Pathward Financial Results Presentation Deck

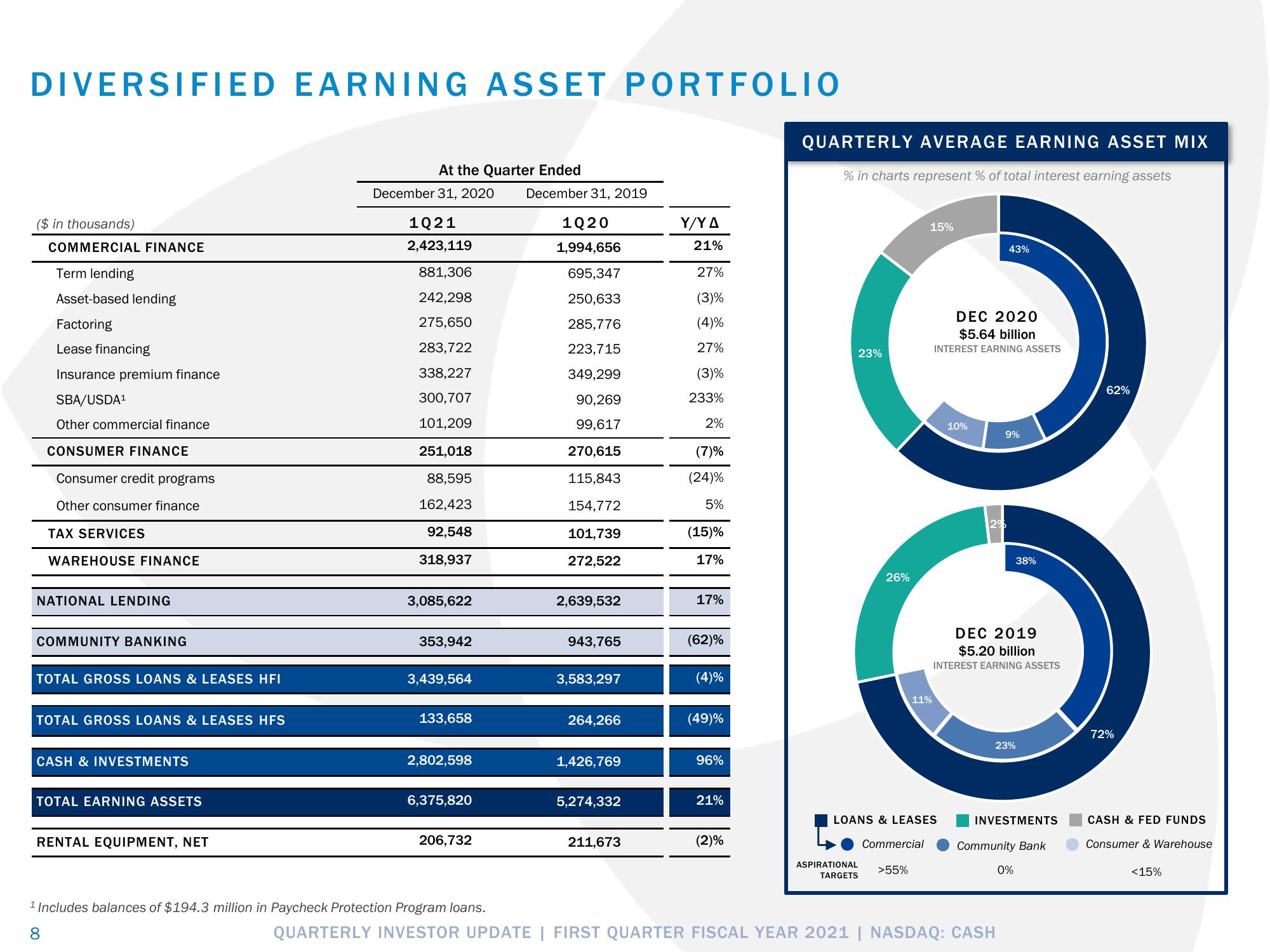

DIVERSIFIED EARNING ASSET PORTFOLIO

($ in thousands)

COMMERCIAL FINANCE

Term lending

Asset-based lending

Factoring

Lease financing

Insurance premium finance

SBA/USDA¹

Other commercial finance

CONSUMER FINANCE

Consumer credit programs

Other consumer finance

TAX SERVICES

WAREHOUSE FINANCE

NATIONAL LENDING

COMMUNITY BANKING

TOTAL GROSS LOANS & LEASES HFI

TOTAL GROSS LOANS & LEASES HFS

CASH & INVESTMENTS

TOTAL EARNING ASSETS

RENTAL EQUIPMENT, NET

At the Quarter Ended

December 31, 2020

1021

2,423,119

881,306

242,298

275,650

283,722

338,227

300,707

101,209

251,018

88,595

162,423

92,548

318,937

3,085,622

353,942

3,439,564

133,658

2,802,598

6,375,820

206,732

¹ Includes balances of $194.3 million in Paycheck Protection Program loans.

8

December 31, 2019

1Q20

1,994,656

695,347

250,633

285,776

223,715

349,299

90,269

99,617

270,615

115,843

154,772

101,739

272,522

2,639,532

943,765

3,583,297

264,266

1,426,769

5,274,332

211,673

Y/YA

21%

27%

(3)%

(4)%

27%

(3)%

233%

2%

(7)%

(24)%

5%

(15)%

17%

17%

(62)%

(4)%

(49)%

96%

21%

(2)%

QUARTERLY AVERAGE EARNING ASSET MIX

% in charts represent % of total interest earning assets

23%

26%

ASPIRATIONAL

TARGETS

15%

11%

Commercial

>55%

LOANS & LEASES

DEC 2020

$5.64 billion

INTEREST EARNING ASSETS

10%

№

2%

43%

9%

DEC 2019

$5.20 billion

INTEREST EARNING ASSETS

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

23%

38%

INVESTMENTS

Community Bank

0%

62%

72%

CASH & FED FUNDS

Consumer & Warehouse

<15%View entire presentation