Aeva Investor Presentation Deck

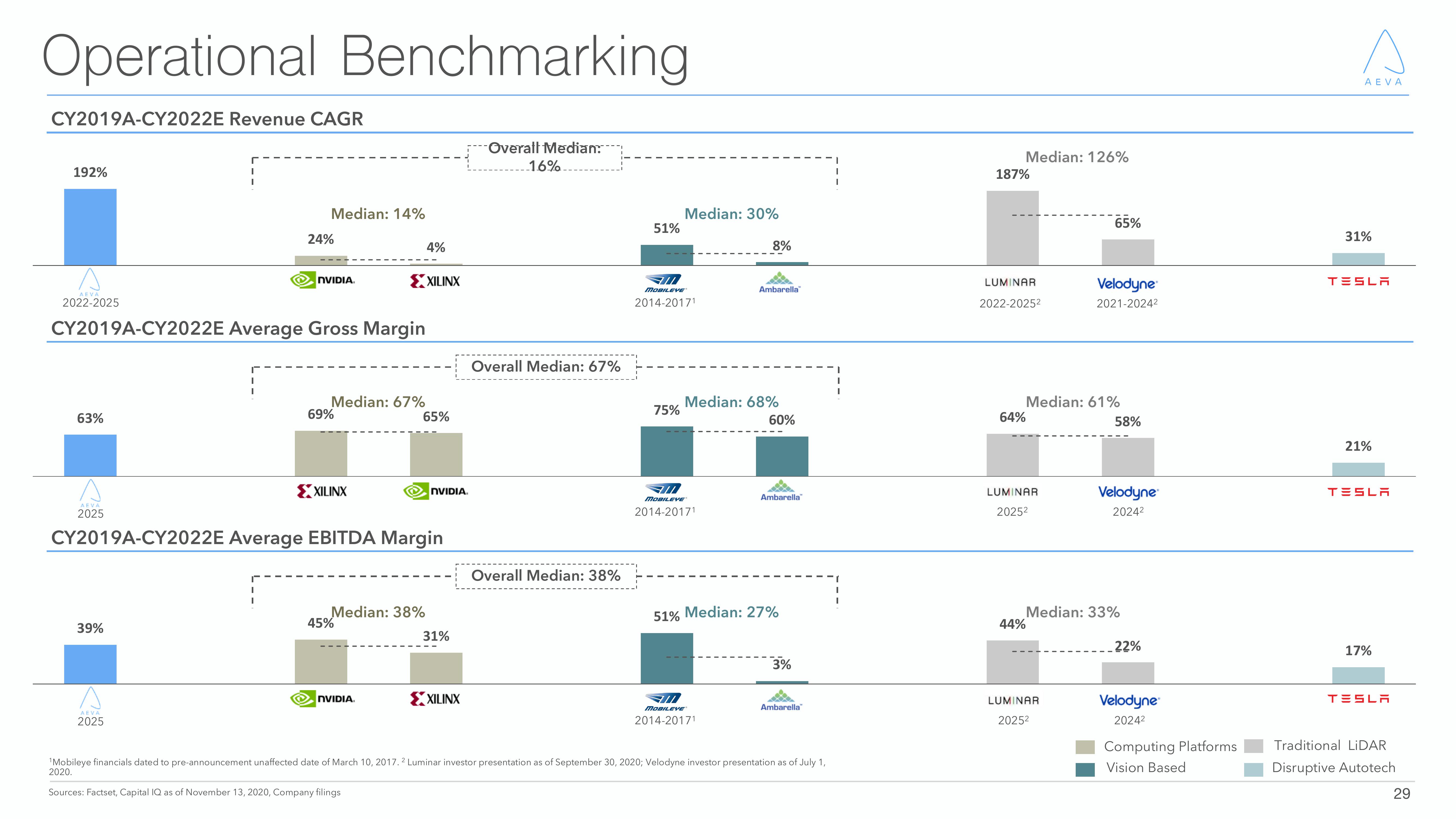

Operational Benchmarking

CY2019A-CY2022E Revenue CAGR

192%

AEVA

2022-2025

63%

AEVA

2025

Median: 14%

CY2019A-CY2022E Average Gross Margin

39%

24%

AEVA

2025

NVIDIA.

Median: 67%

69%

XILINX

XXXILINX

CY2019A-CY2022E Average EBITDA Margin

45%

4%

Median: 38%

NVIDIA

65%

NVIDIA.

31%

XXILINX

Overall Median:

16%

Overall Median: 67%

Overall Median: 38%

51%

Median: 30%

---

ml

MOBILEVE

2014-20171

75%

All

MOBILEVE

2014-20171

8%

Median: 68%

Ambarella

al

MOBILEVE

2014-20171

60%

Ambarella

51% Median: 27%

3%

Ambarella

¹Mobileye financials dated to pre-announcement unaffected date of March 10, 2017. 2 Luminar investor presentation as of September 30, 2020; Velodyne investor presentation as of July 1,

2020.

Sources: Factset, Capital IQ as of November 13, 2020, Company filings

Median: 126%

187%

LUMINAR

2022-2025²

64%

LUMINAR

2025²

44%

65%

Median: 61%

Velodyne

2021-2024²

LUMINAR

2025²

58%

Median: 33%

Velodyne

2024²

22%

Velodyne

2024²

Computing Platforms

Vision Based

AEVA

31%

TESLA

21%

TESLA

17%

TESLA

Traditional LiDAR

Disruptive Autotech

29View entire presentation