Q3 2022 Investor Presentation

cr

CS

cr

OCS

CI

OC

C

APPENDIX

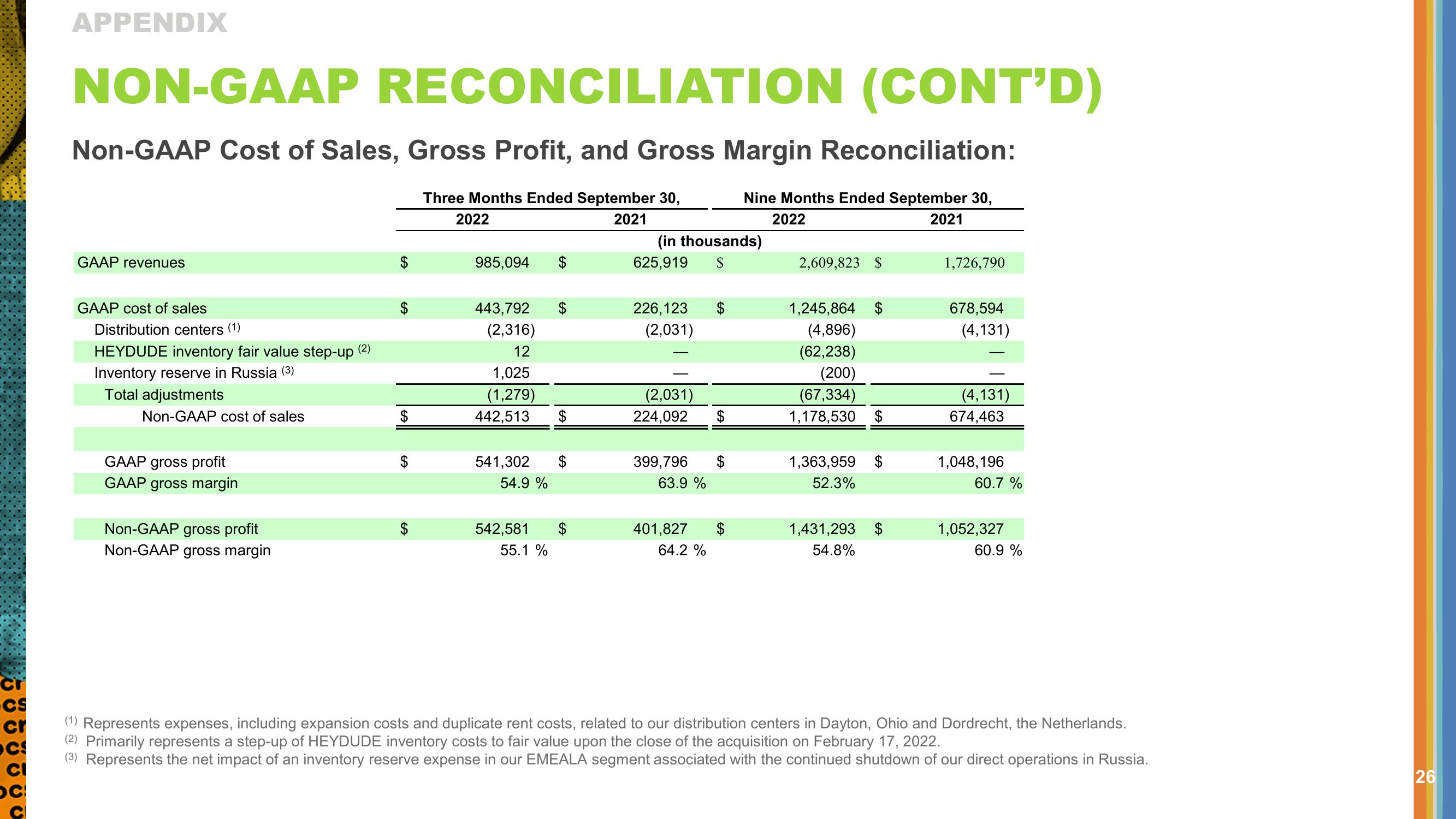

NON-GAAP RECONCILIATION (CONT'D)

Non-GAAP Cost of Sales, Gross Profit, and Gross Margin Reconciliation:

Three Months Ended September 30,

2022

Nine Months Ended September 30,

2022

2021

2021

GAAP revenues

GAAP cost of sales

Distribution centers (1)

HEYDUDE inventory fair value step-up (2)

Inventory reserve in Russia (3)

Total adjustments

Non-GAAP cost of sales

GAAP gross profit

GAAP gross margin

Non-GAAP gross profit

Non-GAAP gross margin

SA

GA

985,094 $

443,792

(2,316)

12

1,025

(1,279)

442,513 $

541,302

54.9 %

542,581

55.1 %

(in thousands)

625,919 $

226,123

(2,031)

(2,031)

224,092

399,796

63.9 %

401,827

64.2%

$

2,609,823 $

1,245,864

(4,896)

(62,238)

(200)

(67,334)

1,178,530 $

1,363,959 $

52.3%

1,431,293

54.8%

1,726,790

678,594

(4,131)

(4,131)

674,463

1,048, 196

60.7 %

1,052,327

60.9 %

(1) Represents expenses, including expansion costs and duplicate rent costs, related to our distribution centers in Dayton, Ohio and Dordrecht, the Netherlands.

(2) Primarily represents a step-up of HEYDUDE inventory costs to fair value upon the close of the acquisition on February 17, 2022.

(3) Represents the net impact of an inventory reserve expense in our EMEALA segment associated with the continued shutdown of our direct operations in Russia.

26View entire presentation