Maersk Investor Presentation Deck

We continue to strengthen the capacity management

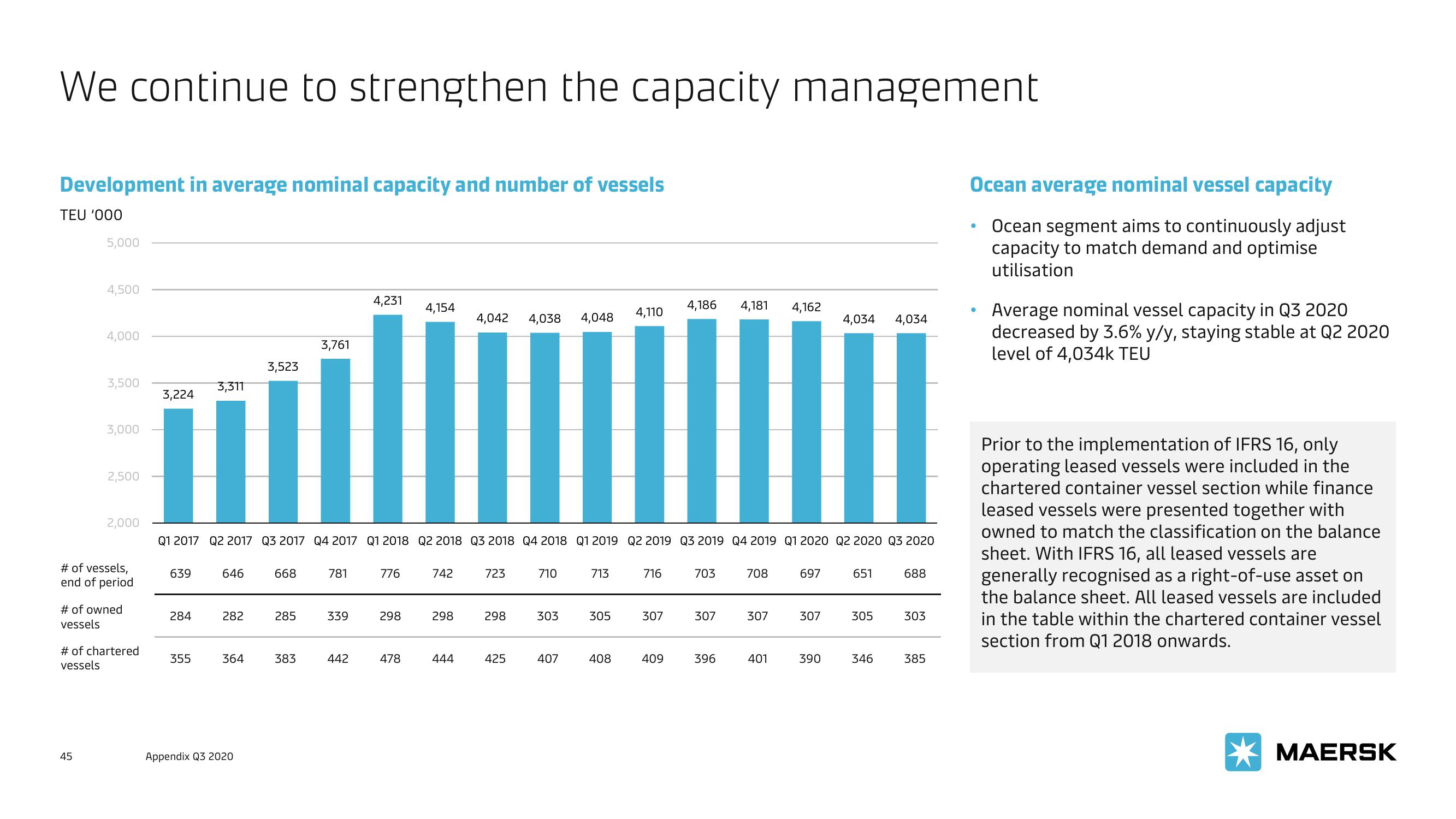

Development in average nominal capacity and number of vessels

TEU '000

5,000

4,500

4,000

45

3,500

3,000

2,500

2,000

# of vessels,

end of period

# of owned

vessels

# of chartered

vessels

639

284

355

646

282

364

3,523

Appendix Q3 2020

3,311

3,224

il

Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020

668

285

3,761

383

781

339

4,231

442

776

298

4,154

478

742

298

4,042 4,038 4,048

444

723

298

425

710

303

407

713

305

4,110

408

716

307

4,186 4,181 4,162

409

703

307

396

708

307

401

697

307

4,034 4,034

390

651

305

346

688

303

385

Ocean average nominal vessel capacity

Ocean segment aims to continuously adjust

capacity to match demand and optimise

utilisation

●

Average nominal vessel capacity in Q3 2020

decreased by 3.6% y/y, staying stable at Q2 2020

level of 4,034k TEU

Prior to the implementation of IFRS 16, only

operating leased vessels were included in the

chartered container vessel section while finance

leased vessels were presented together with

owned to match the classification on the balance

sheet. With IFRS 16, all leased vessels are

generally recognised as a right-of-use asset on

the balance sheet. All leased vessels are included

in the table within the chartered container vessel

section from Q1 2018 onwards.

MAERSKView entire presentation