AngloAmerican Investor Update

Quellaveco modelling

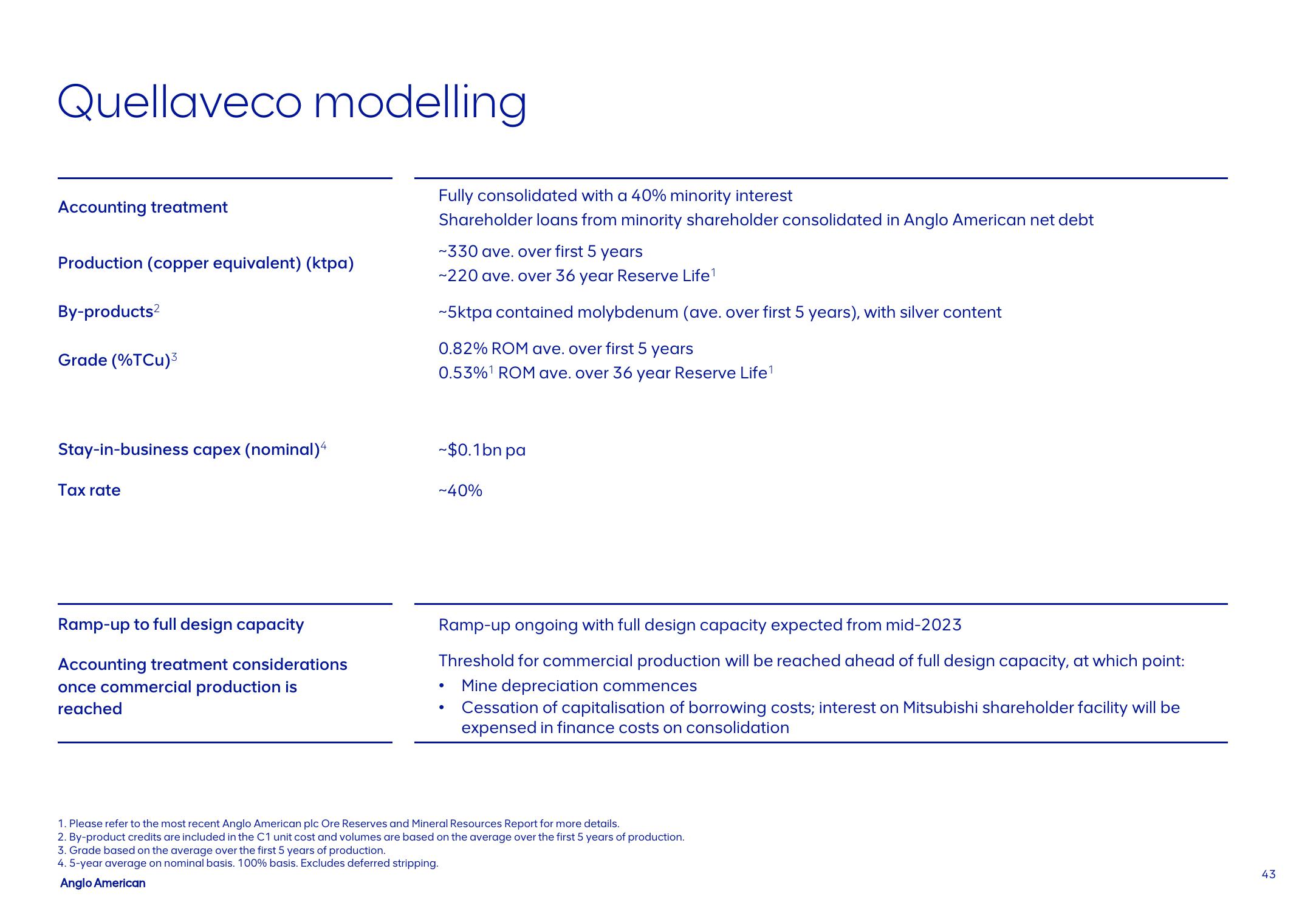

Accounting treatment

Production (copper equivalent) (ktpa)

By-products²

Grade (%TCu)³

Stay-in-business capex (nominal)4

Tax rate

Ramp-up to full design capacity

Accounting treatment considerations

once commercial production is

reached

Fully consolidated with a 40% minority interest

Shareholder loans from minority shareholder consolidated in Anglo American net debt

~330 ave. over first 5 years

~220 ave. over 36 year Reserve Life¹

~5ktpa contained molybdenum (ave. over first 5 years), with silver content

0.82% ROM ave. over first 5 years

0.53%¹ ROM ave. over 36 year Reserve Life¹

~$0.1bn pa

~40%

Ramp-up ongoing with full design capacity expected from mid-2023

Threshold for commercial production will be reached ahead of full design capacity, at which point:

Mine depreciation commences

Cessation of capitalisation of borrowing costs; interest on Mitsubishi shareholder facility will be

expensed in finance costs on consolidation

●

●

1. Please refer to the most recent Anglo American plc Ore Reserves and Mineral Resources Report for more details.

2. By-product credits are included in the C1 unit cost and volumes are based on the average over the first 5 years of production.

3. Grade based on the average over the first 5 years of production.

4. 5-year average on nominal basis. 100% basis. Excludes deferred stripping.

Anglo American

43View entire presentation