Flutter Investor Day Presentation Deck

US

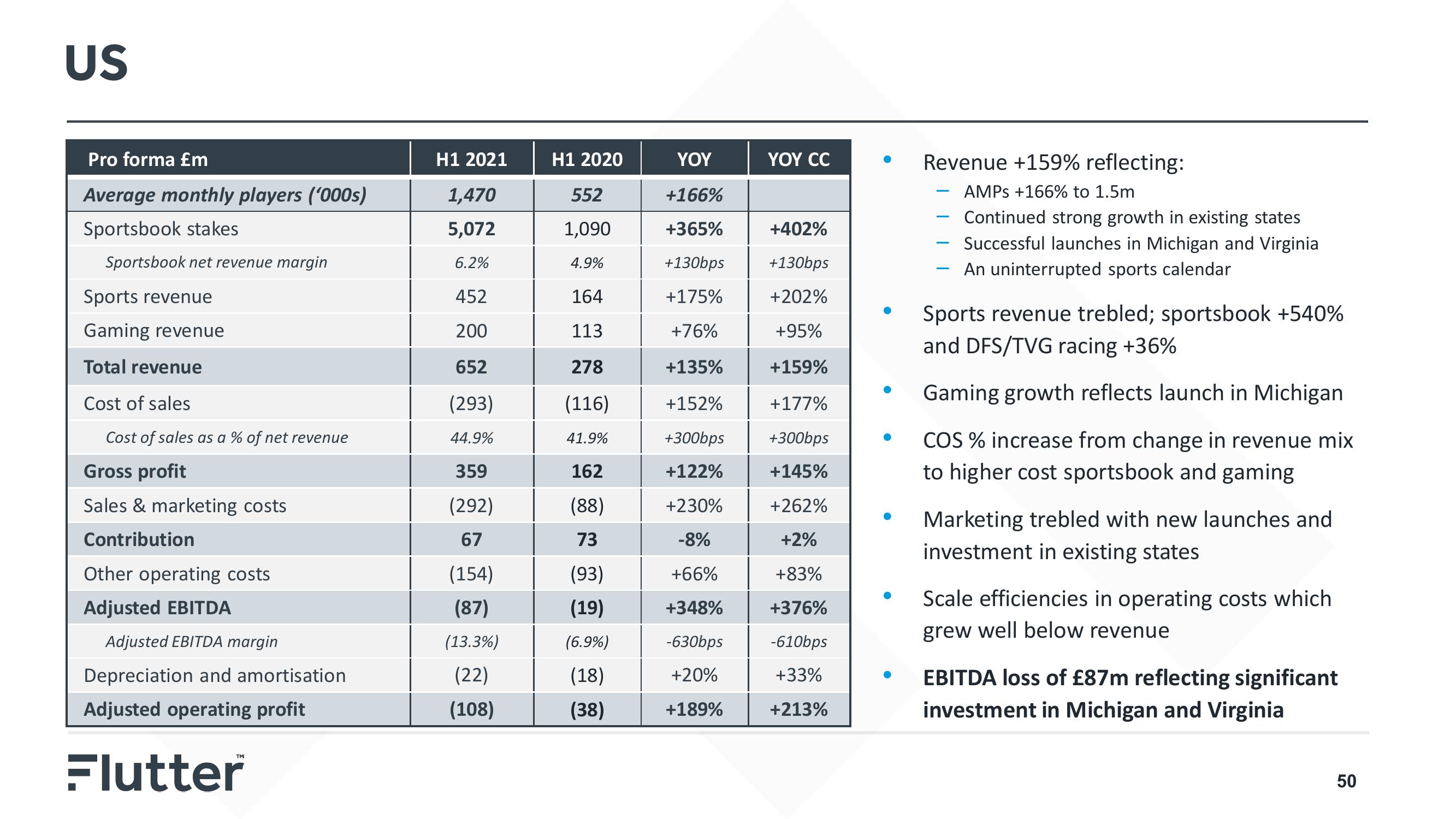

Pro forma £m

Average monthly players ('000s)

Sportsbook stakes

Sportsbook net revenue margin

Sports revenue

Gaming revenue

Total revenue

Cost of sales

Cost of sales as a % of net revenue

Gross profit

Sales & marketing costs

Contribution

Other operating costs

Adjusted EBITDA

Adjusted EBITDA margin

Depreciation and amortisation

Adjusted operating profit

Flutter

H1 2021

1,470

5,072

6.2%

452

200

652

(293)

44.9%

359

(292)

67

(154)

(87)

(13.3%)

(22)

(108)

H1 2020

552

1,090

4.9%

164

113

278

(116)

41.9%

162

(88)

73

(93)

(19)

(6.9%)

(18)

(38)

YOY

+166%

+365%

+130bps

+175%

+76%

+135%

+152%

+300bps

+122%

+230%

-8%

+66%

+348%

-630bps

+20%

+189%

YOY CC

+402%

+130bps

+202%

+95%

+159%

+177%

+300bps

+145%

+262%

+2%

+83%

+376%

-610bps

+33%

+213%

●

Revenue +159% reflecting:

AMPS +166% to 1.5m

Continued strong growth in existing states

Successful launches in Michigan and Virginia

An uninterrupted sports calendar

-

-

-

Sports revenue trebled; sportsbook +540%

and DFS/TVG racing +36%

Gaming growth reflects launch in Michigan

COS % increase from change in revenue mix

to higher cost sportsbook and gaming

Marketing trebled with new launches and

investment in existing states

Scale efficiencies in operating costs which

grew well below revenue

EBITDA loss of £87m reflecting significant

investment in Michigan and Virginia

50View entire presentation