BenevolentAI Investor Day Presentation Deck

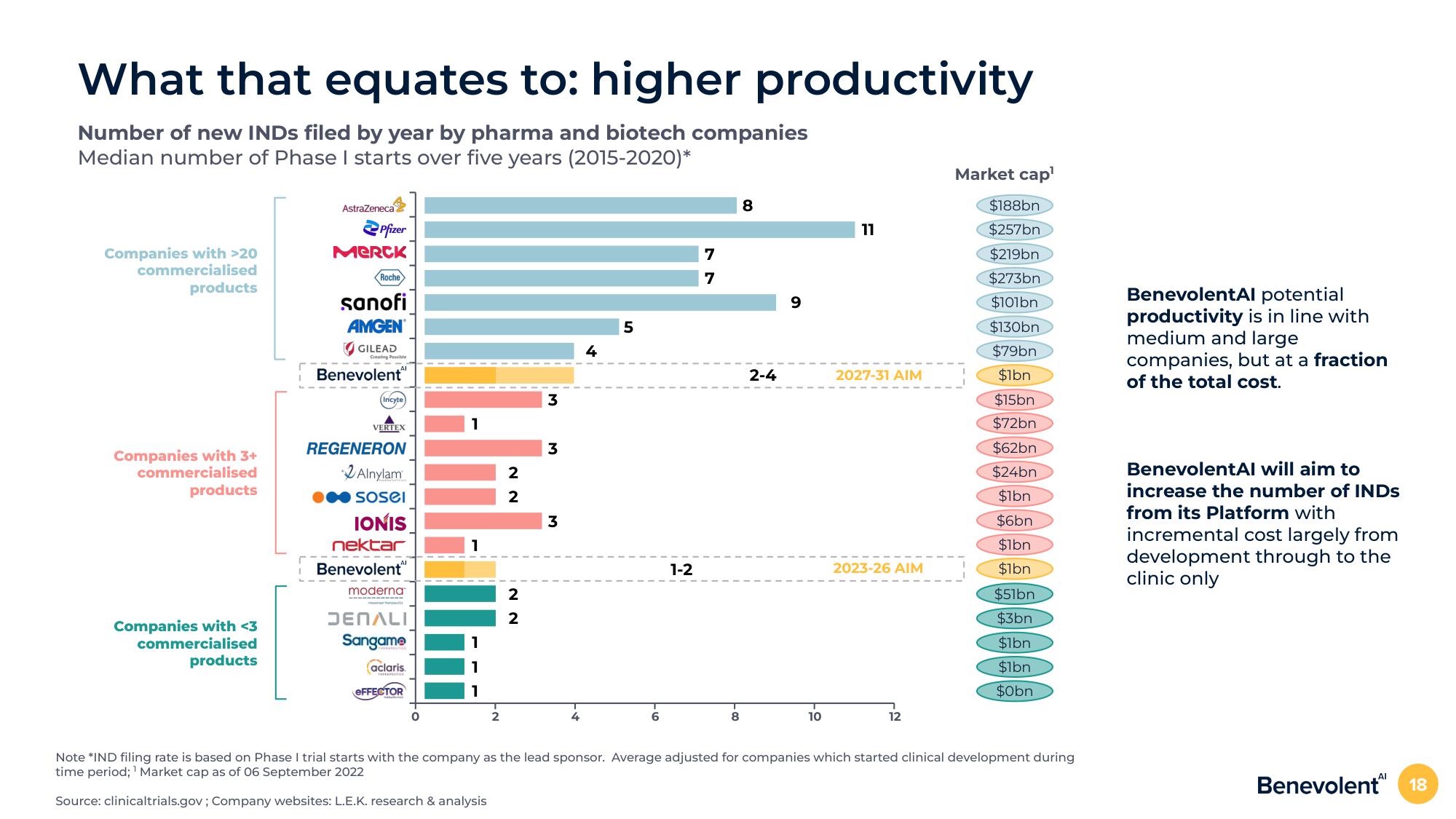

What that equates to: higher productivity

Number of new INDs filed by year by pharma and biotech companies

Median number of Phase I starts over five years (2015-2020)*

Companies with >20

commercialised

products

Companies with 3+

commercialised

products

Companies with <3

commercialised

products

AstraZeneca

Pfizer

MERCK

Roche

sanofi

AMGEN

GILEAD

Creating Possible

Benevolent

Incyte)

VERTEX

REGENERON

Alnylam

● sosel

IONIS

nektar

Benevolent

moderna

DENALI

Sangame

aclaris

EFFECTOR

0

2

2

2

N N

2

3

3

3

4

4

5

1-2

7

7

8

2-4

9

10

11

2027-31 AIM

2023-26 AIM

12

Market cap¹

$188bn

$257bn

$219bn

$273bn

$101bn

$130bn

$79bn

$1bn

$15bn

$72bn

$62bn

$24bn

$1bn

$6bn

$1bn

$1bn

$51bn

$3bn

$1bn

$1bn

$0bn

Note *IND filing rate is based on Phase I trial starts with the company as the lead sponsor. Average adjusted for companies which started clinical development during

time period; ¹ Market cap as of 06 September 2022

Source: clinicaltrials.gov; Company websites: L.E.K. research & analysis

BenevolentAl potential

productivity is in line with

medium and large

companies, but at a fraction

of the total cost.

BenevolentAl will aim to

increase the number of INDs

from its Platform with

incremental cost largely from

development through to the

clinic only

Benevolent 18View entire presentation