1) (%)

Q220

Q320

Q420

Q121

Q221

Loan Yield

Core Loan Yield (1)

Cost of Deposits

(1) Non-GAAP measure that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

8View entire presentation