Morgan Stanley Investment Banking Pitch Book

Portions of this exhibit marked [*] are requested to be treated confidentially

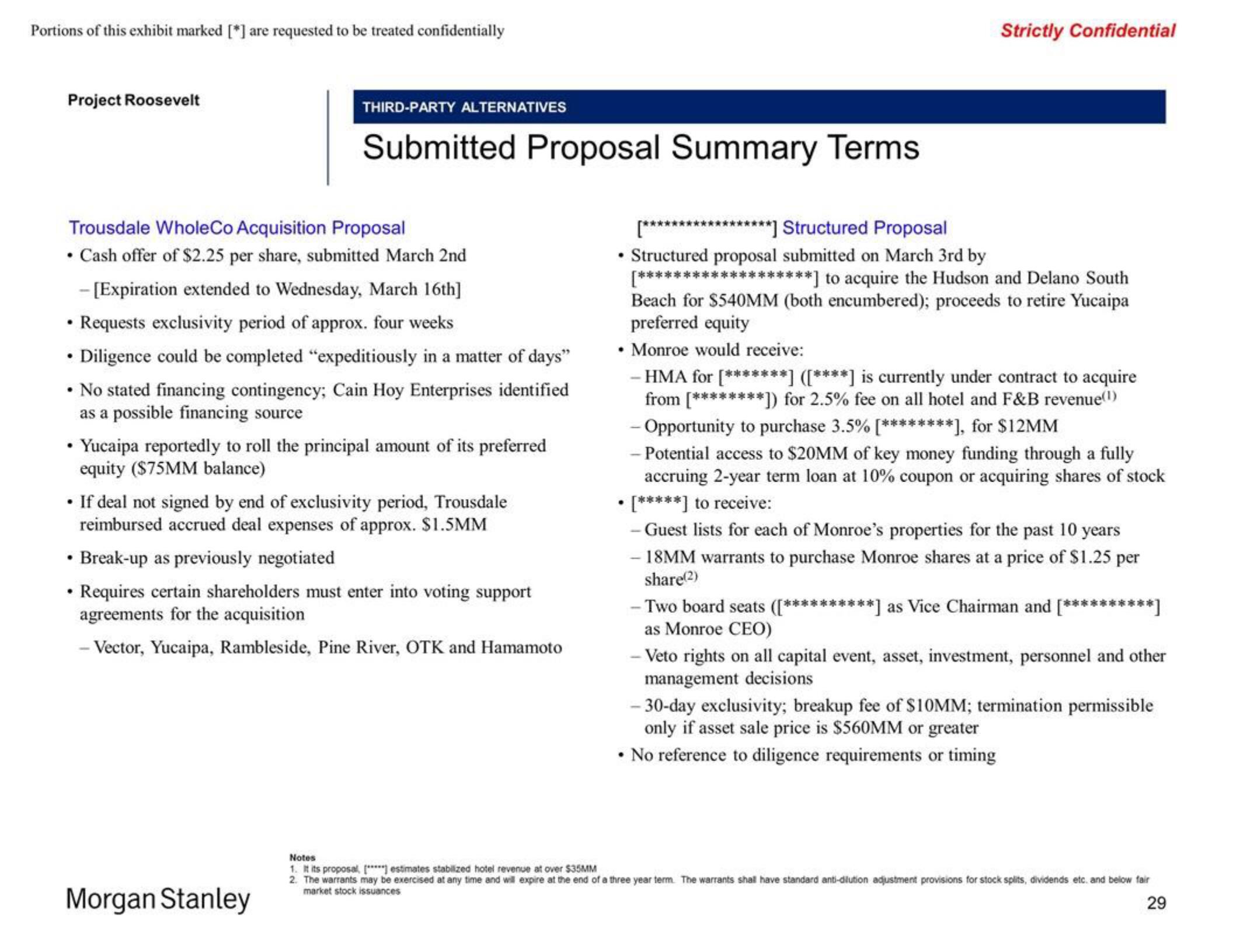

Project Roosevelt

THIRD-PARTY ALTERNATIVES

Submitted Proposal Summary Terms

Trousdale Whole Co Acquisition Proposal

• Cash offer of $2.25 per share, submitted March 2nd

- [Expiration extended to Wednesday, March 16th]

• Requests exclusivity period of approx. four weeks

• Diligence could be completed "expeditiously in a matter of days"

• No stated financing contingency; Cain Hoy Enterprises identified

as a possible financing source

• Yucaipa reportedly to roll the principal amount of its preferred

equity ($75MM balance)

Morgan Stanley

• If deal not signed by end of exclusivity period, Trousdale

reimbursed accrued deal expenses of approx. $1.5MM

• Break-up as previously negotiated

• Requires certain shareholders must enter into voting support

agreements for the acquisition

- Vector, Yucaipa, Rambleside, Pine River, OTK and Hamamoto

Strictly Confidential

[******************] Structured Proposal

• Structured proposal submitted on March 3rd by

********] to acquire the Hudson and Delano South

Beach for $540MM (both encumbered); proceeds to retire Yucaipa

preferred equity

• Monroe would receive:

[*********

- HMA for [*******] ([****] is currently under contract to acquire

from [********]) for 2.5% fee on all hotel and F&B revenue(¹)

-Opportunity to purchase 3.5 % [********], for $12MM

- Potential access to $20MM of key money funding through a fully

accruing 2-year term loan at 10% coupon or acquiring shares of stock

• [*****] to receive:

- Guest lists for each of Monroe's properties for the past 10 years

- 18MM warrants to purchase Monroe shares at a price of $1.25 per

share(2)

-Two board seats ([**********] as Vice Chairman and [*********

as Monroe CEO)

- Veto rights on all capital event, asset, investment, personnel and other

management decisions

- 30-day exclusivity; breakup fee of $10MM; termination permissible

only if asset sale price is $560MM or greater

• No reference to diligence requirements or timing

Notes

1. It its proposal, [*****] estimates stabilized hotel revenue at over $35MM

2. The warrants may be exercised at any time and will expire at the end of a three year term. The warrants shall have standard anti-dilution adjustment provisions for stock splits, dividends etc. and below fair

market stock issuances

29View entire presentation