Playboy SPAC Presentation Deck

PLAYBOY 2020

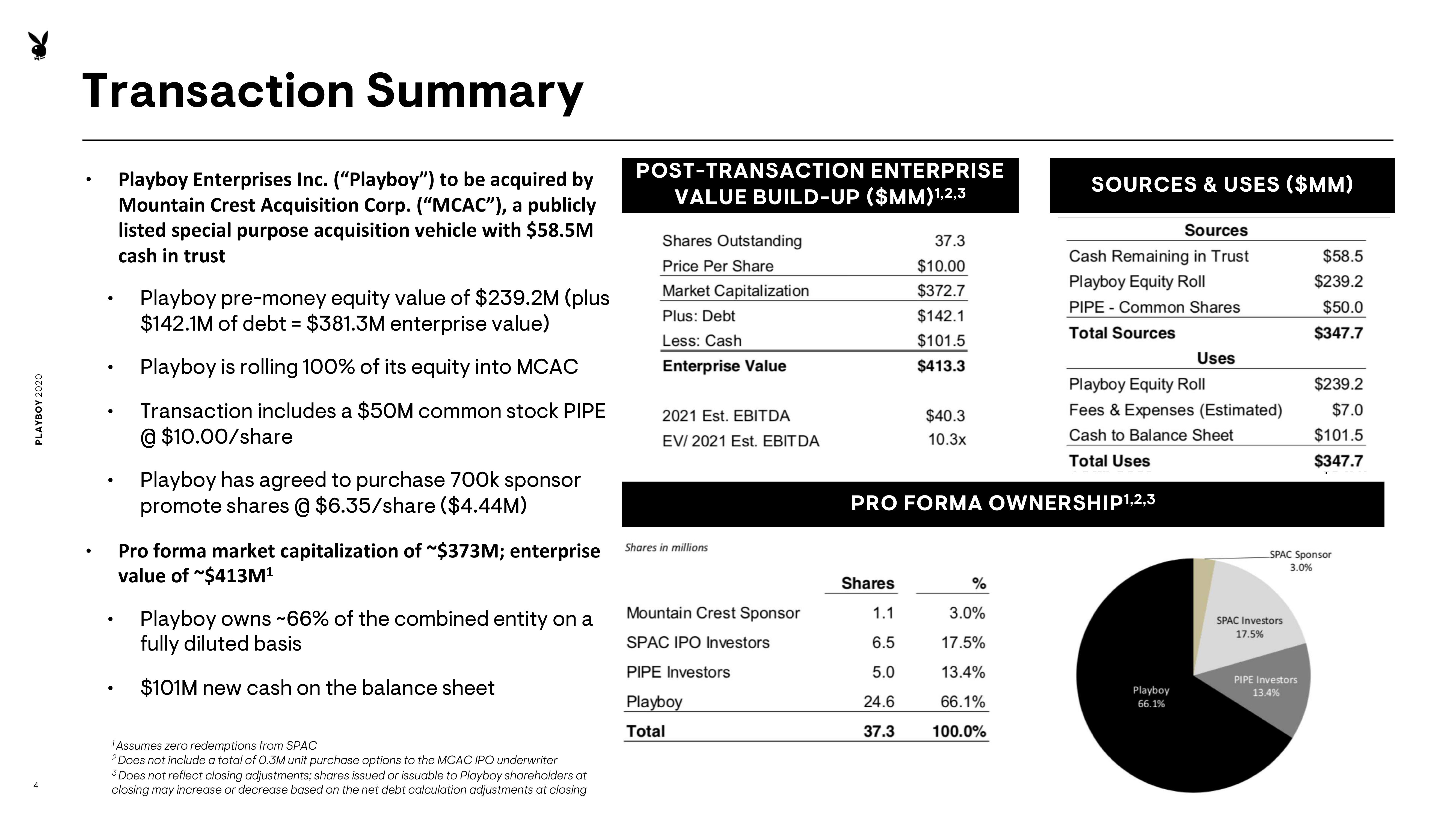

Transaction Summary

Playboy Enterprises Inc. ("Playboy") to be acquired by

Mountain Crest Acquisition Corp. ("MCAC"), a publicly

listed special purpose acquisition vehicle with $58.5M

cash in trust

.

Playboy pre-money equity value of $239.2M (plus

$142.1M of debt = $381.3M enterprise value)

Playboy is rolling 100% of its equity into MCAC

Transaction includes a $50M common stock PIPE

@ $10.00/share

Playboy has agreed to purchase 700k sponsor

promote shares @ $6.35/share ($4.44M)

Pro forma market capitalization of ~$373M; enterprise

value of $413M¹

Playboy owns ~66% of the combined entity on a

fully diluted basis

$101M new cash on the balance sheet

¹Assumes zero redemptions from SPAC

2 Does not include a total of 0.3M unit purchase options to the MCAC IPO underwriter

3Does not reflect closing adjustments; shares issued or issuable to Playboy shareholders at

closing may increase or decrease based on the net debt calculation adjustments at closing

POST-TRANSACTION ENTERPRISE

VALUE BUILD-UP ($MM)1,2,3

Shares Outstanding

Price Per Share

Market Capitalization

Plus: Debt

Less: Cash

Enterprise Value

2021 Est. EBITDA

EV/ 2021 Est. EBITDA

Shares in millions

Mountain Crest Sponsor

SPAC IPO Investors

PIPE Investors

Playboy

Total

37.3

$10.00

$372.7

$142.1

$101.5

$413.3

Shares

1.1

6.5

5.0

24.6

37.3

$40.3

10.3x

%

SOURCES & USES ($MM)

PRO FORMA OWNERSHIP1,2,3

3.0%

17.5%

13.4%

66.1%

100.0%

Sources

Cash Remaining in Trust

Playboy Equity Roll

PIPE Common Shares

Total Sources

Playboy Equity Roll

Fees & Expenses (Estimated)

Cash to Balance Sheet

Total Uses

Uses

Playboy

66.1%

SPAC Investors

17.5%

$58.5

$239.2

$50.0

$347.7

SPAC Sponsor

3.0%

PIPE Investors

13.4%

$239.2

$7.0

$101.5

$347.7View entire presentation