Credit Suisse Investment Banking Pitch Book

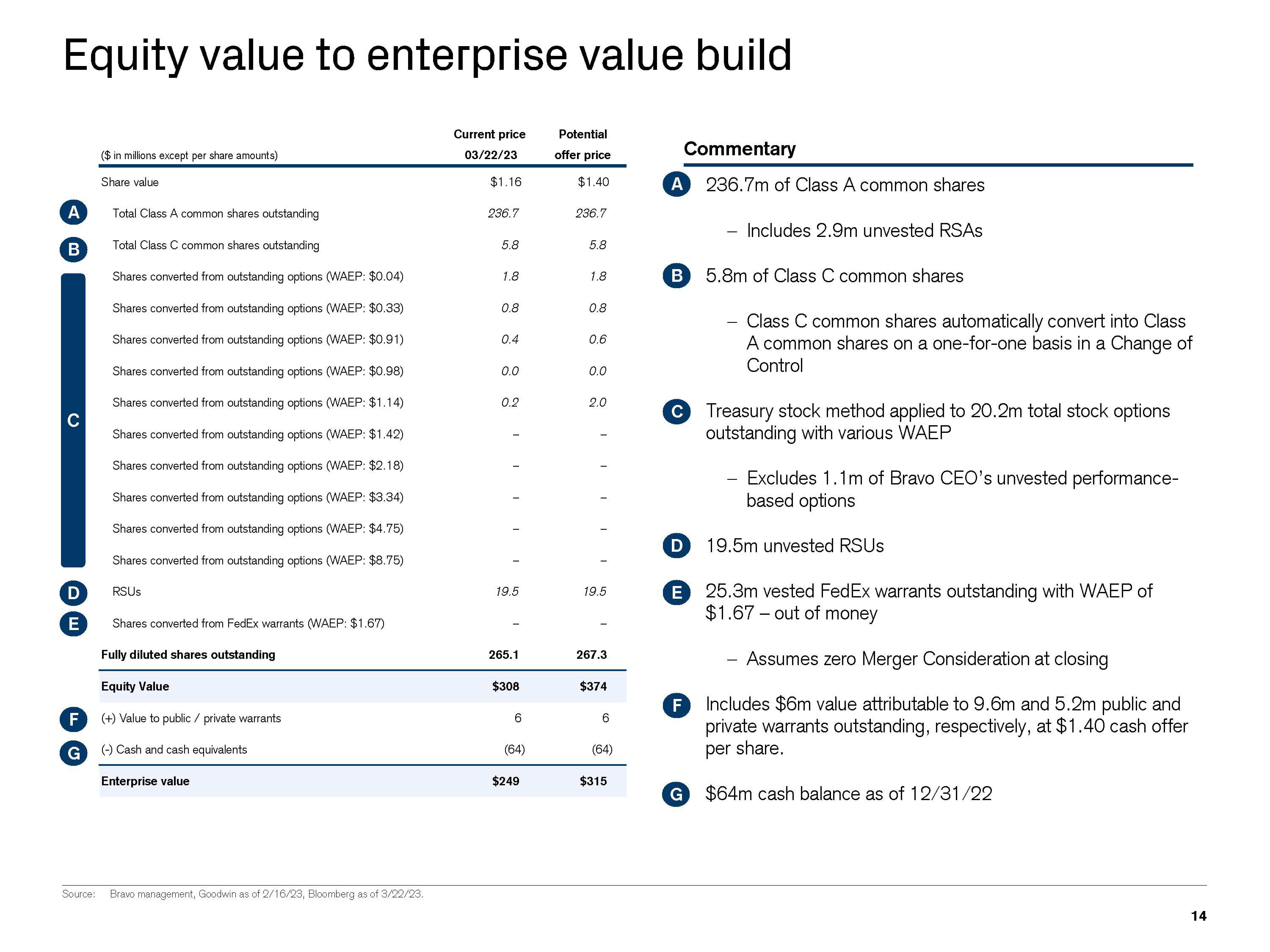

Equity value to enterprise value build

A

B

D

E

F

G

Source:

($ in millions except per share amounts)

Share value

Total Class A common shares outstanding

Total Class C common shares outstanding

Shares converted from outstanding options (WAEP: $0.04)

Shares converted from outstanding options (WAEP: $0.33)

Shares converted from outstanding options (WAEP: $0.91)

Shares converted from outstanding options (WAEP: $0.98)

Shares converted from outstanding options (WAEP: $1.14)

Shares converted from outstanding options (WAEP: $1.42)

Shares converted from outstanding options (WAEP: $2.18)

Shares converted from outstanding options (WAEP: $3.34)

Shares converted from outstanding options (WAEP: $4.75)

Shares converted from outstanding options (WAEP: $8.75)

RSUS

Shares converted from FedEx warrants (WAEP: $1.67)

Fully diluted shares outstanding

Equity Value

(+) Value to public/private warrants

(-) Cash and cash equivalents

Enterprise value

Bravo management, Goodwin as of 2/16/23, Bloomberg as of 3/22/23.

Current price

03/22/23

$1.16

236.7

5.8

1.8

0.8

0.4

0.0

0.2

I

I

19.5

265.1

$308

6

(64)

$249

Potential

offer price

$1.40

236.7

5.8

1.8

0.8

0.6

0.0

2.0

19.5

267.3

$374

6

(64)

$315

Commentary

A 236.7m of Class A common shares

Includes 2.9m unvested RSAs

B 5.8m of Class C common shares

Class C common shares automatically convert into Class

A common shares on a one-for-one basis in a Change of

Control

C Treasury stock method applied to 20.2m total stock options

outstanding with various WAEP

F

Excludes 1.1m of Bravo CEO's unvested performance-

based options

19.5m unvested RSUS

E 25.3m vested FedEx warrants outstanding with WAEP of

$1.67 out of money

- Assumes zero Merger Consideration at closing

Includes $6m value attributable to 9.6m and 5.2m public and

private warrants outstanding, respectively, at $1.40 cash offer

per share.

G $64m cash balance as of 12/31/22

14View entire presentation