Kinnevik Results Presentation Deck

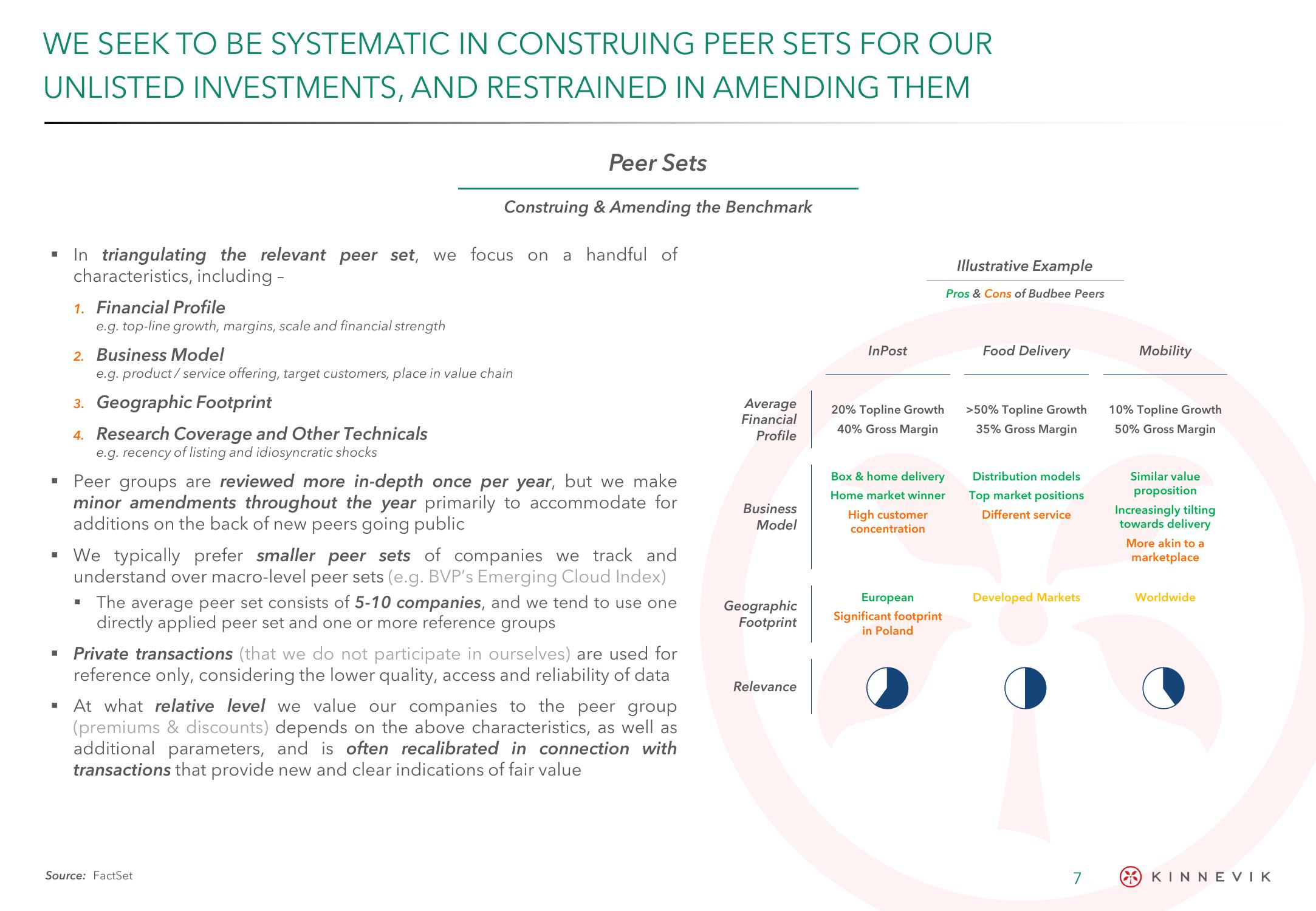

WE SEEK TO BE SYSTEMATIC IN CONSTRUING PEER SETS FOR OUR

UNLISTED INVESTMENTS, AND RESTRAINED IN AMENDING THEM

▪ In triangulating the relevant peer set, we focus on a handful of

characteristics, including -

I

1. Financial Profile

e.g. top-line growth, margins, scale and financial strength

2. Business Model

I

Peer Sets

Construing & Amending the Benchmark

e.g.product/service offering, target customers, place in value chain

3. Geographic Footprint

4. Research Coverage and Other Technicals

e.g. recency of listing and idiosyncratic shocks

Peer groups are reviewed more in-depth once per year, but we make

minor amendments throughout the year primarily to accommodate for

additions on the back of new peers going public

▪ We typically prefer smaller peer sets of companies we track and

understand over macro-level peer sets (e.g. BVP's Emerging Cloud Index)

■

The average peer set consists of 5-10 companies, and we tend to use one

directly applied peer set and one or more reference groups

Private transactions (that we do not participate in ourselves) are used for

reference only, considering the lower quality, access and reliability of data

▪ At what relative level we value our companies to the peer group

(premiums & discounts) depends on the above characteristics, as well as

additional parameters, and is often recalibrated in connection with

transactions that provide new and clear indications of fair value

Source: FactSet

Average

Financial

Profile

Business

Model

Geographic

Footprint

Relevance

InPost

20% Topline Growth

40% Gross Margin

Box & home delivery

Home market winner

High customer

concentration

European

Significant footprint

in Poland

Illustrative Example

Pros & Cons of Budbee Peers

Food Delivery

>50% Topline Growth

35% Gross Margin

Distribution models

Top market positions

Different service

Developed Markets

7

Mobility

10% Topline Growth

50% Gross Margin

Similar value

proposition

Increasingly tilting

towards delivery

More akin to a

marketplace

Worldwide

KINNEVIKView entire presentation