Granite Ridge Investor Presentation Deck

Overview

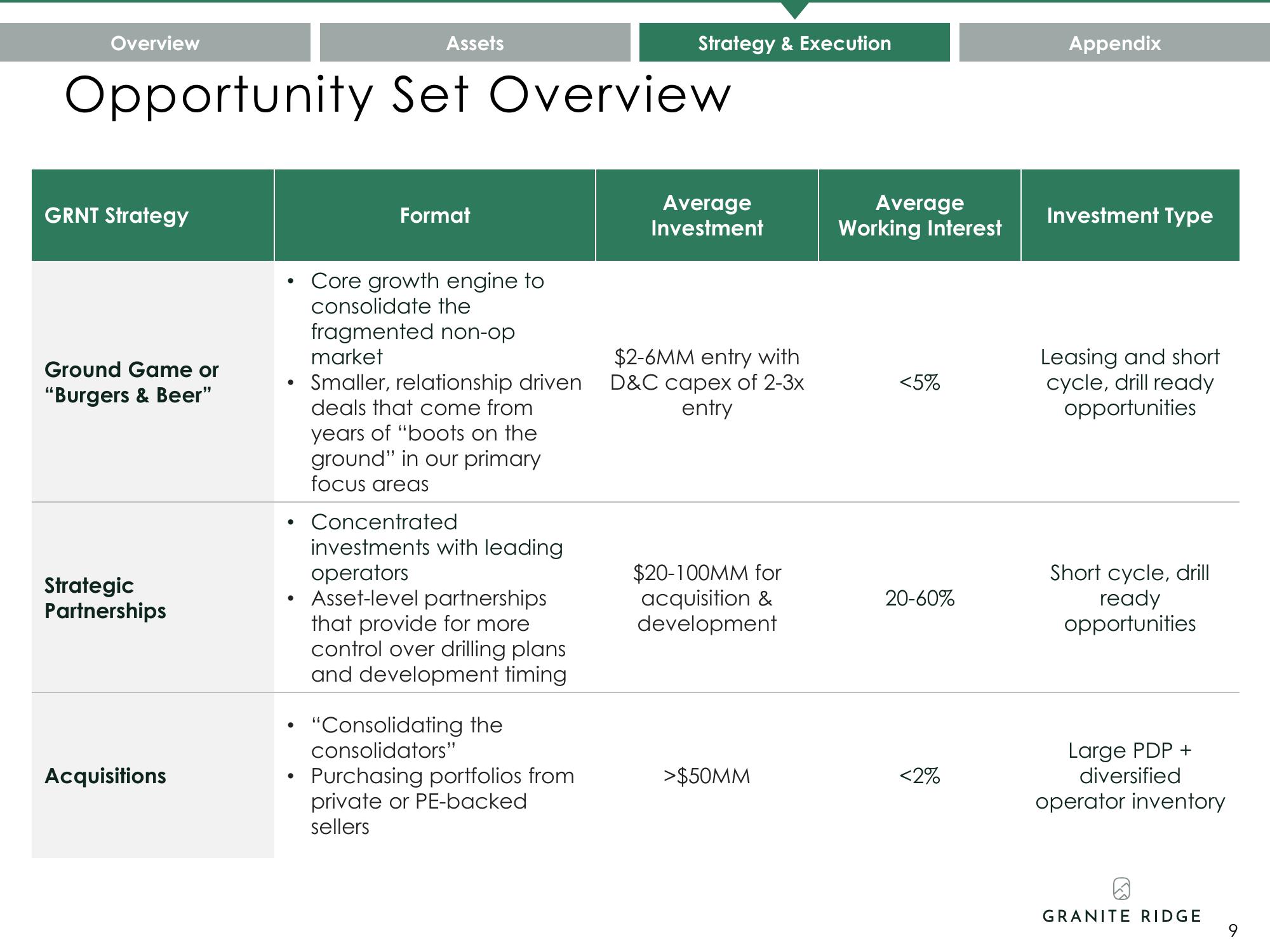

GRNT Strategy

Opportunity Set Overview

Ground Game or

"Burgers & Beer"

Strategic

Partnerships

Acquisitions

●

●

Assets

●

Format

Core growth engine to

consolidate the

fragmented non-op

market

Smaller, relationship driven

deals that come from

years of "boots on the

ground" in our primary

focus areas

Concentrated

investments with leading

operators

Asset-level partnerships

that provide for more

control over drilling plans

and development timing

"Consolidating the

consolidators"

Strategy & Execution

Purchasing portfolios from

private or PE-backed

sellers

Average

Investment

$2-6MM entry with

D&C capex of 2-3x

entry

$20-100MM for

acquisition &

development

>$50MM

Average

Working Interest

<5%

20-60%

<2%

Appendix

Investment Type

Leasing and short

cycle, drill ready

opportunities

Short cycle, drill

ready

opportunities

Large PDP +

diversified

operator inventory

@

GRANITE RIDGE

9View entire presentation