Metals Acquisition Corp SPAC Presentation Deck

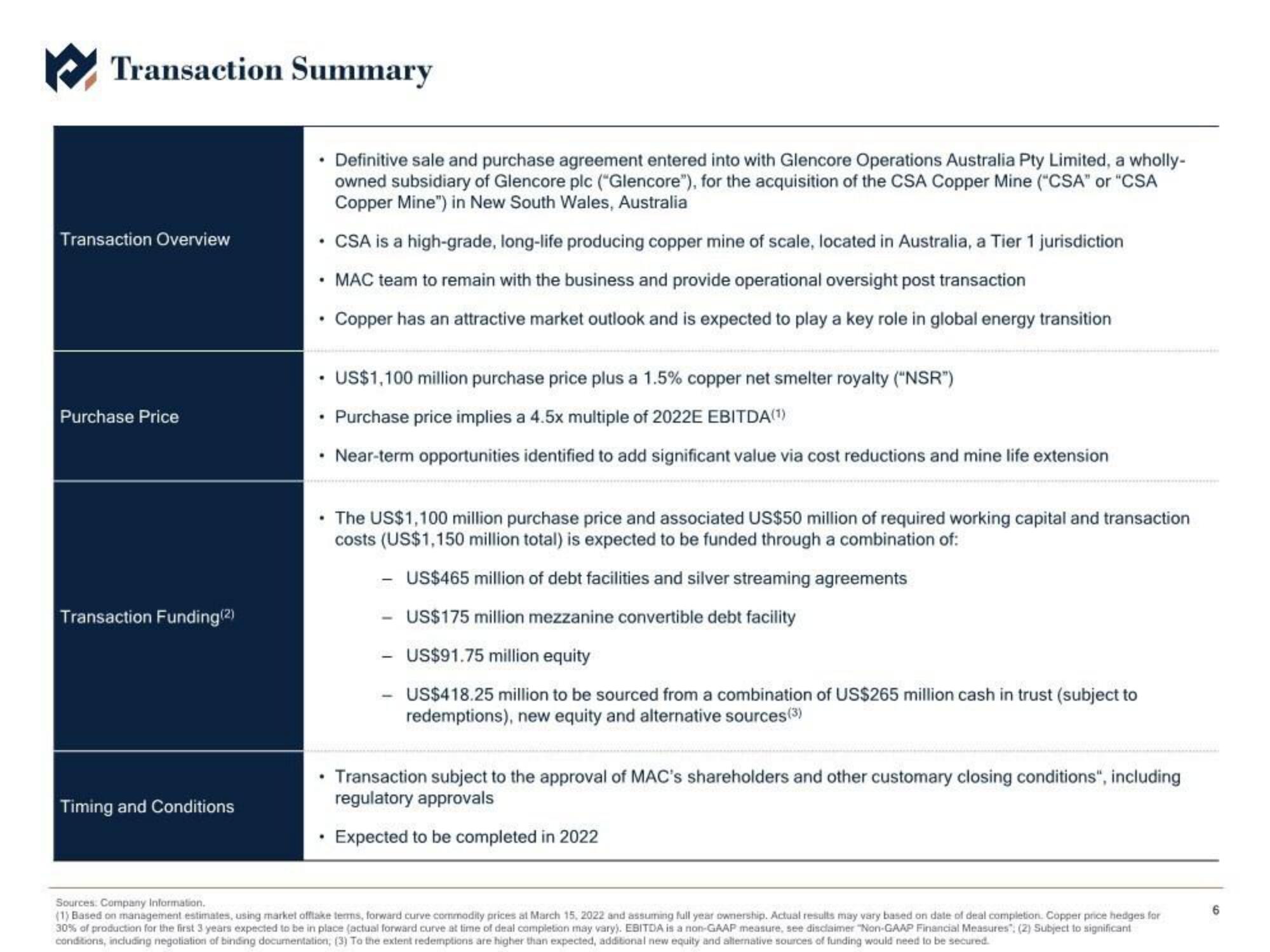

Transaction Summary

Transaction Overview

Purchase Price

Transaction Funding (2)

Timing and Conditions

●

.

.

.

Definitive sale and purchase agreement entered into with Glencore Operations Australia Pty Limited, a wholly-

owned subsidiary of Glencore plc ("Glencore"), for the acquisition of the CSA Copper Mine ("CSA" or "CSA

Copper Mine") in New South Wales, Australia

CSA is a high-grade, long-life producing copper mine of scale, located in Australia, a Tier 1 jurisdiction

MAC team to remain with the business and provide operational oversight post transaction

Copper has an attractive market outlook and is expected to play a key role in global energy transition

US$1,100 million purchase price plus a 1.5% copper net smelter royalty ("NSR")

Purchase price implies a 4.5x multiple of 2022E EBITDA (1)

Near-term opportunities identified to add significant value via cost reductions and mine life extension

The US$1,100 million purchase price and associated US$50 million of required working capital and transaction

costs (US$1,150 million total) is expected to be funded through a combination of:

- US$465 million of debt facilities and silver streaming agreements

US$175 million mezzanine convertible debt facility

US$91.75 million equity

US$418.25 million to be sourced from a combination of US$265 million cash in trust (subject to

redemptions), new equity and alternative sources (3)

Transaction subject to the approval of MAC's shareholders and other customary closing conditions", including

regulatory approvals

Expected to be completed in 2022

Sources: Company Information.

(1) Based on management estimates, using market offlake terms, forward curve commodity prices at March 15, 2022 and assuming full year ownership. Actual results may vary based on date of deal completion. Copper price hedges for

30% of production for the first 3 years expected to be in place (actual forward curve at time of deal completion may vary). EBITDA is a non-GAAP measure, see disclaimer "Non-GAAP Financial Measures (2) Subject to significant

conditions, including negotiation of binding documentation, (3) To the extent redemptions are higher than expected, additional new equity and alternative sources of funding would need to be secured.

6View entire presentation