J.P.Morgan Investment Banking Pitch Book

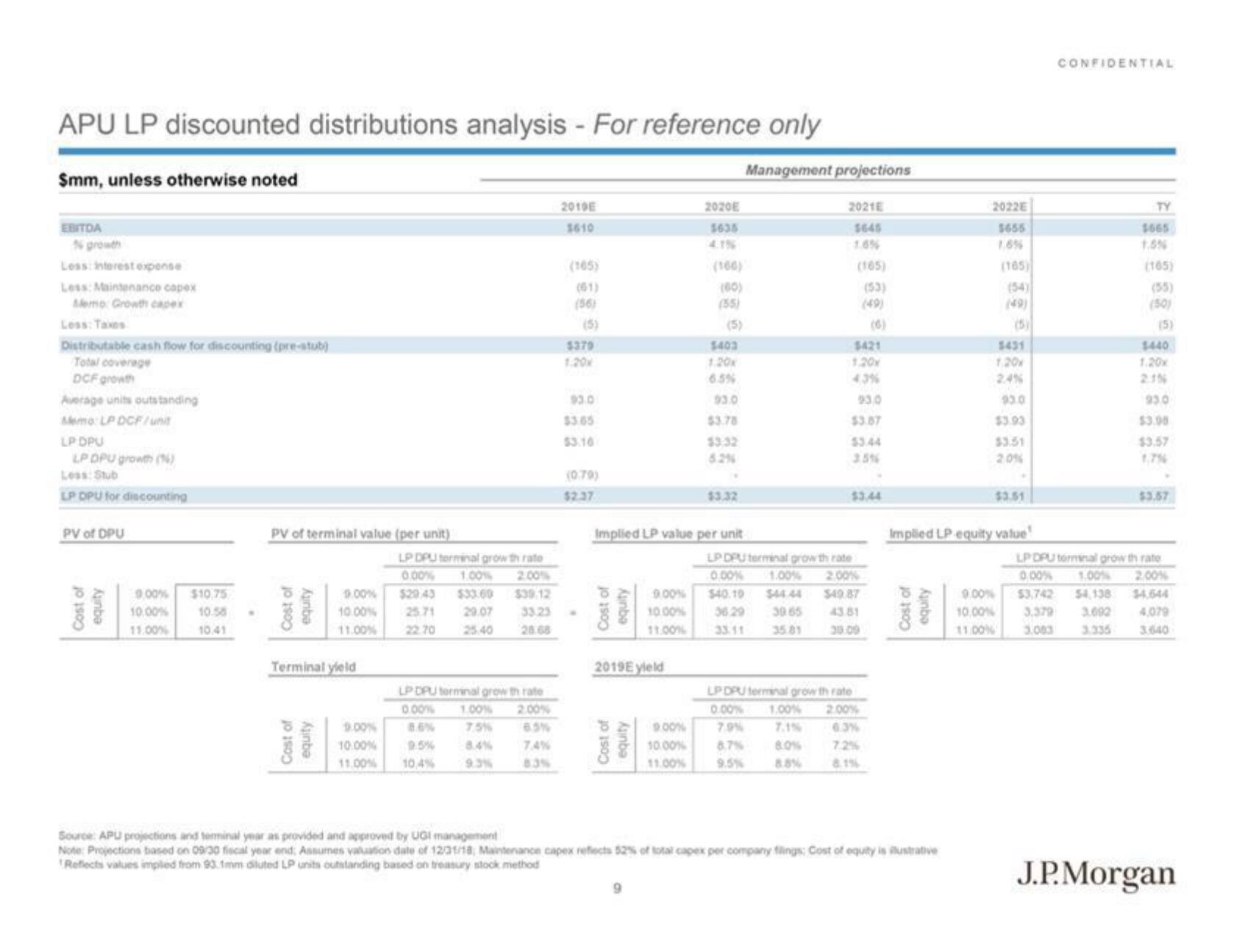

APU LP discounted distributions analysis - For reference only

$mm, unless otherwise noted

EBITDA

Ngrowth

Less interest expense

Less: Maintenance capex

Memo: Growth capex

Less: Taxes

Distributable cash flow for discounting (pre-stub)

Total coverage

DCF growth

Average units outstanding

Memo: LP DCF/unit

LP DPU

LP DPU growth (1)

Less: Stub

LP DPU for discounting

PV of DPU

Cost of

Kunbe

9.00% $10.75

10.00%

10.58

11.00%

10.41

PV of terminal value (per unit)

Cost of

Aunba

Cost of

Terminal yield

Anbe

LP DPU terminal growth rate

0.00% 1.00% 2.00%

9.00% $29.43

10.00% 25.71

11.00% 22.70

$33.60 $39.12

29.07 33.23

25:40

LPDPU terminal growth rate

0.00%

1.00% 2.00%

9.00%

10.00%

9.5%

11.00% 10,4%

8.4%

7.4%

83%

2010E

5610

(165)

(56)

(5)

$379

1.20

93.0

$3.65

$3.16

(0.79)

$2.37

Cost of

Kunba

Cost of

2019E yield

Implied LP value per unit

Asinba

9.00%

10.00%

11.00%

9

2020E

1635

9.00%

10.00%

11.00%

(166)

(80)

(55)

(5)

$403

93.0

$3.78

$3.32

Management projections

2021E

5645

(165)

(53)

(49)

8.0%

8.8%

$421

1,20x

93.0

$3.87

53.44

35%

LPDPU terminal growth rate

0.00% 1.00% 2.00%

$40.10 $44.44 $49.87

36.29 39.65

33.11

35.81

30.09

LPDPU terminal growth rate

0.00% 1.00% 2.00%

7.9%

0.3%

8.7%

9.5%

8.1%

Cost of

Aunbo

Source: APU projections and terminal year as provided and approved by UGI management

Note: Projections based on 09/30 fiscal year end; Assumes valuation date of 12/31/18, Maintenance capex reflects 52% of total capex per company flings: Cost of equity is ilustrative

Reflects values implied from 93.1mm diluted LP units outstanding based on treasury stock method

2022E

5655

(165)

(54)

Implied LP equity value

(5)

1,20x

2.4%

93.0

$3.93

$3.51

20%

$3.51

9.00%

10.00%

11.00%

CONFIDENTIAL

TY

1665

1.5%

(165)

(55)

(50)

(5)

$440

1.20x

93.0

$3.08

$3.57

1.7%

LP DPU torminal growth rate

0,00% 1.00% 2.00%

$3,742 54,138 $4.644

3.379 3.692 4,079

3.003

3.335

3.640

J.P. MorganView entire presentation