Credit Suisse Investment Banking Pitch Book

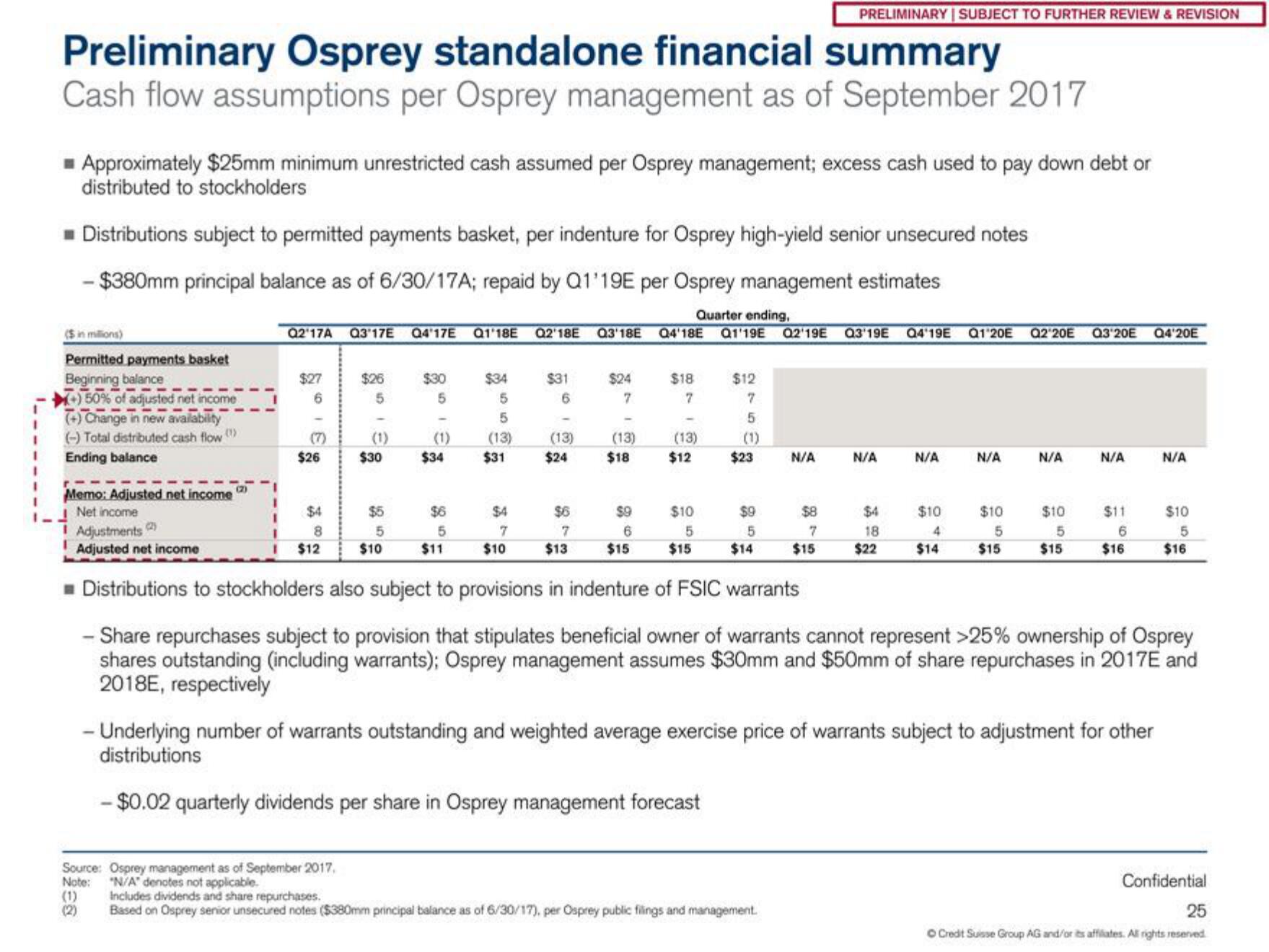

Preliminary Osprey standalone financial summary

Cash flow assumptions per Osprey management as of September 2017

Approximately $25mm minimum unrestricted cash assumed per Osprey management; excess cash used to pay down debt or

distributed to stockholders

Distributions subject to permitted payments basket, per indenture for Osprey high-yield senior unsecured notes

- $380mm principal balance as of 6/30/17A; repaid by Q1'19E per Osprey management estimates

Quarter ending,

Q2:17A Q3'17E Q4'17E Q1'18E Q2'18E Q3'18E Q4'18E Q1'19E Q2'19E Q3'19E Q4'19E Q1'20E Q2 20E Q3'20E Q4'20E

($in millions)

Permitted payments basket

Beginning balance

+) 50% of adjusted net income

(+) Change in new availability

(-) Total distributed cash flow

Ending balance

(1)

Memo: Adjusted net income

Net income

1

$27

6

$26

$4

8

I $12

$26

5

(1)

Source: Osprey management as of September 2017,

Note: "N/A denotes not applicable.

(1)

$30

$5

5

$30

5

$10

12

$34

$6

5

$34

5

5

$11

(13)

$31

$4

7

$31

6

$10

(13)

$24

$6

7

$13

$24

7

(13)

$18

$9

6

$18

7

$15

(13)

$12

$10

5

$15

$12

7

5

$23

$9

5

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

$14

N/A

$8

7

$15

Includes dividends and share repurchases.

Based on Osprey senior unsecured notes ($380mm principal balance as of 6/30/17), per Osprey public filings and management.

N/A

$4

18

$22

N/A

$10

4

$14

N/A

$10

5

$15

Adjustments

Adjusted net income

■ Distributions to stockholders also subject to provisions in indenture of FSIC warrants

Share repurchases subject to provision that stipulates beneficial owner of warrants cannot represent > 25% ownership of Osprey

shares outstanding (including warrants); Osprey management assumes $30mm and $50mm of share repurchases in 2017E and

2018E, respectively

N/A

$10

5

N/A

$15

$11

6

- Underlying number of warrants outstanding and weighted average exercise price of warrants subject to adjustment for other

distributions

- $0.02 quarterly dividends per share in Osprey management forecast

$16

N/A

$10

5

$16

Confidential

25

Credit Suisse Group AG and/or its affiliates. Al rights reservedView entire presentation