Volta SPAC Presentation Deck

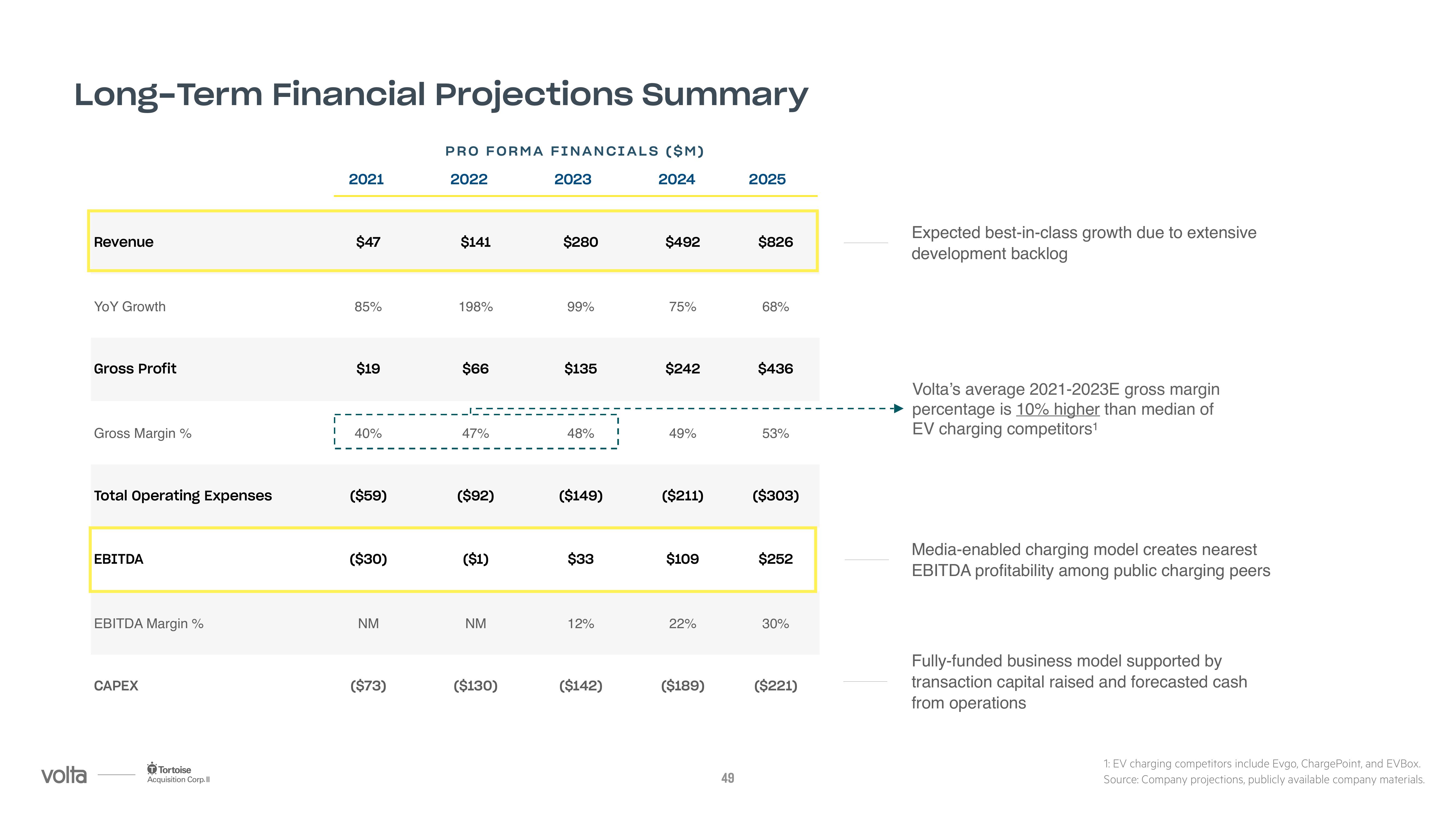

Long-Term Financial Projections Summary

volta

Revenue

YOY Growth

Gross Profit

Gross Margin %

Total Operating Expenses

EBITDA

EBITDA Margin %

CAPEX

Tortoise

Acquisition Corp.Il

2021

$47

85%

$19

40%

($59)

($30)

NM

($73)

PRO FORMA FINANCIALS ($M)

2022

2024

$141

198%

$66

47%

($92)

($1)

NM

($130)

2023

$280

99%

$135

48%

($149)

$33

12%

($142)

$492

75%

$242

49%

($211)

$109

22%

($189)

49

2025

$826

68%

$436

53%

($303)

$252

30%

($221)

Expected best-in-class growth due to extensive

development backlog

Volta's average 2021-2023E gross margin

percentage is 10% higher than median of

EV charging competitors¹

Media-enabled charging model creates nearest

EBITDA profitability among public charging peers

Fully-funded business model supported by

transaction capital raised and forecasted cash

from operations

1: EV charging competitors include Evgo, ChargePoint, and EVBox.

Source: Company projections, publicly available company materials.View entire presentation