Marti Investor Presentation Deck

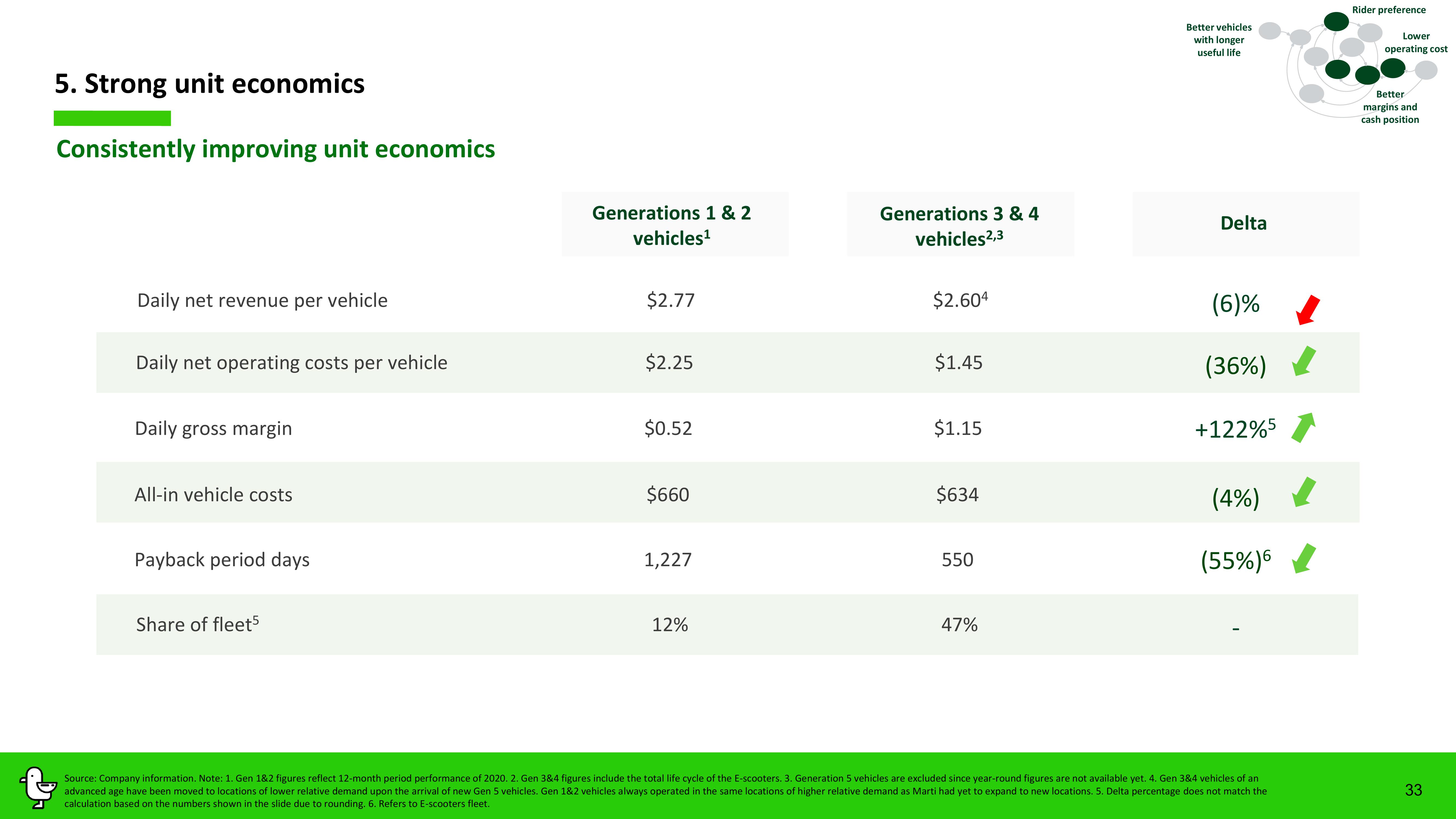

5. Strong unit economics

Consistently improving unit economics

Daily net revenue per vehicle

Daily net operating costs per vehicle

Daily gross margin

All-in vehicle costs

Payback period days

Share of fleet5

Generations 1 & 2

vehicles¹

$2.77

$2.25

$0.52

$660

1,227

12%

Generations 3 & 4

vehicles 2,3

$2.604

$1.45

$1.15

$634

550

47%

Better vehicles

with longer

useful life

Delta

(6)%

(36%)

+122%5

(4%)

(55%)6

Source: Company information. Note: 1. Gen 1&2 figures reflect 12-month period performance of 2020. 2. Gen 3&4 figures include the total life cycle of the E-scooters. 3. Generation 5 vehicles are excluded since year-round figures are not available yet. 4. Gen 3&4 vehicles of an

advanced age have been moved to locations of lower relative demand upon the arrival of new Gen 5 vehicles. Gen 1&2 vehicles always operated in the same locations of higher relative demand as Marti had yet to expand to new locations. 5. Delta percentage does not match the

calculation based on the numbers shown in the slide due to rounding. 6. Refers to E-scooters fleet.

Rider preference

Lower

operating cost

Better

margins and

cash position

33View entire presentation