LanzaTech SPAC Presentation Deck

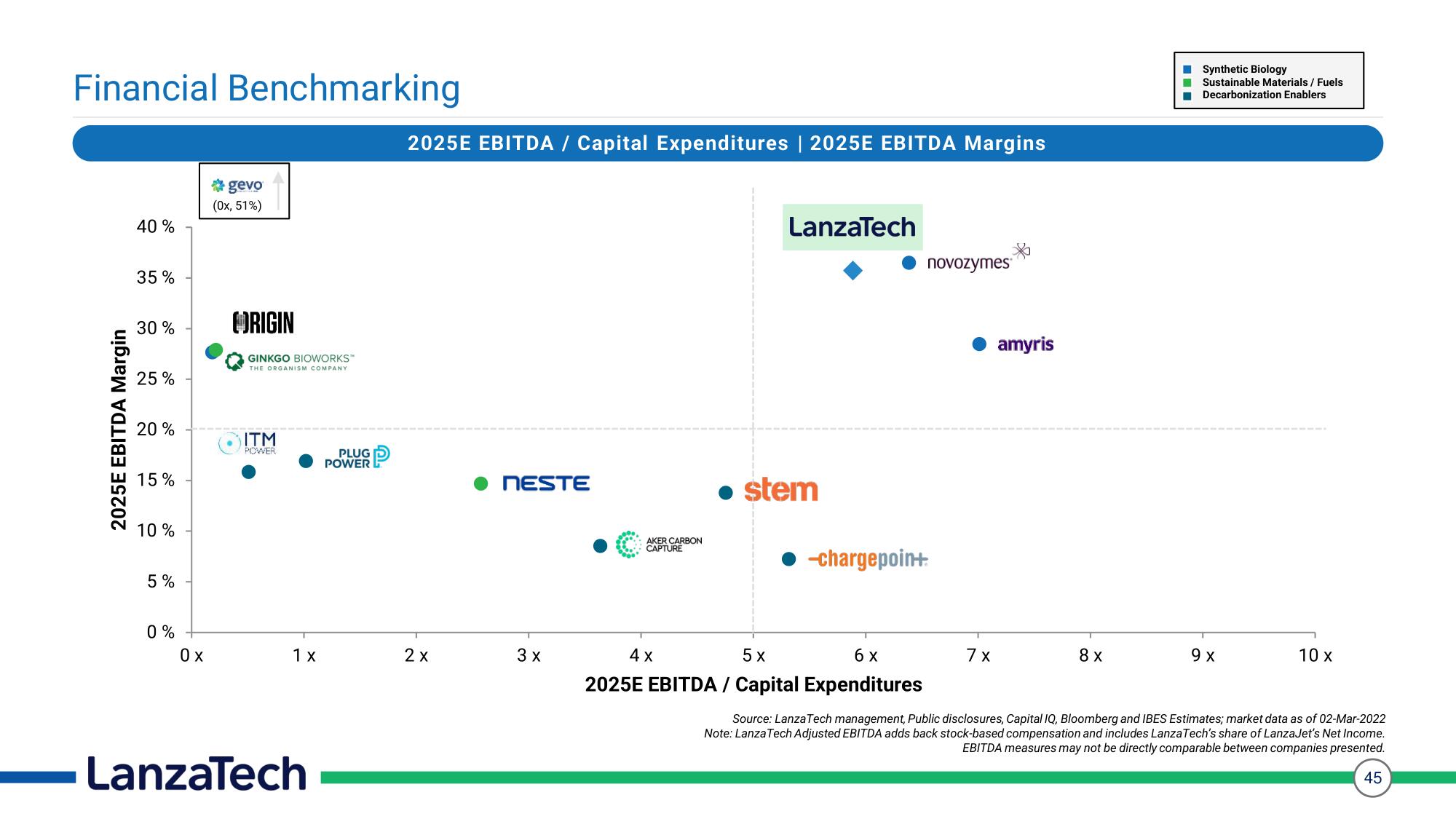

Financial Benchmarking

2025E EBITDA Margin

40 %

35%

30%

25%

20%

15%

10%

5%

0%

Ox

gevo

(0x, 51%)

ORIGIN

GINKGO BIOWORKS™

THE ORGANISM COMPANY

ITM

POWER

1 x

LanzaTech

PLUG

POWER

2025E EBITDA / Capital Expenditures | 2025E EBITDA Margins

2x

NESTE

3 x

AKER CARBON

CAPTURE

LanzaTech

● stem

-chargepoin+

4 x

5 x

6 x

2025E EBITDA / Capital Expenditures

novozymes

7x

amyris

8 x

Synthetic Biology

Sustainable Materials / Fuels

Decarbonization Enablers

9 x

10 x

Source: LanzaTech management, Public disclosures, Capital IQ, Bloomberg and IBES Estimates; market data as of 02-Mar-2022

Note: LanzaTech Adjusted EBITDA adds back stock-based compensation and includes LanzaTech's share of LanzaJet's Net Income.

EBITDA measures may not be directly comparable between companies presented.

45View entire presentation