BlackRock Results Presentation Deck

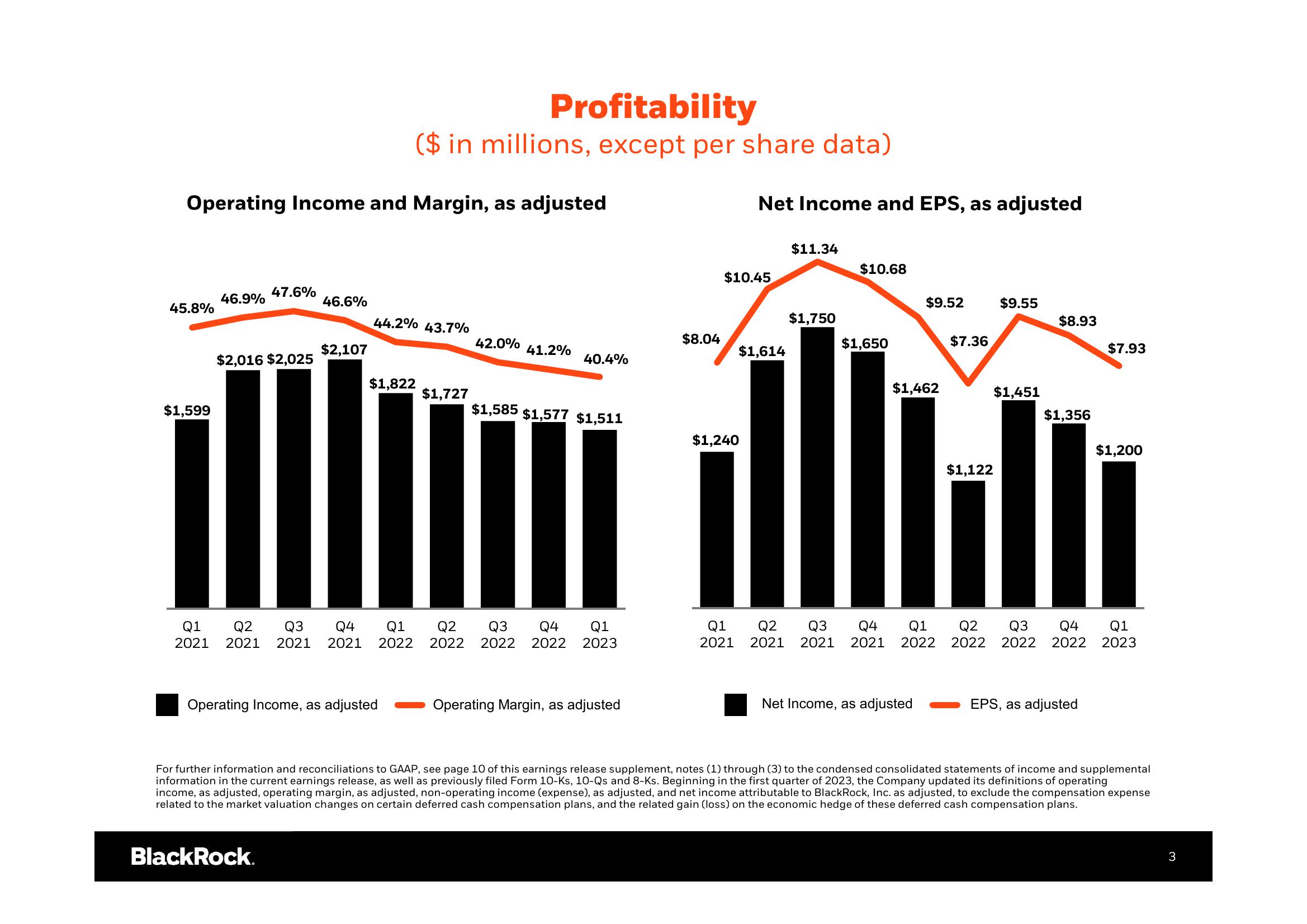

Operating Income and Margin, as adjusted

45.8%

$1,599

46.9%

47.6%

$2,016 $2,025

46.6%

$2,107

BlackRock.

Profitability

($ in millions, except per share data)

44.2% 43.7%

Q1

Q2 Q3 Q4

2021 2021 2021 2021 2022

$1,822

Operating Income, as adjusted

$1,727

42.0%

41.2%

40.4%

$1,585 $1,577 $1,511

Q1 Q2 Q3 Q4 Q1

2022 2022 2022 2023

Operating Margin, as adjusted

$8.04

Net Income and EPS, as adjusted

$10.45

$1,614

$1,240

$11.34

$1,750

$10.68

$1,650

$9.52

$1,462

Q1 Q2

Q3

Q4 Q1

2021 2021 2021 2021 2022

Net Income, as adjusted

$7.36

$1,122

$9.55

$1,451

$8.93

$1,356

$7.93

EPS, as adjusted

$1,200

Q2

Q3 Q4 Q1

2022 2022 2022 2023

For further information and reconciliations to GAAP, see page 10 of this earnings release supplement, notes (1) through (3) to the condensed consolidated statements of income and supplemental

information in the current earnings release, as well as previously filed Form 10-Ks, 10-Qs and 8-Ks. Beginning in the first quarter of 2023, the Company updated its definitions of operating

income, as adjusted, operating margin, as adjusted, non-operating income (expense), as adjusted, and net income attributable to BlackRock, Inc. as adjusted, to exclude the compensation expense

related to the market valuation changes on certain deferred cash compensation plans, and the related gain (loss) on the economic hedge of these deferred cash compensation plans.

3View entire presentation